Credit union earnings shifted significantly in 2023 as the Federal Reserve raised interest rates to combat inflation throughout the year. Such increases affected lending, in particular. Year-to-date loan originations dropped by 28.3% and delinquencies rose for the fourth consecutive quarter.

These factors, along with the increased cost of doing business, played a major role in the industry’s earning model.

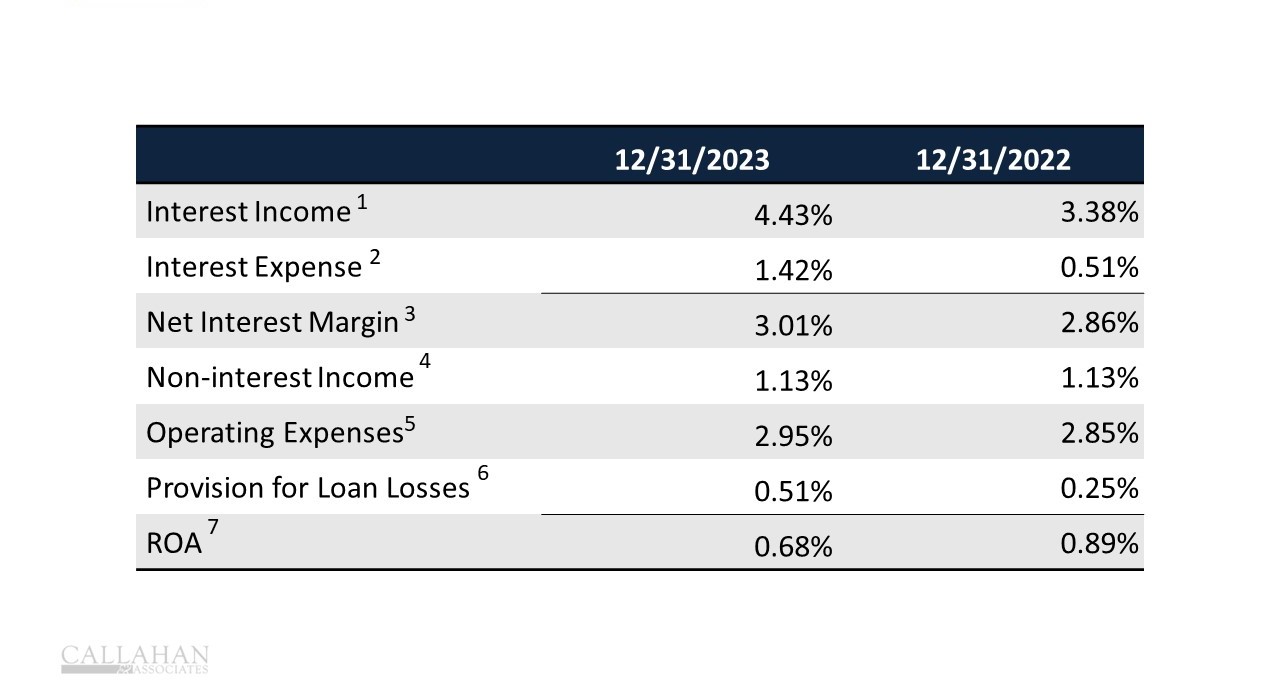

CREDIT UNION EARNINGS MODEL

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.23

© Callahan & Associates | CreditUnions.com

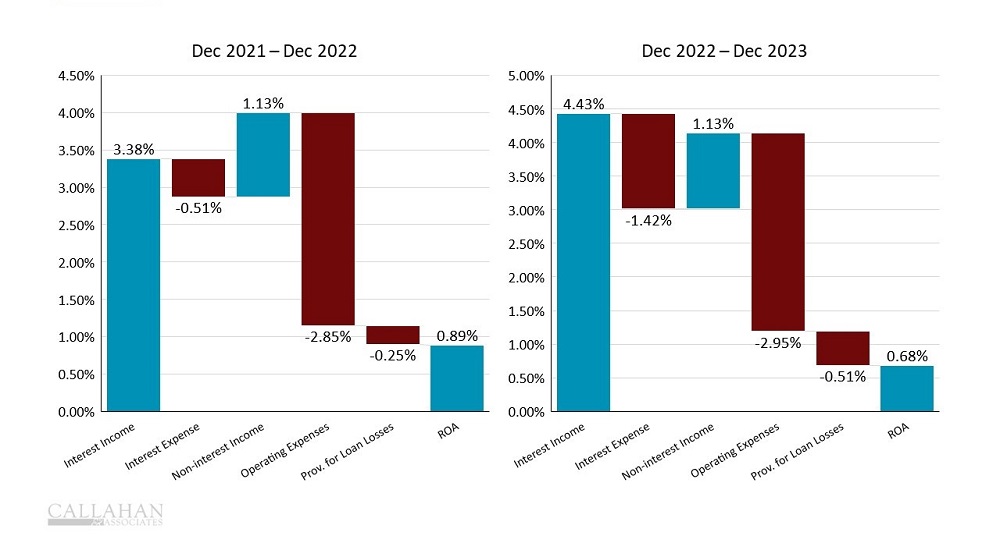

- Interest income and expense increased thanks to the rise in the federal funds rate. Higher rates on loans resulted in a notable upswing in interest income outstanding. It increased a full percentage point year-over-year to 4.43%.

- This boost in interest income came alongside heightened interest expenses, which increased 90 basis points annually to 1.42%. The increased federal funds rate amplified the cost of funds for credit unions, which affected different asset sizes differently. Larger credit unions encountered higher borrowing costs compared to their smaller counterparts, who could sustain their lending operations primarily from shares. Consequently, the average cost of funds for credit unions exceeding $500 million in assets stood at 1.69% of adjusted shares at year-end; for those with less than $500 million in assets, it was only 0.97%.

- Considering both interest income and expense, the net interest margin for credit unions in 2023 reached 3.01% — an annual increase of 15 basis points.

- Non-interest income as a percentage of average assets held steady at 1.13% in 2023. Overdraft and loan repayment fees played a notable role in this income as members opted to make late loan payments or pay a fee to defer payments. With non-interest income stagnant, credit unions heavily relied on lending to generate revenue.

Want more insight about non-interest income? Tap into a universe of non-public data with Callahan & Associates. Reach out today to learn more.

- As the cost of doing business continued to rise in response to inflation, the operating expense ratio increased 10 basis points. It accounted for 2.95% of average assets as of Dec. 31.

- In response to rising delinquency, credit unions increased loan loss provisions by 26 basis points. By year-end, the percentage of provision expense to average assets was 51 basis points.

- Given the changes in the overall earnings model, return on assets declined 20 basis points year-over-year.

EARNINGS MODEL WATERFALL

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.23

© Callahan & Associates | CreditUnions.com

Credit union performance data for this article comes from Callahan’s quarterly Trendwatch webinar, which includes Call Report data from 99% of all industry assets. Watch Trendwatch 2023 today on-demand.