Credit unions continued to report high net interest margins during the second quarter of 2024, and originations have ticked up. However, asset quality is declining, and many institutions are adding fewer loans to their balance sheet than in years past. How will credit unions balance this? Second-quarter data offers a window into the industry’s current performance.

Takeaway 1: Net Interest Margin Outpaces OpEx Ratio

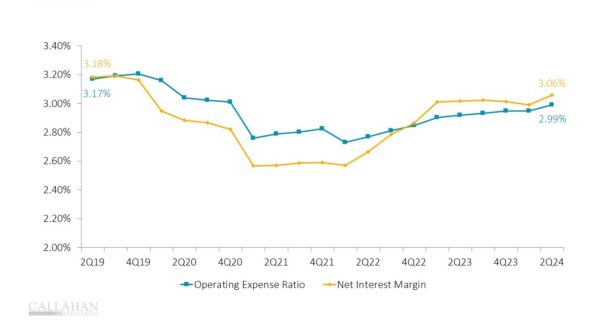

OPERATING EXPENSE RATIO VS. NET INTEREST MARGIN

FOR U.S. CREDIT UNIONS

© Callahan & Associates | CreditUnions.com

- The net interest margin has outpaced the operating expense ratio for seven consecutive quarters. The net interest margin stood at 3.06% at the end of the second quarter, 7 basis points above the operating expense ratio. Although both have trended upward in recent quarters, credit unions have taken advantage of higher interest rates on loans and investments to boost this figure.

- When a credit union’s net interest margin — which represents the difference between interest income and interest expense — is higher than the operating expense ratio, it gives the credit union flexibility in its earnings model. This wiggle room can help credit union leaders think more strategically about income streams.

Takeaway 2: Auto Balances Decline As Loan Growth Slows

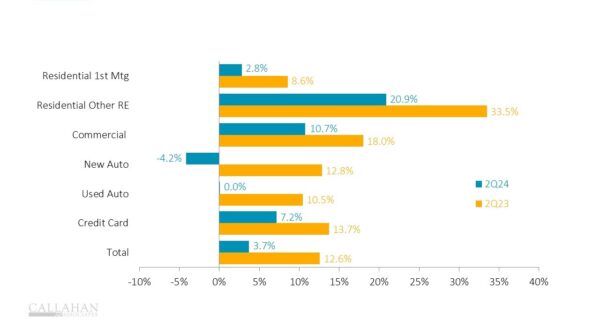

ANNUAL GROWTH IN LOANS OUTSTANDING

FOR U.S. CREDIT UNIONS

© Callahan & Associates | CreditUnions.com

- Lending is slowing across the portfolio for U.S. credit unions. Despite the slowdown, commercial loans, credit cards, and other real estate make up the fastest-growing segments of the portfolio. It’s no surprise credit cards and HELOCs — two products that can be tapped into for purchases of day to day goods — are popular in an era of higher prices.

- This decline in growth is most pronounced in the auto space, where new car loans declined by 4.2% and used auto growth was flat at 0.0%. Much of the decline in auto lending comes as a result of credit unions pulling back on indirect lending. In the past year, indirect lending balances declined 1.7%. With liquidity tight and indirect members only tenuously connected to the credit union, many cooperative leaders have not found this loan type to be as appealing as it once was.

Takeaway 3: Real Estate Lending Pushes Loan Originations Higher

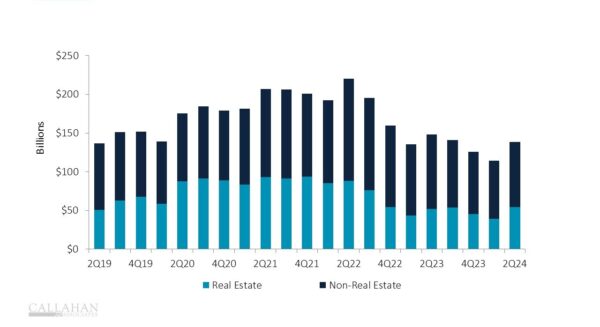

QUARTERLY LOAN ORIGINATIONS

FOR U.S. CREDIT UNIONS

© Callahan & Associates | CreditUnions.com

- Although year-over-year loan originations have fallen, credit unions originated more loans in the second quarter than at any time in the preceding six months. Rising home prices helped propel credit unions to $54.6 billion in real estate loans during the second quarter, the highest quarterly origination amount since the third quarter of 2022, driven by the popularity of HELOCs.

- Meanwhile, credit unions also made more non-real estate loans in the second quarter than they did during the first. What are the implications of this? It might be too early to tell if this is a blip or part of a larger trend, but considering the growth in credit card loan balances at credit unions, members might be continuing to rely on credit to finance purchases.

Takeaway 4: Asset Quality Ratio Components Trending In Different Directions

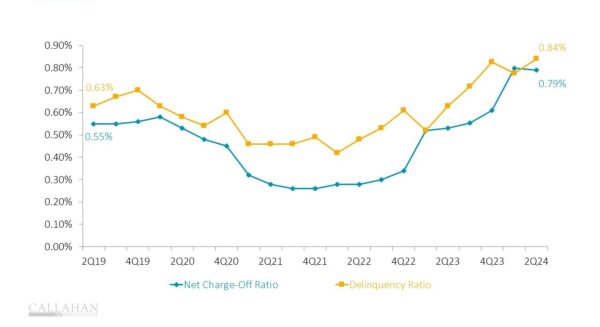

ASSET QUALITY: NET CHARGE-OFF RATIO + DELINQUENCY RATIO

FOR U.S. CREDIT UNIONS

© Callahan & Associates | CreditUnions.com

- Second quarter data shows the asset quality ratio climbing industrywide. Although net charge-offs dipped, delinquency climbed — a sign of deteriorating asset quality. When members’ budgets are stretched thin, many might find it difficult to keep up with payments, leading to worsening asset quality for credit unions.

- When looking at credit union asset quality by type, some loan products are faring better than others. Delinquency for credit union-issued credit cards has dipped for two successive quarters and stood at 1.98% of outstanding credit card loans as of the second quarter. On the other hand, delinquencies in commercial lending has risen to 0.92%.

Takeaway 5: HELOCs Remain Popular As Pace Of Growth Slows

TOTAL HELOC LINES AND UTILIZATION

FOR U.S. CREDIT UNIONS

© Callahan & Associates | CreditUnions.com

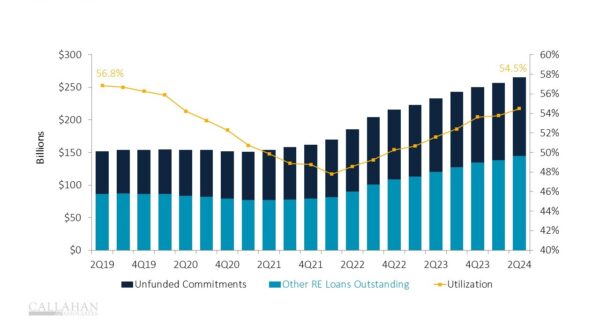

- The pace of growth has slowed, but HELOCs remain a popular way for homeowners to use their existing equity to keep up with rising costs, make home improvements, or pay for other large purchases.

- Although HELOC utilization still lags behind pre-pandemic levels, dollar values have risen thanks to increased housing prices. As homes appreciate in value, members have more available equity to tap into.

Watch Trendwatch On-Demand

Looking for the latest industry insights? Tune into Callahan’s Trendwatch 2Q24 on-demand webinar for an in-depth analysis of credit union performance trends from the second quarter. We’ll explore key financial and operational metrics, including growth, penetration, lending, deposits, member relationships, and more. Ready to elevate your knowledge and drive your strategy forward?