It’s part of the credit union mission to serve consumers of modest means; however, two designations have a major influence on who cooperatives serve and how they fulfill their mission. These designations can lead to vastly different outcomes for credit unions, in turn significantly impacting the entire industry’s financial performance.

Credit unions that want to seriously focus on serving consumers with limited income streams have two primary vehicles to do so: the low-income credit union (LICU) certification from the National Credit Union Administration and the Community Development Financial Institution (CDFI) certification through the Treasury Department. LICU certification requires more than 50% of a credit union’s potential membership to qualify as low income, with income thresholds determined based on data from the U.S. Census Bureau. CDFI certification has more rigorous eligibility requirements. Some credit unions pursue both classifications.

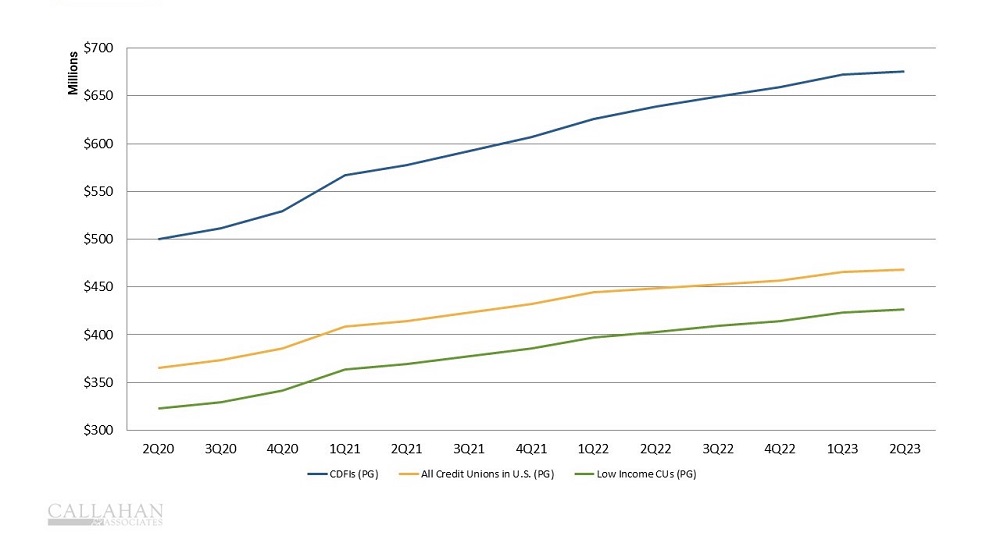

AVERAGE ASSETS

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.23

© Callahan & Associates | CreditUnions.com

At midyear 2023, 54% of the industry — 2,598 credit unions — held a low-income designation. By comparison, approximately 9% of the industry — 423 credit unions — were CDFIs.

1. Membership Growth Is Not The Same

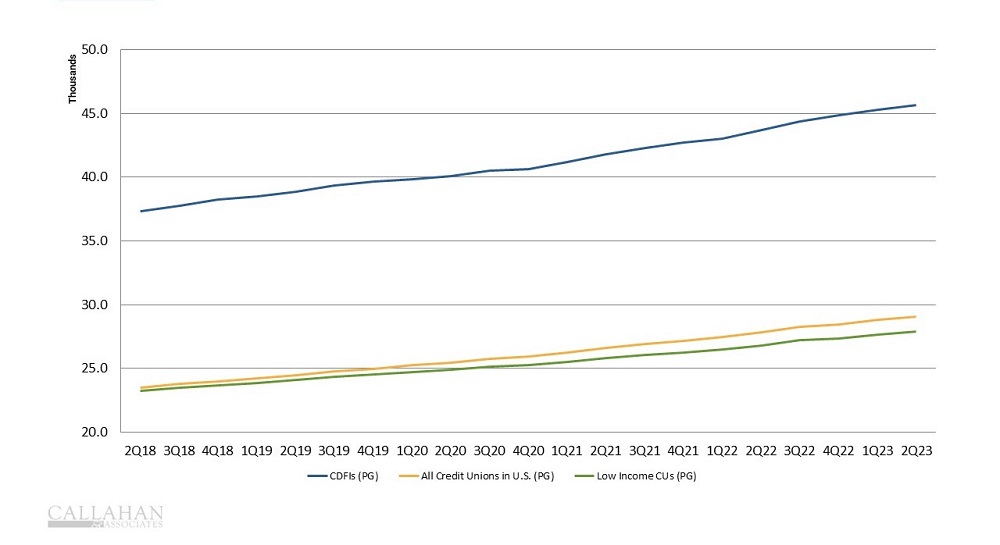

AVERAGE NUMBER OF MEMBERS

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.23

© Callahan & Associates | CreditUnions.com

CDFI eligibility requires credit unions to serve more low-income members than LICU eligibility. As a result, it might seem like assets and membership at CDFI credit unions would be lower than their low-income-designated counterparts; however, the opposite is true.

According to data available in Callahan’s Peer Suite, the average CDFI credit union is consistently larger than the average non-CDFI credit union, regardless of low-income status. One reason might be that larger credit unions have more assets and resources available to take full advantage of the benefits that come with CDFI status, such as access to grants from the CDFI Fund. The Treasury Department requires every credit union applying for CDFI certification to provide “services in conjunction with its financing activities,” a service that smaller credit unions might not have the infrastructure to provide. As a result, larger credit unions might have more motivation to put for the effort necessary to obtain CDFI status.

2. CDFIs Have An Edge In Accounts Per Member

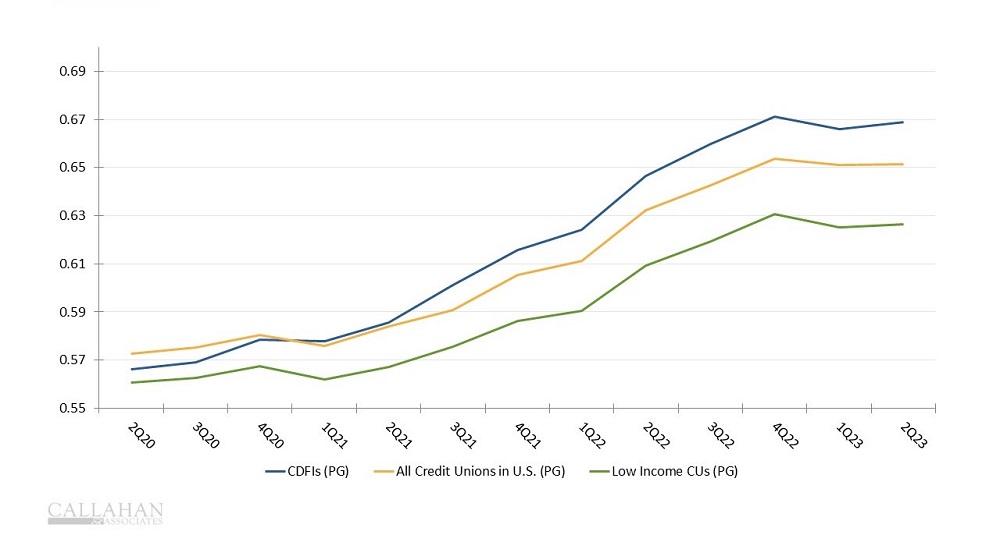

LOAN ACCOUNTS PER MEMBER

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.23

© Callahan & Associates | CreditUnions.com

To be certified as a CDFI, the applying institution must make it a mission to invest in the low-income communities it serves. Thanks to grant funding from the federal government, CDFIs can make more loans at lower rates, thereby encouraging members to take out additional loans. As a result, these credit unions tend to have more loan accounts per member than their low-income counterparts.

Interestingly, LICUs tend to have have fewer loan accounts per member than both CDFIs and the average credit union. Many CDFI credit unions also carry a low-income designation and can apply for community development grants from the NCUA’s revolving loan fund (though far less money is available there than via the CDFI Fund). That gap might be because LICUs without a CDFI certification tend to be smaller and have less diversified loan offerings.

3. CDFIs Have More Loans With Lower Balances

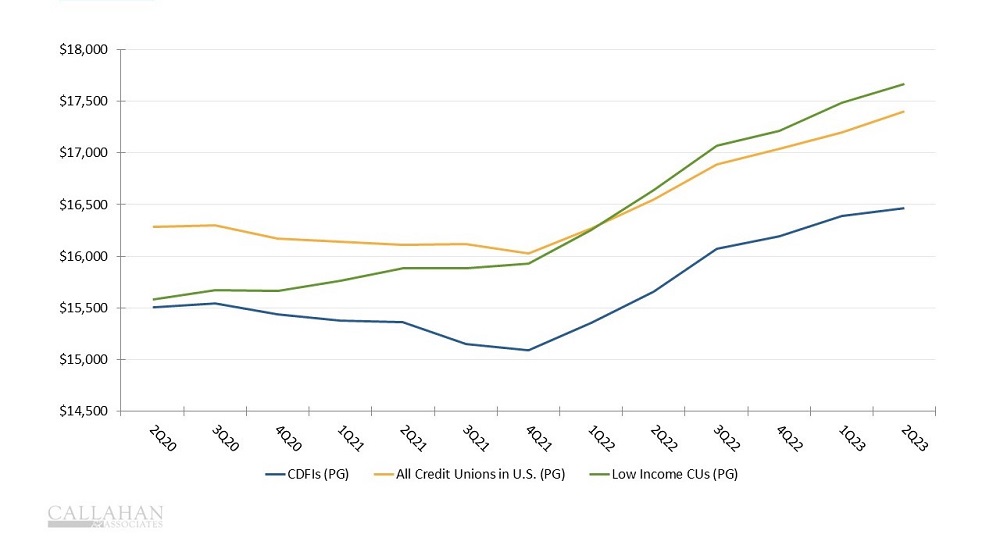

AVERAGE LOAN BALANCE

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.23

© Callahan & Associates | CreditUnions.com

CDFI credit unions tend to carry lower average loan balances than their non-CDFI counterparts — a statistic that has remained steady for at least the past three years. Yet, CDFI credit unions and low-income credit unions share similar loan portfolio compositions, such as a lower percentage of first mortgages and a higher percentage of used auto loans when compared to other credit unions. Here, too, grant funding available from the Treasury Department allows CDFIs to offer more, smaller loans at lower rates than other financial institutions.

Despite the advantages when it comes to membership, asset size, and loans per member, CDFI credit unions still carry lower average loan balances than LICUs and the rest of the credit union industry. This is largely due to a combination of consumer loan dominance and lower average member net worth. These institutions have determined they want to serve low-income consumers and have undertaken a rigorous certification process to do so, indicating a willingness to do what it takes to meet members’ needs.

In other words, although CDFIs and LICUs both serve the underserved, CDFIs have to navigate not only an arduous certification process but also difficult audits to prove they “walk the talk” when it comes to how they use grant money.

Measure Your Performance Against CDFI Peer Groups

REQUEST YOUR SCORECARD