Lending is a sweet spot for Atlanta-based Associated Credit Union ($1.4B, Atlanta, GA). The Peach State credit union increased lending volume in nearly every major category during the second quarter.

Elevated consumer confidence and higher levels of disposable income have contributed to rising demand for loan products of all types at Associated as well as credit unions nationally as evidenced by the increased lending at credit unions reporting as part of Callahan & Associates FirstLook program.

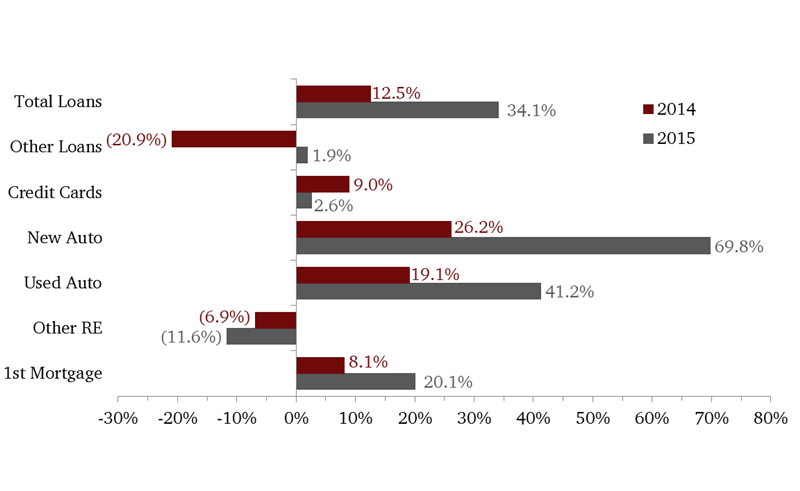

LOAN GROWTH BY PRODUCT

Associated Credit Union | Data as of 06.30.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

As of June 30, 2015, Associated reported a year-over-year increase of 34.1% for its aggregate loan portfolio. In terms of dollar amount growth, auto loans led the way at Associated, growing collectively nearly $200 million over the period, of which new auto loans accounted for $110.2 million. First mortgages, credit cards, and other loans also exhibited growth, rising $34.9 million, $1.1 million, and $362 thousand, respectively.

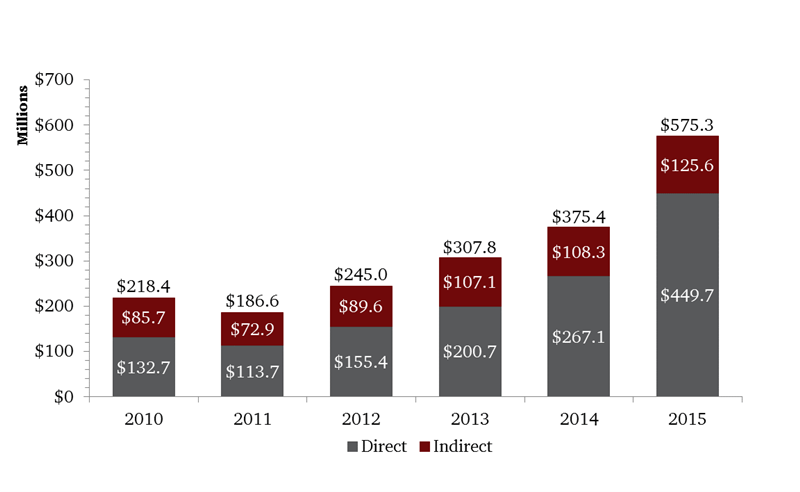

DIRECT VS. INDIRECT AUTO LENDING

Associated Credit Union | Data as of 06.30.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

Within the automotive portfolio, Associated generated the majority of its loans through the direct channel. As a percentage of the total automotive loan portfolio, direct lending has grown from 60.7% in 2010 to 78.2% as of June 2015. From June 2014 to June 2015, direct automotive lending increased 68.4% while indirect grew 16.0%.

How Do You Compare?

Check out Associated’s performance profile.

Click Here