2023 Vendor Showcase

Vendors break down the problems they solve and highlight what makes them stand out in a crowded industry.

Vendors break down the problems they solve and highlight what makes them stand out in a crowded industry.

Credit unions must invest in data to intelligently protect and serve members.

More and more credit unions are partnering with financial technology firms to provide solutions that make it easier and faster to grow their business.

Top-Level Takeaways A better understanding of data trends has helped Peoples Advantage get buy-in from staff at all levels when it comes to meeting lending and membership goals. Credit unions with low-income and CDFI certification can use data to ensure they’re fulfilling the mission that goes along with those designations. Analytics isn’t just for large

CreditUnions.com has the inspiration leaders need to improve their credit union’s impact. Check out stories below featured recently that highlight strategies, initiatives, products, and services of credit unions making a positive impact for the members and communities they serve. Brother, Can You Spare A Dollar? In 2004, North Carolinians witnessed the birth of a philanthropic

A better borrower experience offers a clear competitive advantage.

Kristine Rellihan works toward the ideal blend of efficiency, goal alignment, impact, internal service satisfaction, and process workflow at Dupaco Community Credit Union.

Making the most of business intelligence involves building bridges between departments byte by byte.

Making the most of business intelligence involves building bridges between departments byte by byte.

Leveraging data from across the credit union delivers optimized products and services, as well as enhanced member experiences that foster stronger, more trusted relationships.

Fluctuating loan demand upset credit union lending pipelines and balance sheets in the first half of the year. How significant were these impacts?

Six data points showcase what’s happening in the U.S. economy that could direct credit union decision-making for the rest of the year.

Credit unions have made the choice to back away from indirect auto lending, but that has come with a substantial opportunity cost.

Credit unions leverage their member-first mission to better serve all members, even those of modest means, making cooperatives especially valuable in challenging economic times.

Credit unions are reigniting investment strategies amid rate shifts and slowing loan demand.

The need for responsible higher education financing continues to grow, and your credit union has an opportunity to provide affordable, flexible funding for college and technical careers.

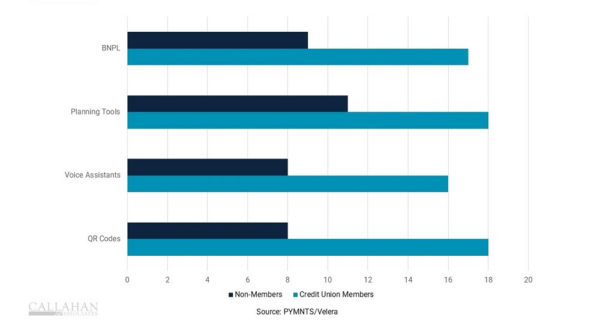

BNPL programs have become a key player in the financial landscape, with some credit unions adopting their own version for their members.

Market pressures and compliance challenges are just two variables pushing cooperatives to hand off their card operations.

How credit card reward programs drive business and loyalty at Alliant and Affinity credit unions.

A March 2024 study determined Buy Now, Pay Later tools are among the top features consumers want from their payments options.