A League Apart

Whether credit unions are in the planning phase of disaster recovery or have actually been hit, regional leagues offer resources and support for members, employees, and institutions.

Whether credit unions are in the planning phase of disaster recovery or have actually been hit, regional leagues offer resources and support for members, employees, and institutions.

We aren’t known for our tight relationships with financial services providers, but credit unions can set their business apart from the competition.

Local Government Federal Credit Union makes known its dedication to cooperative principles in the marketplace.

Real comments from online review sites can help credit unions better tout their cooperative advantages, diffuse technology tensions, and decide when to send bad eggs packing.

To buck the trend in rising merger rates, credit unions are developing innovative ways to operate independently.

Beyond the rhetoric, AAFCU members demonstrate that shared branching is a service they need and use.

How Member Loyalty Group grows credit unions’ ability to understand and act on feedback through AI-powered analytics.

Although the industry is chock-full of foundations, some institutions rely on donor-advised funds as a pathway to giving back.

The Fortera Foundation is breaking the cycle of generational poverty by providing essential resources and financial aid to single-parent students.

The United Nations FCU Foundation helps the New York-based credit union make an impact on multiple continents.

The regulator’s Community Development Revolving Loan Fund distributed $3.8 million in grant funding last year, benefitting more than 140 credit unions.

Five years after launching a successful mortgage digital campaign, the New York-based credit union has expanded into other business areas.

After two large Minnesota credit unions merged, staff set to work creating a new brand identity.

Three seasoned marketers share tips and tactics to turn everyday sponsorships into avenues for connection and prosperity.

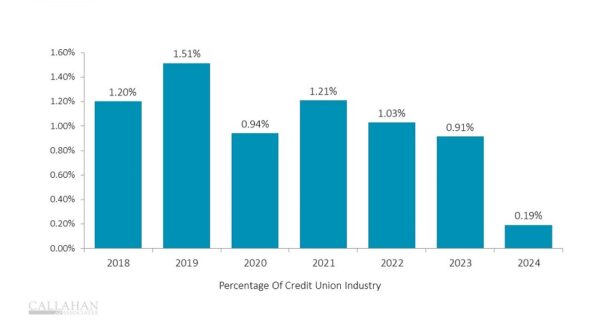

Marketing spend is up since the onset of COVID-19, but fewer institutions are pursuing new identities, choosing instead to embrace familiarity.

Technology partnerships offer a path to innovation and enhanced member service.