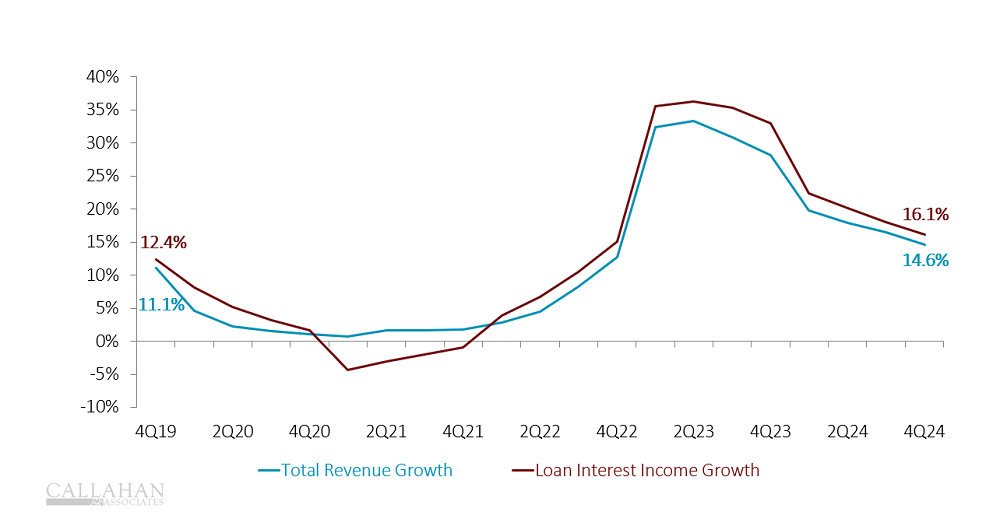

Credit union revenue surged after the Federal Reserve began raising interest rates in March 2022. The consistent rate bumps between March 2022 and September 2024 allowed credit unions to add higher-yielding loans to their balance sheets and expand adjustable-rate loans, driving revenue through interest income.

Since September 2024, however, the inflow of higher-yielding assets has slowed. Consequently, revenue growth has also slowed. Credit union revenue grew 14.6% in 2024, nearly half the rate reported in 2023.

Interest on loans — the primary driver of growth — increased 16.1% in 2024 versus 33.0% growth in 2023. Interest rates on loans have plateaued, liquidity is tight, and consumer demand for loans is soft, creating a difficult lending environment for credit unions. As such, loan balances were up only 2.6% in 2024.

At the same time, growth in investment income slowed from 63.1% in 2023 to 23.7% in 2024 as credit unions reduced their investment portfolios as part of a larger balance sheet management strategy.

ANNUAL GROWTH OF REVENUE AND LOAN INTEREST INCOME

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

Where’s The Bang For The Buck

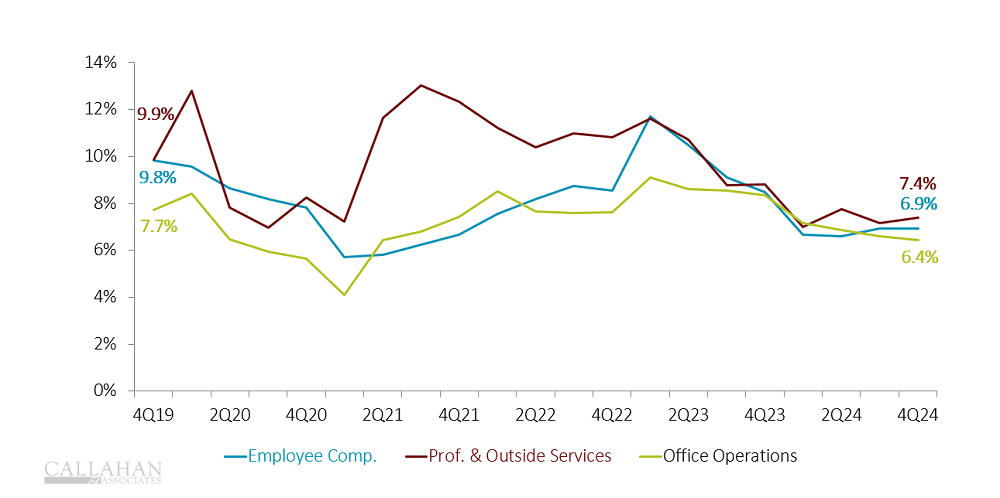

That fact that revenue is still growing is a good sign. However, expenses are growing, too, albeit at a slower pace since 2022.

Operating expenses grew 6.2% in 2024, expanding to 3.04% of average assets. That increase did not come from one single area; all major categories of operating expenses grew at least 2.8%. Compensation per employee expanded 6.2% in 2024 despite employee counts remaining relatively stable. Average compensation closed out 2024 at $102,855 per employee.

Spending on professional and outside services also increased in 2024, a sign that credit unions might be trying to outsource tasks rather than hire in-house. Such investments can prove to be beneficial down the line but are often expensive up front.

ANNUAL OPERATING EXPENSE GROWTH BY TYPE

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

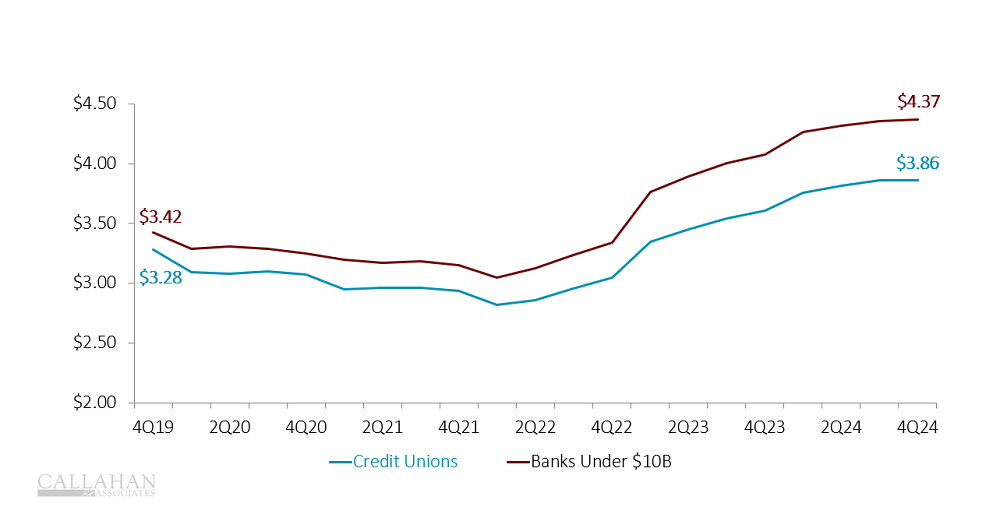

Credit unions generated $3.86 in revenue for every dollar spent on employee compensation — a stable but unchanged figure from the third quarter. This ratio levelled off similarly at the end of 2024 for banks with less than $10 billion in assets, although at a higher $4.37 per dollar of compensation expense. If future revenue growth struggles to keep pace with rising compensation costs, this metric will decline across all financial institutions.

REVENUE PER SALARY AND BENEFITS EXPENSE

FOR U.S. CREDIT UNIONS AND BANKS <$10B

SOURCE: Callahan & Associates

Cautious Support

Provision expenses represented another area of increased growth. They jumped 25.6% year-over-year in 2024 and comprised 0.62% of average assets at year-end 2024 versus 0.51% one year earlier.

Members have depleted their savings and have little excess to cover debt obligations. Consequently, asset quality has worsened. The net charge-off ratio increased 19 basis points in 2024, and the delinquency ratio increased 14 basis points. This erosion of asset quality plus new CECL accounting standards have pushed credit unions to allocate substantially more to cover potential losses.

However, it’s important to note credit unions should be concerned about more than their financial statements when evidence arises that members are struggling. Although provisions do impact earnings, credit unions exist to support members in need. Hard times necessitate special measures.

Cause For Optimism

As operating expenses and provisions grow, credit unions look to support earnings through margin management and non-interest income.

Falling rates can boost margins because they generally make funding sources less expensive, too. Although competition might support prolonged elevated deposits, borrowing costs should drop for those in need of funds.

On the lending side, high rates have pushed many members to the sidelines; however, real estate offers an avenue for optimism. The mortgage market — both purchases and refinances — flashed life in the fourth quarter. First mortgage loan originations rose 40.5% in the fourth quarter of 2024 versus the fourth quarter of 2023. Real estate lending has been in decline the past several years, but if interest rates continue to drop in 2025 and originations continue to rise, it could be a saving grace for credit union revenue.

Let’s Review Your Year-End Performance Together. Join Callahan for a complimentary 1:1 session to analyze your performance reports using key insights from Trendwatch 4Q24. We’ll benchmark your credit union against two to three peer groups of your choice and provide a detailed report of our findings at the end of the session to help your team make informed strategic decisions. Request now.