CECL: A Half-Baked Cake

One year after implementation, there’s still work to be done when it comes to new rules around expected credit losses.

Our Risk page is the top spot to learn about business continuity, compliance, enterprise risk management, fraud, and vendor management.

One year after implementation, there’s still work to be done when it comes to new rules around expected credit losses.

For the past decade, the credit union’s head risk leader has been evangelizing the idea that everyone must be a risk manager to ensure the

The crisis is still unfolding, but the latest high-profile bank failure has plenty of takeaways for credit unions around asset management, net worth, communication, and

The growing role of credit union service organizations in providing scale and expertise has caused increased scrutiny from the industry regulator.

The need for monitoring grows as does the bank account as another $161 million is added ahead of the fund’s 2021 shutdown date.

Future shock, building a credit union blockchain, and a sustainable initiative to create credit union awareness were all topics at America’s Credit Union Conference.

CU InfoSecurity Conference speakers tell attendees they need better artificial intelligence capabilities to thwart cyber attacks.

Day two at ACUC sees focus on polling, projects, the regulatory burden, and how to compete.

New regs would provide a safe harbor under NCUA rule, but some say the effects could re-define small-dollar lending and sharply reduce availability.

NAFCU conference attendees hear of hope for change in Washington, how size and gender matters in executive pay, and that risk management includes reputations.

Risk managers monitor disparate areas of the credit union. For key ratios to follow, start with the measures that correspond to the risk indicators outlined by the NCUA.

PSCU reports “a couple hundred thousand dollars” in saved chargebacks already as the big card brands prepare solutions to perceptions of chip card speed trap.

Examiners expected to follow new mobile rules from joint regulator council.

A cross-functional team comprising nearly 20% of staff helped the Maryland-based credit union manage the crisis while staying focused on helping members.

Four executives share how they are skilling up and soothing nerves as they navigate the AI revolution in real time.

The future of leadership starts now. This week, CreditUnions.com is diving into the strategies shaping tomorrow’s talent: from a bold overhaul of succession planning to how credit unions are tackling the AI skills gap.

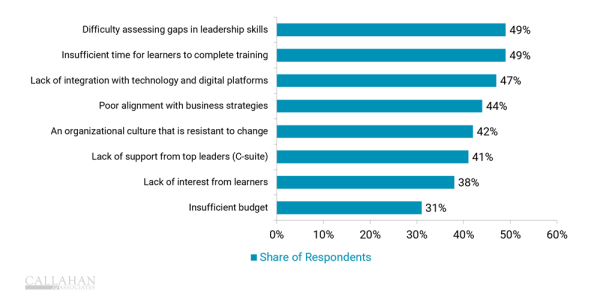

Assessing skills gaps among leaders and providing time to complete training are major hurdles today, but strong leadership development strategies are essential in building a future-ready credit union.

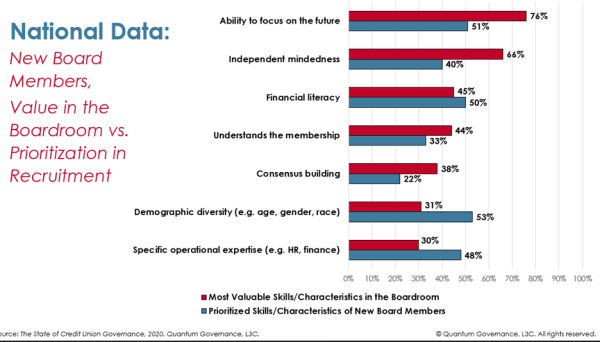

A report from Quantum Governance reveals a gap between board recruitment priorities and the most valuable skills in governance.

Fair, transparent succession helps credit unions strengthen board effectiveness, align leadership with strategy, and safeguard member value.

The California cooperative moves beyond the 9-box to identify skills, gaps, and opportunities to prepare leaders for what’s next.

The right tools and consistent approach make succession planning simpler for credit union leaders and board members.

CreditUnions.com revisits three credit unions to learn how their strategies have evolved since their original spotlight and see what’s in store for the future.

A national leader in urban agriculture shows how front-line insights drive real local impact — and why credit union branches are perfectly positioned to do the same.

The Corporate Bailout Fund Grows While Credit Unions Wait