Meet The Finalists For The 2026 Innovation Series: Data And Decision Intelligence

This year’s finalists are reimagining how credit unions use data to boost service levels and improve efficiencies.

This year’s finalists are reimagining how credit unions use data to boost service levels and improve efficiencies.

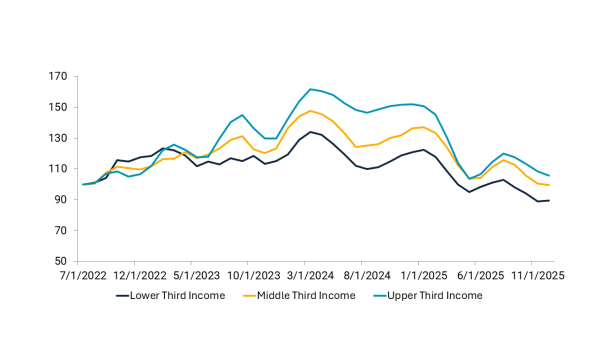

Join Franklin Madison as they cover how you can identify and serve members with different financial needs at different life stages, and how to align product offerings with those needs in real time.

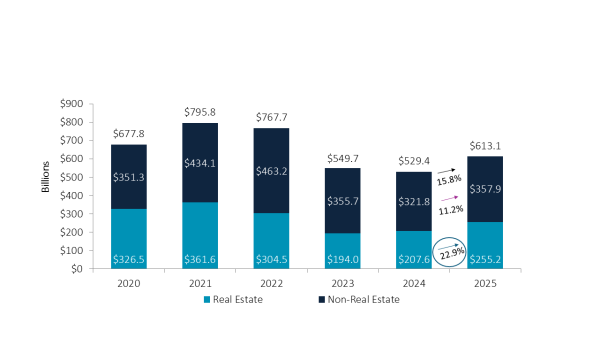

Join us for an insightful webinar designed specifically for credit union leaders. Uncertainty around loan rates continues to create a dynamic lending environment but the competition for loan opportunities is beginning to heat up. The majority of consumers would prefer to take out a loan with their primary credit union, but the importance of low

PSECU takes a realistic segmentation strategy to keep personalization manageable yet effective.

Two credit unions with double-digit share growth offer insight into how they are attracting, and keeping, money in the cooperative.

This Valentine’s Day, see how credit unions share the love via rewards programs and other givebacks.

The Memphis credit union has improved retention, electronic services, and accounts per household by delivering the right messages to the right members.

BCU uses spreadsheet ciphering to identify potential new employee group partners while KCT relies on shoe leather.

This week, CreditUnions.com looks at best practices to make the most of mobile and online strategies.

How Redstone Credit Union’s small marketing staff used email analytics and automation to help sell thousands of new checking accounts.

A radical shift is taking place in the way consumers move money and engage with their financial institution.

How the Michigan-based cooperative’s “Culture of Finance” curriculum is reframing financial education.

The gulf between the haves and the have-nots has widened in recent years. Credit unions can help members catch up.

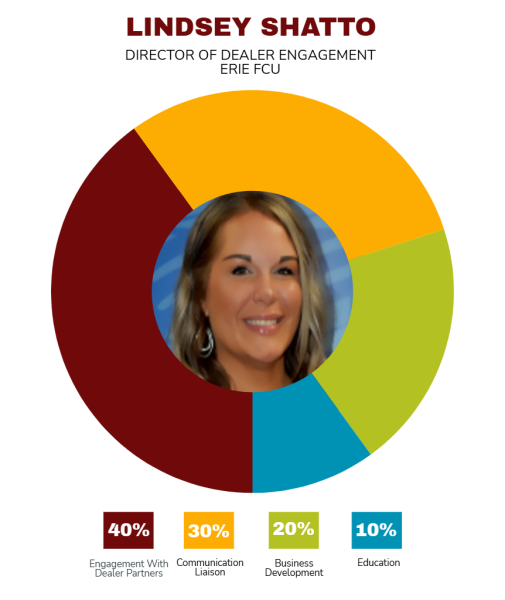

A veteran branch manager takes indirect lending to a new level at Erie FCU.

As the Federal Reserve cuts interest rates, credit unions are adapting in tandem, balancing membership needs with asset quality. This balance will be one of many topics discussed during Callahan’s quarterly Trendwatch webinar.

Callahan & Associates provides an early look at quarterly performance results. Sneak a peek at the latest trends here.

On-site coverage at the National Association of Latino Credit Union Professionals’ 2026 conference explores how representation, emotional experience, and community trust are converging to shape the future of credit unions.

Look beyond the headlines to better understand what is driving current market trends and how they could impact credit union investment portfolios.

This year’s finalists are reimagining how credit unions use data to boost service levels and improve efficiencies.

In order to adopt a more proactive strategy, the Iowa cooperative is using a dedicated product development team to promote visibility and follow-through from idea to launch.