How To Run A Loan Program With 256 Origination Centers

State Employees’ Credit Union takes a decentralized approach to its lending model. How does it work, and why does the credit union believe this complex, pricey model is worth it?

State Employees’ Credit Union takes a decentralized approach to its lending model. How does it work, and why does the credit union believe this complex, pricey model is worth it?

Finding the right employees to connect with members through video technology can be a challenge, but it doesn’t have to be.

More than 125 employees at the North Carolina credit union chipped in to pull off the intensive tech project.

Transparency and an objective salary scale encourages top performance from staff at Local Government FCU.

Apple Watch is just the beginning for mobile-oriented, blue-sky thinkers in the credit union space.

Call it what you will, CFPB’s promise to go easy on mortgage disclosure changes provides some temporary relief.

This North Carolina credit union scores with targeted marketing driven by philosophy of dealing with the data it can handle.

Preparation, speculation underway as same-day settlement gets green light on nation’s largest payment rail.

The strong growth in the auto portfolio drives gains in first quarter consumer lending for America’s credit unions.

A half-million members respond so far to North Carolina credit union’s offer of free credit scores. President digs it, too.

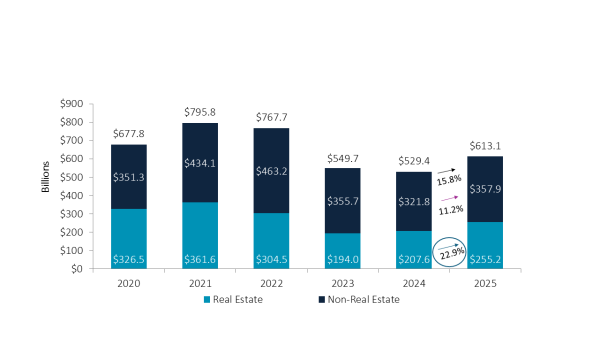

As the Federal Reserve cuts interest rates, credit unions are adapting in tandem, balancing membership needs with asset quality. This balance will be one of many topics discussed during Callahan’s quarterly Trendwatch webinar.

Callahan & Associates provides an early look at quarterly performance results. Sneak a peek at the latest trends here.

On-site coverage at the National Association of Latino Credit Union Professionals’ 2026 conference explores how representation, emotional experience, and community trust are converging to shape the future of credit unions.

Look beyond the headlines to better understand what is driving current market trends and how they could impact credit union investment portfolios.

This year’s finalists are reimagining how credit unions use data to boost service levels and improve efficiencies.

In order to adopt a more proactive strategy, the Iowa cooperative is using a dedicated product development team to promote visibility and follow-through from idea to launch.

This year’s finalists are reimagining how credit unions can use AI to combine cutting-edge technology with old-school member service.

Financial advice comes in many forms. How can credits union make sure they are the No. 1 choice for their members?

This year’s finalists are uncovering new ways to harness the power of technology to improve and expand lending across the industry.

A program to help staffers improve their savings skills generated more than $200,000 in deposits and helped change participants’ financial habits.

SECU Scores Obama Nod With FICO Program