With nearly 6,000 credit unions reporting second quarter data, Callahan Associates projects the credit union industry will break records in first mortgage origination and market share.

State Of The Union

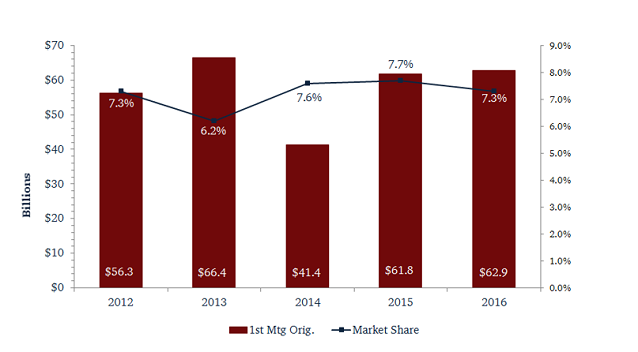

Thanks to strong member demand in the second quarter of 2016, first mortgage originations reached $62.9 billion nationwide for the credit union industry. That’s a 1.7% increase year-over-year and the highest second quarter origination balance since June 2013. Elsewhere in the portfolio, credit unions posted 13.6% origination growth in other real estate loans and lines of credit a net increase of $13.9 billion.

YEAR-OVER-YEAR FIRST MORTGAGE ORIGINATIONS

For U.S. credit unions* | Data as of 06.30.16

Callahan Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan Associates

*For 5,959 credit unions

Credit unions now also hold more than $340.7 billion in first mortgage loans, the highest ever reported balance.

Although growth is strong, lenders should always consider the risks that lie within their real estate loan portfolio. For instance, first mortgage delinquency increased five basis points over first quarter to reach 0.65% as of June 2016. At an aggregate level, this is the second-lowest delinquency on record since June 2008. Clearly not a cause for alarm, rather, a reminder to keep an eye on real estate loans.

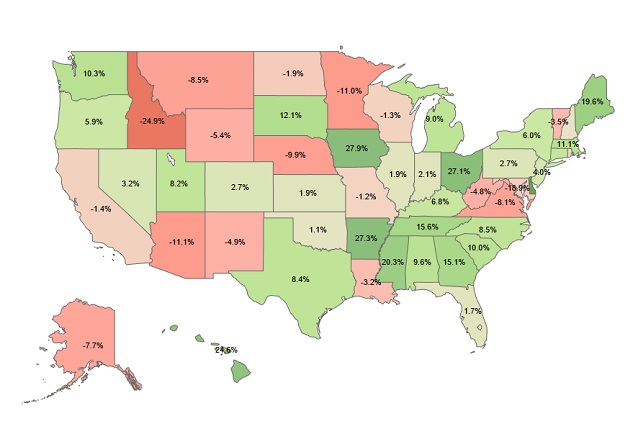

State Of The States

Most states posted positive growth in first mortgage originations, as denoted by the green shading in the United States map below. Collectively, credit unions in nearly 25% of all states benefited from double-digit first mortgage origination growth in the second quarter.

YEAR-OVER-YEAR FIRST MORTGAGE ORIGINATION GROWTH

For U.S. credit unions* | Data as of 06.30.16

Callahan Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan Associates

*For 5,959 credit unions

Credit unions in the southern states posted heavy concentrations of growth, whereas growth slowed considerably for credit unions in much of the Western and Mid-Western regions. Iowa was the exception with 27.9% year-over-year growth, leading all states in first mortgage origination growth.

A variety of economic trends, from rising rent costs in cities nationwide to historically low interest rates, are pushing demand for housing inventory. Overall, credit unions are benefitting. As of the second quarter of 2016, 4.4% of members have a real estate loan first mortgage, second mortgage, or home equity line with their credit union. This indicates members are taking greater advantage of real estate loan offerings and choosing credit unions as their lender of choice.

BE SMART. ATTEND TRENDWATCH.

This must-attend quarterly event for credit union leaders covers performance trends, industry success stories, and areas of opportunity. Attendees will find insight they won’t find anywhere else weeks before the official NCUA data release.

You Might Also Enjoy

- Great Meadow FCU Scores Big While Thinking Small

- Lending Highlights From First Quarter 2016

- Indirect Lending Grows Its Direct Impact On Credit Unions

- A Team Solution To The Payday Lending Problem