Introduction to CDFIs: Why Credit Unions Are (and Always Have Been) Community Development Financial Institutions

Credit unions have always been engines of community development, long before the CDFI Fund existed.

Credit unions have always been engines of community development, long before the CDFI Fund existed.

Mike Beall, John McKechnie. and Christine Duncan wrap up an eventful year for the CDFI Fund and cover what credit unions need to know heading into 2026.

The next big storm in the Gulf isn’t an “if,” it’s a “when,” but the small Gulf-area credit union has a plan to help the community get back on its feet when the time comes.

Amid a turbulent financial landscape, credit unions across the country stepped in with lending, grants, and community partnerships to support small businesses and entrepreneurs.

The Arizona-based credit union has revamped its approach to financial education and community partnerships to better serve the needs of its market.

A pair of CDFI grants allowed the Florida-based credit union to help members restart their lives on the island or relocate to the United States.

NOLA Firemen’s FCU helps members qualify for a mortgage in a state where poverty is high and insurance premiums are keeping many would-be borrowers out of a home.

Stay up-to-date with the latest changes, opportunities, and compliance requirements for CDFIs, including certification, grants, and legislative updates for 2025 and beyond.

Lake Trust Credit Union is driving statewide entrepreneurial spirit with a loan program that has provided more than $22 million in funding.

A partnership that helps the homeless wouldn’t be nearly as successful without the right people in the right seats — but that means more than just looking for the right work background.

A radical shift is taking place in the way consumers move money and engage with their financial institution.

How the Michigan-based cooperative’s “Culture of Finance” curriculum is reframing financial education.

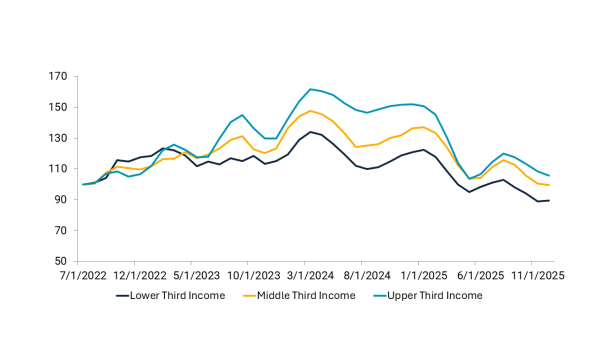

The gulf between the haves and the have-nots has widened in recent years. Credit unions can help members catch up.

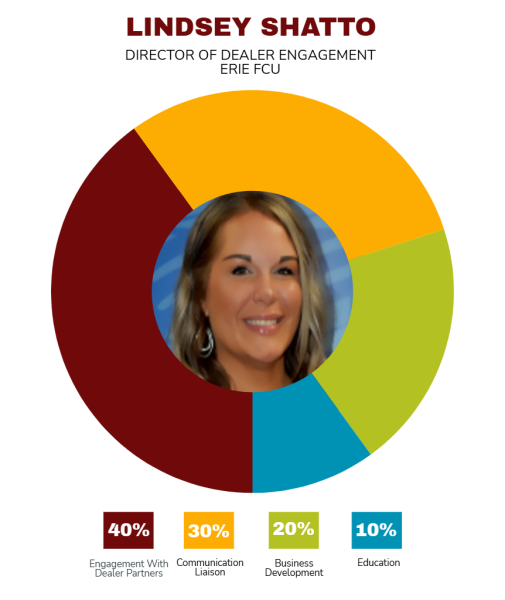

A veteran branch manager takes indirect lending to a new level at Erie FCU.

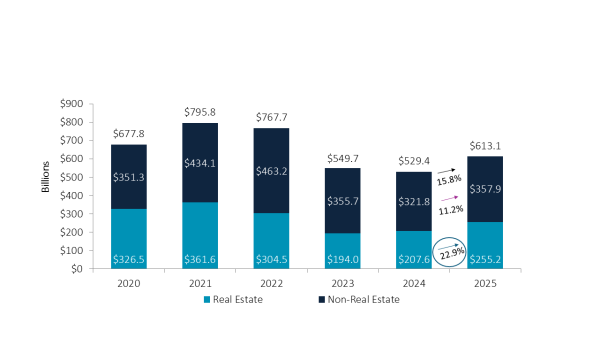

As the Federal Reserve cuts interest rates, credit unions are adapting in tandem, balancing membership needs with asset quality. This balance will be one of many topics discussed during Callahan’s quarterly Trendwatch webinar.

Callahan & Associates provides an early look at quarterly performance results. Sneak a peek at the latest trends here.

On-site coverage at the National Association of Latino Credit Union Professionals’ 2026 conference explores how representation, emotional experience, and community trust are converging to shape the future of credit unions.

Look beyond the headlines to better understand what is driving current market trends and how they could impact credit union investment portfolios.

This year’s finalists are reimagining how credit unions use data to boost service levels and improve efficiencies.

In order to adopt a more proactive strategy, the Iowa cooperative is using a dedicated product development team to promote visibility and follow-through from idea to launch.