First Financial of Maryland Federal Credit Union ($1.2B, Sparks, MD) has been developing young people and the schools they attend for nearly 20 years. Cindy Jones has been an integral part of that effort.

Jones joined the Baltimore-area cooperative in 1993 and began writing educational promotional materials and leading youth programs a decade later. Her title changed from youth marketing manager to youth outreach manager in 2017 to reflect the growth in First Financial’s program and her own responsibilities.

Here Jones talks about First Financial and its involvement in community schools.

What’s the history of youth outreach at First Financial?

Cindy Jones: The credit union created a youth-specific position in 2003 when we launched a young adult newsletter on financial topics. We wrote it in-house and mailed it quarterly to our teenage members. We also provided the newsletters to high school classrooms within our field of membership, specifically to educators who taught economics, business, career and technical education, consumer math, and more.

We also created a speakers bureau to complement the newsletter and provided subject-matter experts from the credit union who would present in classrooms on financial topics.

In 2006, First Financial FCU added two more initiatives a campus debit card program and a student-run branch program. Both programs fall under my oversight. Later additions to our youth programs include Millionaires Clubs that we sponsor at individual elementary, middle, and high schools; reality fairs; and personal finance experiences we usually offer at the high school level.

I also have oversight of our scholarship program. Since it began in 1998, we have awarded more than $1.9 million in scholarships to our outstanding young adult members. Our youth outreach team has a passion for financial literacy education and loves working with the students and young adults that First Financial FCU serves.

Another gauge of success is when I see a former student intern who has become financially aware and fiscally responsible later in life, and they attribute it to the experience they had with First Financial FCU and our young adult programming.

Did the credit union create the youth outreach manager specifically for you in 2017?

CJ: The job was specific to me. As interest in our youth financial literacy offerings grew, I began to manage the writing and production of the newsletter. Over time, I found myself as the credit union’s subject matter expert for financial literacy presentations in the classroom. The other youth initiatives grew out of the enthusiasm First Financial FCU and its leaders have for giving back to our community.

What challenges does your role address?

CJ: In today’s economy and global marketplace, there’s a great need for financial literacy among adults. Even creating the awareness around this issue is a challenge. First Financial is tackling this problem head-on by partnering with our schools and working with our young adults to help them to get on the path to financial literacy, financial wellness, and, ultimately, financial freedom.

In Standard & Poor’s Global Financial Literacy Survey of 2019, it was determined that only 57% of American adults are financially literate. According to Everfi, 40% of adults cannot afford a $400 emergency expense; 68% of high school students do not understand credit scores; and 59% of employees cite financial matters as their top cause of stress. There is a need for financial literacy, and it is awesome First Financial sees this as a priority.

What opportunities does your role address?

CJ: Awareness, both of our credit union and of financial wellness. The team makes our members and prospective members, our young adults, and our teachers aware that credit unions care about them, care about their financial wellbeing, and care about their communities. First Financial works for them and with them on their journey to financial freedom. We supply resources at no cost to them using a variety of platforms to support and engage our members to meet all of their different needs.

What makes you a great fit for this job?

CJ: I have an MSA degree with a concentration in human resources management and a BS degree in economics and business administration. I’m a Certified Educator in Personal Finance as is our youth outreach coordinator and recently completed the Accredited Financial Counselor certification through the Association for Financial Counseling & Planning Education.

Who do you report to? Who reports to you?

CJ: I report to our chief marketing officer. Our youth outreach team is made up of myself and our youth outreach coordinator.

CU QUICK FACTS

First Financial Of Maryland FCU

DATA AS OF 03.31.21

HQ: Sparks, MD

ASSETS: $1.2B

MEMBERS: 65,545

BRANCHES: 13 (7 in-school)

12-MO SHARE GROWTH: 18.1%

12-MO LOAN GROWTH: 6.1%

ROA: 0.19%

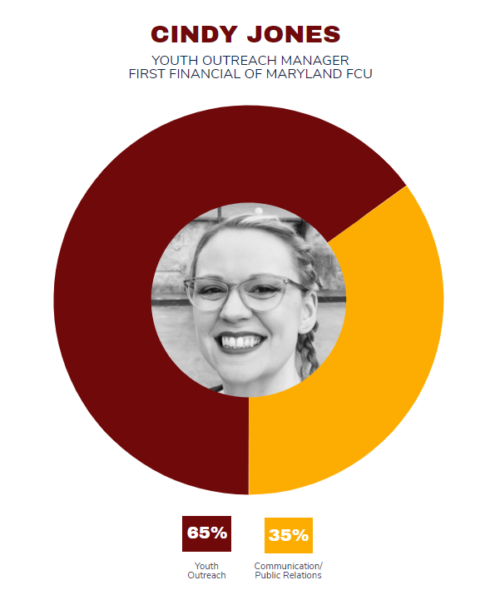

What are your areas of responsibility?

CJ: I’m primarily responsible for implementing youth outreach initiatives and developing strategic partnerships with community and educational leaders. I supervise our youth outreach coordinator as well as develop and implement a wide range of youth financial literacy and community outreach experiences.

The youth outreach team promotes the First Financial brand in our community and represents First Financial for the advancement of youth financial literacy both locally and nationally. On an ongoing basis, I evaluate new youth financial literacy products and our existing youth products and services to ensure our offerings meet the many needs of our young adults.

What’s your daily routine?

CJ: The best part about my job is that every day is different. Sometimes I start my day early for a first period financial literacy class with an area high school, some days I work with our student interns at our student-run branches, other days I work on youth outreach strategies and am in the office all day, and still other days we’re out serving in the community and our schools.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

Has the pandemic changed strategies or tactics at First Financial? What has been your role in that response?

CJ: Our strategy has remained the same and is even more important during the pandemic. We’re making sure members have access to financial resources and tools to keep them on the right financial path.

As the world, and especially our schools, shifted to a virtual setting, we moved our youth outreach offerings to a virtual program. We now virtually visit classrooms and work with students via Google Meet, Microsoft Teams, or whatever platform a school uses.

We’ve gotten creative in making sure we keep in touch with our schools, our educators, and our students so they know we’re ready to assist. First Financial shifted in this way as well making sure our members and our community know we are all #bettertogether.

How do you track success in your job?

CJ: We track success through a variety of standard reporting metrics such as audience reach, utilization of offerings, member growth and engagement, and scope of community outreach and awareness. Beyond the numbers and statistical reporting, however, we strive each day to work with educators and parents toward a common goal of financial success for their students.

Another gauge of success is when I see a former student intern who has become financially aware and fiscally responsible later in life, and they attribute it to the experience they had with First Financial FCU and our young adult programming.

We have many former student interns who have come to work for the credit union either while completing their college degrees or after they’ve completed college. It brings me extreme pride to celebrate their successes with them whether it’s a promotion earned at First Financial or a personal goal they have accomplished. I’m passionate about what I do, and these successes are heartwarming.

How do you stay current with topics that fall under your role?

CJ: I’m an avid reader, so I try to soak up as much information as I can from whatever source I can find. In addition, webinars are readily available on all types of topics. The youth outreach team works to stay in the know on all trends with financial literacy and education in general.

I also serve on our local school system’s Career and Technical Education Advisory Board and on the Board for the Maryland Council on Economic Education. Our youth outreach team participates with the National Youth Involvement Board (NYIB) and the Education Credit Union Council (ECUC) as well.

This interview has been edited and condensed.