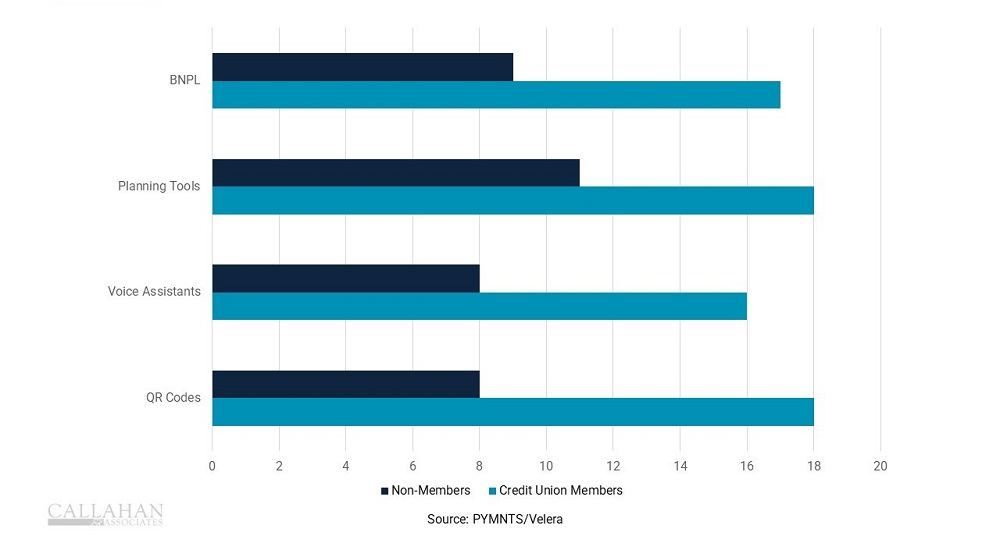

FEATURES AND CAPABILITIES CONSUMERS WANT IN THE NEXT 3 YEARS

FOR RESPONDENTS TO A PYMTS AND VELERA SURVEY

© Callahan & Associates | CreditUnions.com

- Buy Now, Pay Later programs; planning tools; QR codes; and voice assistants are among the top features consumers want with their payments solution within the next three years, according to a March survey from PYMTNS and Velera.

- Among non-credit union members, 9.3% reported wanting a BNPL solution in the next three years. That number jumped to 17% for credit union members. Notably, only 1.5% of credit unions surveyed currently offer a BNPL solution, and roughly half of all credit unions surveyed had no plans to implement one in the next three to six years.

- Further, compared with non-credit union members, nearly twice the share of credit union members also reported wanting their financial institution to offer QR codes and voice assistants in the next three years.

- By offering advanced features that help members manage their cash flow and financial transactions, credit unions can raise their odds of engaging members and reducing churn among existing and new members alike.

BNPL programs have become a key player in the financial landscape, with some credit unions adopting their own version for their members. Learn more in “Buy Now Pay Later: Fad Or The Future?”