CECL: A Half-Baked Cake

One year after implementation, there’s still work to be done when it comes to new rules around expected credit losses.

Our Risk page is the top spot to learn about business continuity, compliance, enterprise risk management, fraud, and vendor management.

One year after implementation, there’s still work to be done when it comes to new rules around expected credit losses.

For the past decade, the credit union’s head risk leader has been evangelizing the idea that everyone must be a risk manager to ensure the

The crisis is still unfolding, but the latest high-profile bank failure has plenty of takeaways for credit unions around asset management, net worth, communication, and

Vermont State Employees Credit Union ($440M, Montpelier, VT) is always looking to protect their members from various forms of fraud, without inconveniencing them.

William Cook, Senior Vice President for Planning & Member Service, Northwest Federal Credit Union, lays out his approach of working with employees to create a culture of awareness on business continuity.

A review of NCUSIF audits show a rebuff of reality that marks seven years of building budgets while thwarting the fund’s intent to sustain and nurture.

APL FCU in Maryland leveraged the CARD Act to teach their members about responsible credit card practices. They’ve seen new outstanding card balances triple from the year prior.

testing

Negative headlines about financial institutions are commonplace in our current national climate, but one issue in particular has risen above the din in the last few months.

NCUA chair Debbie Matz leaves the board as the movement prepares to live with burdensome new capitalization standards that data show nearly no credit unions currently run afoul of.

The new accounting standard from FASB presents challenges and opportunities to credit unions and CUSOs.

The regulator’s drastic move is a troubling illustration of how the agency created to foster the movements safety and soundness is becoming a threat to its future.

NACUSO conference points up innovative opportunities, regulatory challenges for collaborative entrepreneurship in the credit union model.

A cross-functional team comprising nearly 20% of staff helped the Maryland-based credit union manage the crisis while staying focused on helping members.

Four executives share how they are skilling up and soothing nerves as they navigate the AI revolution in real time.

The future of leadership starts now. This week, CreditUnions.com is diving into the strategies shaping tomorrow’s talent: from a bold overhaul of succession planning to how credit unions are tackling the AI skills gap.

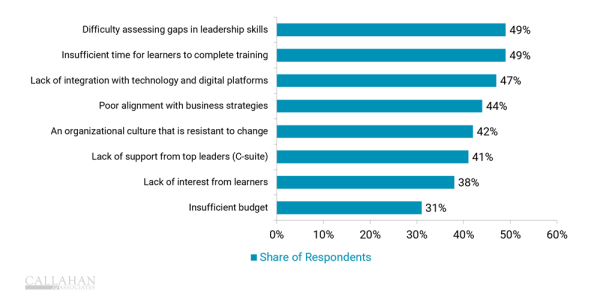

Assessing skills gaps among leaders and providing time to complete training are major hurdles today, but strong leadership development strategies are essential in building a future-ready credit union.

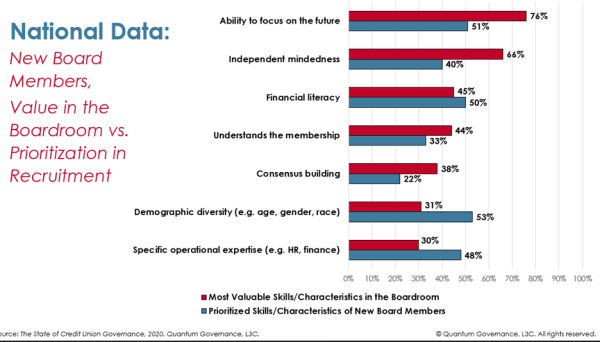

A report from Quantum Governance reveals a gap between board recruitment priorities and the most valuable skills in governance.

Fair, transparent succession helps credit unions strengthen board effectiveness, align leadership with strategy, and safeguard member value.

The California cooperative moves beyond the 9-box to identify skills, gaps, and opportunities to prepare leaders for what’s next.

The right tools and consistent approach make succession planning simpler for credit union leaders and board members.

CreditUnions.com revisits three credit unions to learn how their strategies have evolved since their original spotlight and see what’s in store for the future.

A national leader in urban agriculture shows how front-line insights drive real local impact — and why credit union branches are perfectly positioned to do the same.

A Cash Cow 7 Years In The Making