There was no pandemic in sight when Allegacy Federal Credit Union ($1.8B, Winston-Salem, NC) promoted Ernie Hanington to vice president of emerging technologies in April 2018.

The seasoned technologist had been with the cooperative for three years as vice president of technology. The Tarheel State cooperative created the new role to define Hanington’s leadership as the credit union began the process of picking and deploying a new core processing system.

When it came time to test and go live, the coronavirus forced a virtual conversion. Now, Hanington is focused on building out the cooperative’s ability to leverage the functionalities of its new core platform, the multitude of ancillary systems it supports, and the people the technology empowers and serves.

Here, Hanington shares more about leading emerging technologies at Allegacy.

Why did Allegacy create your role? What challenges and opportunities does it address?

Ernie Hanington: Allegacy created the role when I was assigned to lead our core enhancement initiative. We wanted to separate Allegacy’s emerging technologies from day-to-day technology operations.

Who do you report to? Who reports to you?

EH: I report to Annette Knight, our chief experience officer. I don’t have any direct reports. I led a cross-functional team of approximately 75 people during the core enhancement initiative.

What makes you a great fit for this job?

EH: I have more than 20 years of progressive technology leadership experience developing IT strategy and leading operations in view of business goals, compliance, and security.

I have run large initiatives and led diverse teams across many industries throughout my career with IBM Global Services, and I helped build the technology consulting business for Arthur Andersen. That experience combined with time leading global IT audit while with Sara Lee Corporation enabled me to develop strategy and define technology solutions that align with business objectives.

I also hold a bachelor’s degree in information science and data processing from the University of Louisville.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

What’s your daily routine?

EH: I start by reviewing my calendar to plan the day and answer emails. From there, I’ll meet with various lines of business within Allegacy to discuss needs and design, plan, and implement solutions.

Collaboration is important to our industry, and I’m fortunate to participate in calls with teams from other credit unions and vendors to learn and share ideas and solutions. I also take time during the day to catch up on general and financial news and to conduct research on emerging technologies that could benefit Allegacy.

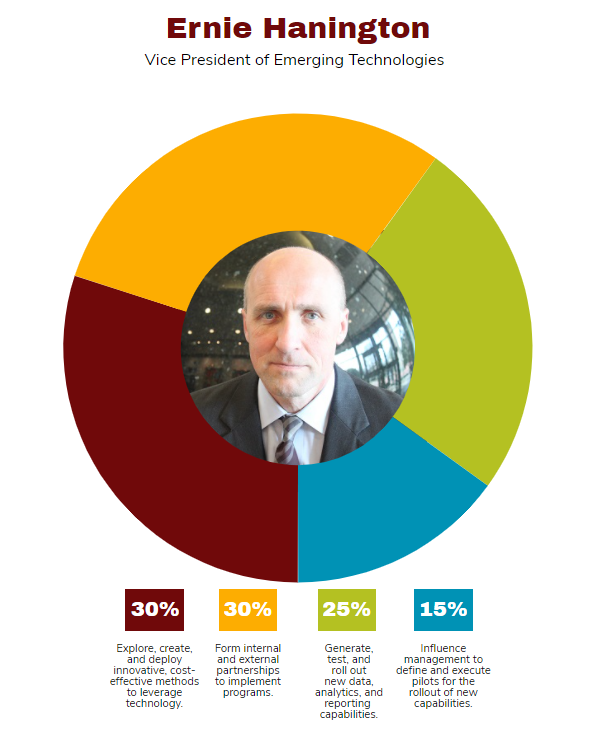

What are your areas of responsibility?

EH: Part of my responsibility is to create, implement, and direct innovative, cost-effective technological methods to advance our strategy for information management.

Through it all, I actively participate in ideation, design thinking, and experimentation of new capabilities that leverage emerging data and digitalization technologies. I also lead the development and enterprise rollout of new capabilities in reporting and analytics programs.

A key component of my role is also to work cross-functionally with Allegacy business units, legal and compliance, information security, vendor management, and external partners.

How has the COVID-19 pandemic changed strategies and tactics at Allegacy, and what has been your role in that response?

EH: COVID-19 required us to change strategies and tactics for both our mock core conversion and go-live weekends.

The pandemic hit right before mock weekend. I organized meetings with our strategic partners [Next Step, Fiserv, Reason Consulting and NCR] to identify steps to protect our employees health but still have a successful event and keep this critical corporate initiative on track.

We developed a plan to have all third-party consultants work remotely. This added risk, but we were well prepared and structured as a team, so we could take on this risk. We established a bridge line that remained open 24/7 and allowed everyone to get status updates, have questions answered, and request assistance.

Everyone from all sides came together during the weekend, kept their spirits high during a trying time, and achieved a successful mock conversion. That success enabled our team to pull off a successful go-live weekend in May.

I also participate on our return-to-work taskforce that meets regularly to discuss the pandemic, how to implement state guidelines, and what we can do to alleviate stress on our employees.

How do you track success in your job?

EH: Success is the implementation of technology that: improves the member experience by making it easier, more convenient, and secure; delivers business results by generating revenue, simplifying processes, and building efficiencies; and eases administrative burden on our employees.

For example, our core conversion enabled our indirect sales department to double the number of loans they could process per day by providing an interface between their system and the core platform. This met all the criteria listed above.

There’s an openness to sharing information and experiences among credit unions that I have not encountered in other industries. I find this mutually beneficial and refreshing.

How do you stay current with topics that fall under your role?

EH: I read trade magazines, use research and advisory companies such as Gartner and CEB [recently acquired by Gartner] to conduct research on different topics, and attend webinars and seminars.

I also find great value in participating on calls with my credit union peers and strategic partners to discuss emerging technologies. There’s an openness to sharing information and experiences among credit unions that I have not encountered in other industries. I find this mutually beneficial and refreshing.

This interview has been edited and condensed.