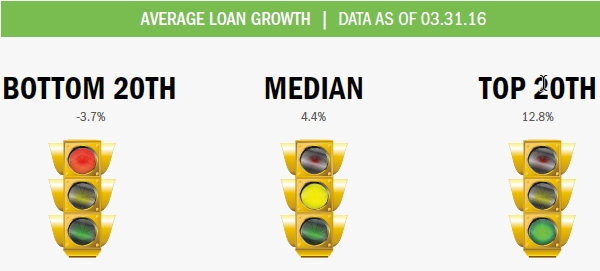

The median credit union loan portfolio expanded 4.4% year-over-year. Performers in the top 20th percentile posted 12.8% growth while credit unions in the bottom 20th percentile posted negative growth of -3.7%.

Click here to learn more about lending trends in first quarter 2016.

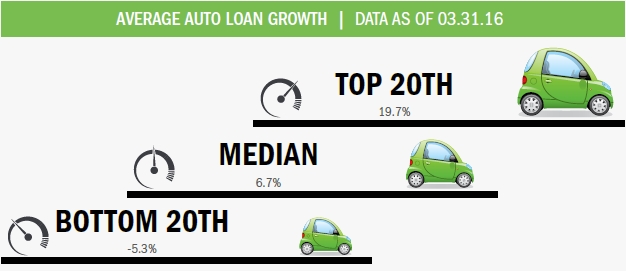

Auto loan balances increased 14.1% in the first quarter of 2016. Credit unions in the top 20th percentile reported auto loan growth of 19.7% while the median and bottom 20th percentile grew at a slower rate of 6.7% and -5.3%, respectively.

Click here to learn more about auto lending in first quarter 2016.

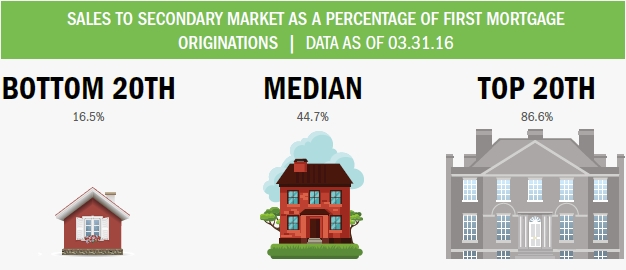

Credit unions in the bottom 20th percentile sold, on average, 16.5% of their first mortgage loan originations to the secondary market. The industry median for sales to the secondary market was 44.7%. Credit unions in the upper 20th percentile sold 86.6% on average.

Click here to learn more about mortgage lending in first quarter 2016.

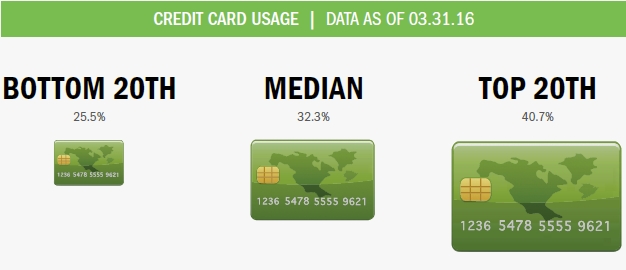

For all three percentile rankings bottom 20th, median, and top 20th credit card usage rates declined slightly year-over-year. Lower usage rates indicate lower outstanding balances as a percentage of available credit. When members are not fully using their credit cards, credit unions must monitor unfunded commitments in case borrowers decide to charge more throughout the year.

Click here to learn more about credit cards in first quarter 2016.

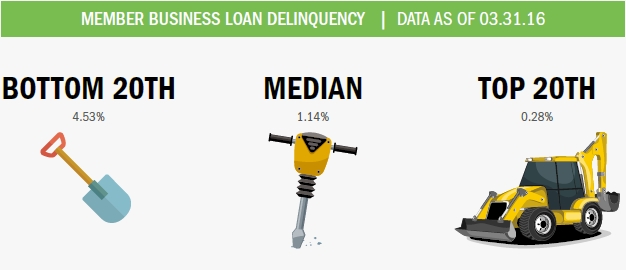

The median MBL delinquency reached 1.14% as of March 31, 2016. That’s more than three percentage points lower than credit unions in the bottom 20th percentile, which posted a 4.53% delinquency, but greater than the 0.28% posted by credit unions in the top 20th percentile.

Click here to learn more about member business lending in first quarter 2016.

You Might Also Enjoy

- Great Meadow FCU Scores Big While Thinking Small

- Credit Unions Set A Record For Dollar Amount Originated

- Indirect Lending Grows Its Direct Impact On Credit Unions

- A Team Solution To The Payday Lending Problem