TOTAL BRANCHES

FOR ALL U.S. CREDIT UNIONS

© Callahan & Associates | CreditUnions.com

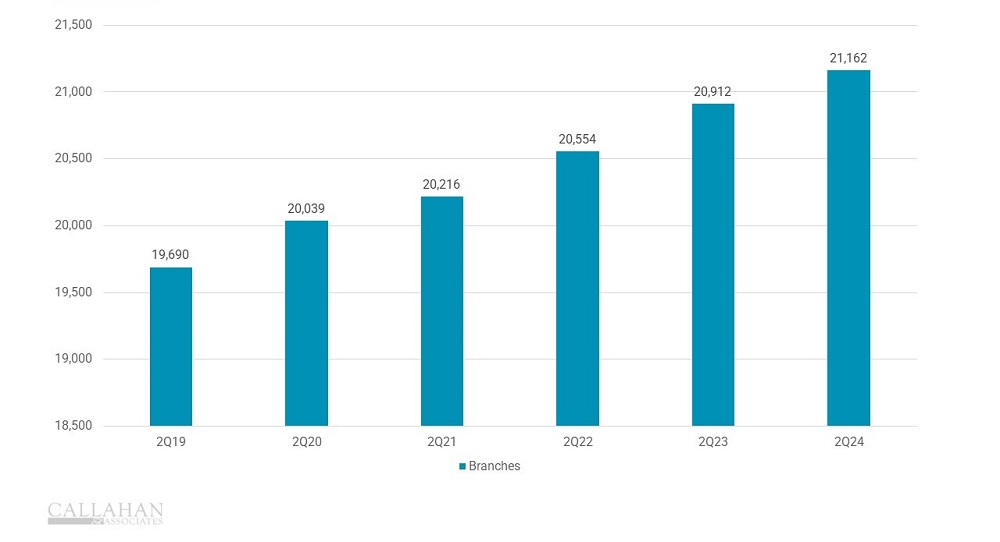

Despite a slight slowdown in 2020 due to the pandemic, total branch numbers of all active credit unions continue to increase, with nearly 1,500 new facilities opening their doors in the past five years.

Strategic Insights

- Investing heavily on two fronts: Credit unions have invested heavily in self-service channels in recent years, but that doesn’t mean branches have gotten the short end of the stick. The industry continues to pour resources into brick-and-mortar facilities, with overall branch numbers for active credit unions rising by 7% since the second quarter of 2019.

- Branching with intent: Even better, as the number of members continues to rise, credit unions are taking steps to ensure consumers everywhere have access to affordable banking services, opening branches in impoverished communities, in communities abandoned by for-profit banks, and more.

- Banks’ perspective: All of this comes as banks continue to shutter brick-and-mortar locations. In the year ending June 30, the five biggest banks in America closed nearly 500 branches — and that figure doesn’t take into account shrinking branch footprints at regional and community banks. One report found banks nationwide closed more than 4,000 branches following the pandemic.

- Reimagining familiar spaces: One thing is clear — footprints are expanding but branches are getting smaller and smarter. Newer open-branch concepts do away with teller lines, allowing for universal bankers and more personalized services in less space. Consequently, credit unions don’t need as much square footage per branch. Good thing because branch costs continue to rise. A 2022 Bancography report indicated the average cost for a free-standing branch was up approximately 5% from 2019 to $1.9 million.

Need A Better Branch Strategy? Identify important trends in your local market, evaluate potential new markets, and uncover hidden potential in vacated branches — Peer Suite from Callahan & Associates helps you do all this and more. Featuring data for credit unions and banks across the country, Peer Suite gives leaders the power to analyze branches, institutions, and markets to craft a strategy that stands out from the rest. Learn more today.