Bags might be packed and pencils sharpened, but the chaos is just beginning. As families and students gear up for another academic year filled with rising costs, tech hurdles, and mounting pressures, credit unions across the country are stepping in with real solutions. From holistic school-prep sessions to loans, grants, immersive educational sessions, and more, here are 10 ways the industry is helping communities kick off the year strong.

1. Grants For Educators

Credit Union of America ($1.7B, Wichita, KS) offers educator loans for school-related expenses and beyond. Its grant program, on the other hand, is for learning, says Bradley Dyer, Jr., senior business development officer.

The credit union funds its grants — up to $1,000 per application — with profits from its giveback credit card and returns more than $80,000 to schools every year via awards made in the spring and fall.

“We’ve put back over half a million dollars into Kansas classrooms, benefitting over 1,200 educators,” Dyer says.

Credit Union of America ensures the grant review committee includes at least one retired teacher every year, and it scrubs applications of information that might identify applicants. Although the grant is intended to benefit classroom learning, the credit union has relaxed that definition in recent years and, consequently, grant requests have increased in size. In response, the credit union doubled its previous grant amount of $500 to $1,000 in 2024.

Recipients may use grant money for classroom projects or supplies — everything from calculators to library books and beyond — or funnel the award toward field trips and other educational experiences. College educators, too, can apply and use the grant money for educational experiences for college students.

“Last year, when students were learning about the legal system, we gave a grant for them to take a trip to an actual courtroom to hear real lawyers debate a case,” Dyer says. “We might not have funded a field trip for students in the past. I’m not sure we felt that fell into the classroom category.”

Based in Wichita, Credit Union of America serves teachers in 15 school districts across the state. The bulk of the grant applications come from local teachers; however, the number coming from further afield has “grown substantially” in recent years, Dyer says.

2. A Holistic Approach To Back-To-School Readiness

During this year’s back-to-school season, TruWest Credit Union ($1.7B, Tempe, AZ) teamed up with Community Bridges, Inc. to deliver more than just supplies — the duo delivered support.

As the title sponsor of the 2025 Supply Drive and Back To School Giveaway, TruWest hosted a month-long drive, and provided backpacks and supplies for the event. But the event went even further, offering free laptops, haircuts, dental screenings, sports physicals, and more to remove barriers and set up students for success in every aspect of life. Over 1,800 individuals visited the event, which supplied nearly 1,400 backpacks for students to start the school year with confidence

“This kind of support is about investing in the whole child,” Natalia Chimbo-Andrade, director of community education and outreach at Community Bridges, Inc., said in a press release. “And TruWest was happy to increase access to essential resources for life and school.”

“We’re proud to support students and help families ease the stress of back-to-school season,” says Chris Kearney, CEO of TruWest. “Every child should have the supplies they need to feel prepared and ready to learn.”

3. CU In School

Students in select public school districts in Michigan will once again have the opportunity to open bank accounts, save money, and learn valuable financial skills this academic year via in-school branches hosted by LOC Credit Union ($457.8M, Farmington, MI). What’s more, these in-school branches also offer hands-on experience in financial operations to students working under credit union supervision. LOC opened its first in-school branch in 1996 and now operates 19 such facilities across Farmington Public Schools, Hartland Consolidated Schools, and Howell Public Schools.

According to data from Callahan & Associates, credit unions operate almost 800 in-school branches across elementary, middle, and high school locations. Those facilities have been an industry fixture for decades, providing financial education and hands-on experience to students of all ages while exposing them to the industry’s “people helping people” philosophy.

4. CU On TV

Leaders Credit Union ($1.2B, Jackson, TN) is using its sponsored time on local newscast WREG to help families manage the high cost of heading back to school. In a recent appearance, Carrie Cantrell, community engagement specialist at Leaders, suggested families work with their students to inventory reusable supplies from last year, take advantage of tax-free weekends, or pair up with other families to buy school supplies in bulk to combat rising prices.

5. In Touch With Tech Tools

Tax dollars might pay for public education, but they don’t cover the equipment necessary for classroom success. That’s why many credit unions offer technology loans to help families meet their students’ educational needs. Laptop loans are among the most popular, but credit unions also offer programs that cover iPads, new smartphones, and other tech tools.

Community West Credit Union ($251.9M, Kentwood, MI) offers interest-free laptop loans for members between the ages of 18 and 24. Financing after the fact is available for members who bring in receipts for tablets or laptops within 30 days of purchase. The credit union reimburses their accounts and allows them to spread payments over 24 months.

6. School Spirit

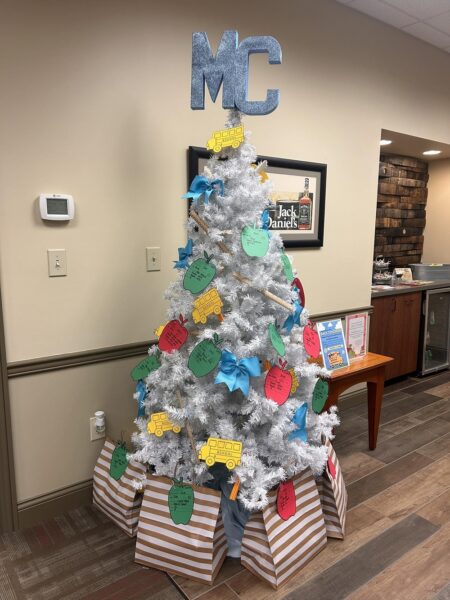

Jack Daniel Employees’ Credit Union ($52.4M, Lynchburg, TN) hosted a back-to-school apple tree in its branch — similar to a holiday “Angel Tree” — so members and the community at large could anonymously donate school supplies and other materials for needy families with children heading back to school.

“In so many aspects of life in a small town, people come together just to lift one another up,” CEO Pam Case said on the credit union’s website. “This is evident whether it is a tragedy impacting a family or providing a hand-up, such as the Back-to-School Apple Tree.”

The cooperative also offers an in-school branch, branded as Raiders Credit Union, for students at Lynchburg Elementary School.

7. A Penny (Or More) For Private School

Approximately 4.7 million K-12 students were enrolled at private schools in 2021, according to the most recent data available from the National Center for Education Statistics. That’s approximately 9% of the total student population. Many state legislatures have considered rules to allow parents to use taxpayer-funded vouchers and public money to pay for private schools, but in the meantime, credit unions are also working to make admission more affordable.

At Pelican State Credit Union ($769.1M, Baton Rouge, LA), private school loans are available starting at 13.11% APR with a one-year term. If a member’s loan application is approved, schools submit tuition invoices to the credit union, which then pays the school directly.

8. Student Support In The Tarheel State

The nation’s second-largest credit union, State Employees’ Credit Union ($55.4B, Raleigh, NC), spent the month of July collecting school supplies for Tarheel State students at all 275 of its branches as part of the Governor’s School Supply Drive. This is the seventh year the credit union has served as a drop-off site for items like pencils, paper, headphones, sanitary wipes, and more, and North Carolina Gov. Josh Stein visited the credit union’s Salisbury Street location on July 2 to kick off the event.

To maximize impact at the local level, donated supplies go to public schools in the counties where they are collected.

9. Summer School, So Cool

Learning shouldn’t stop just because it’s summer. With that in mind, Abound Federal Credit Union ($2.5B, Radcliff, KY) partnered with Western Kentucky University in 2020 to host a financial education summer camp for high school students. For the 2025 session, 45 high school sophomores, juniors, and seniors spent five days and four nights on the WKU campus living in dorms, eating in the university cafeteria, and getting a taste of college life — all while taking a deep dive into the basics of personal finance.

This year, approximately 45 high school sophomores, juniors, and seniors will arrive at the WKU campus in mid-June for five days and four nights. They’ll stay in the dorms, eat at the cafeteria, and generally gain a taste of the college experience.

“We’ve built financial education into our overall strategy, supporting schools, colleges, the military, and other groups across Central Kentucky,” says Ray Springsteen, CEO of Abound. “We have about 100 team members directly involved in delivering financial education, and we reached over 20,000 individuals last year. This work is part of our culture and brand.”

Don’t Stop Here. Abound Credit Union helps keep financial literacy alive through a dynamic summer camp that blends campus life with real-world money skills. Read more in “School’s Out For Summer, But Financial Education Continues.”

10. Sound Scholarships

Sound Credit Union ($3.2B, Tacoma, WA) recently awarded $20,000 in scholarship to 13 students continuing their education at colleges and universities in Washington and beyond. The cooperative selected recipients based on academic achievements, community involvement, and commitment to furthering their education.

Although credit unions are not required to formally log their philanthropic work, the industry awards hundreds of thousands of dollars every year to students across the country, making secondary education a major beneficiary of credit unions’ commitment to community.

“By supporting these students, we’re investing in future leaders — individuals we believe will make a meaningful impact in their communities,” Jennifer Reed, Sound’s vice president of public relations, said in a press release.