Many credit unions plan out two or even five years in advance. Not Blue Federal Credit Union ($2.1B, Cheyenne, WY).

The Wyoming-based cooperative is more than halfway through an ambitious 10-year strategic plan known as Blueprint 2030.

“Every credit union says it exists to serve members,” says CEO Stephanie Propps, a 25-year veteran of the credit union dating back to its days as Warren Air Force Base Federal Credit Union. “We wanted to take it one level deeper. What value proposition do we have that could offer something greater beyond what we currently were offering?”

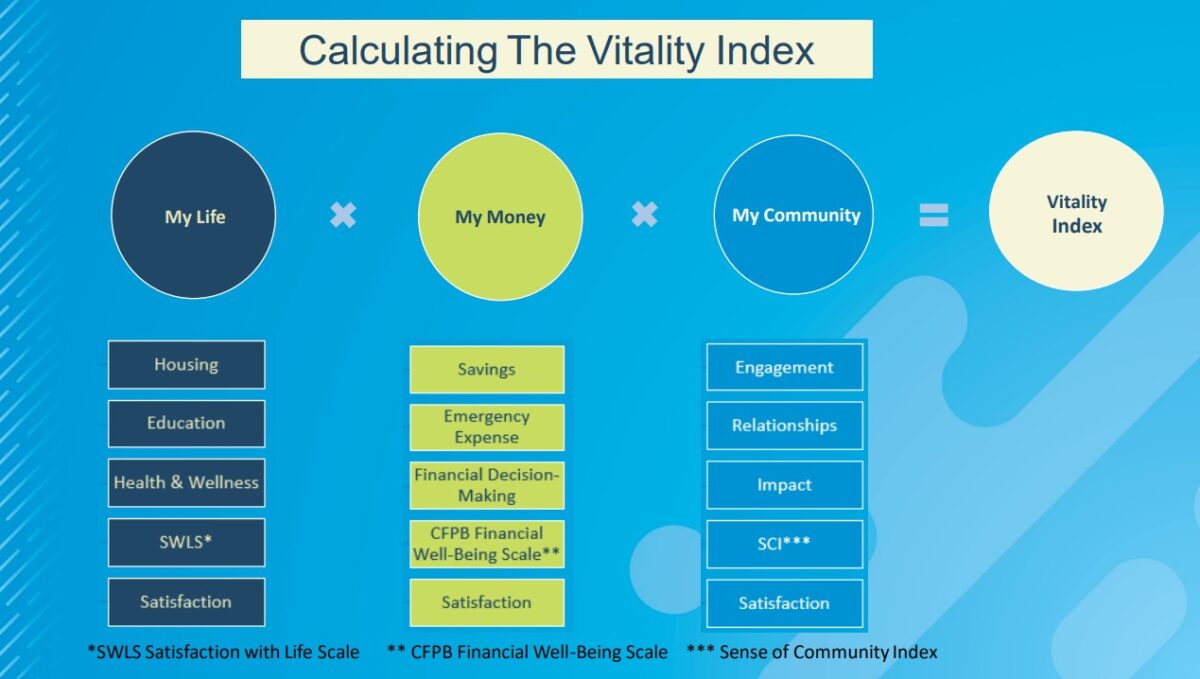

The result is a multi-pronged strategic plan focused on three pillars at the heart of Blue’s “Vitality Index,” a custom system designed to measure success beyond traditional KPIs. Those pillars are:

- My Life (including financial coaching and education).

- My Money (including financial products and services).

- My Community (focused on community engagement, the credit union’s foundation, and impact).

Blue still measures traditional KPIs, budgets, NPS scores, and more, but the Vitality Index measures how well the credit union is delivering on its mission.

That process starts with extensive community surveys covering each of those three pillars. The surveys, for members and non-members alike and administered and held by Corona Insights, includes questions that address what percentage of income respondents spend on housing and how confident they are that they can get or keep housing they want. The survey also covers total savings, how spending and income have changed over time, and a range of questions on community engagement. Blue then slices and dices results by region, income, and other factors.

The credit union conducted the survey in 2021 and 2023, and both editions so far have included questions about health and wellness. Although Blue can’t directly help in those areas, it asks the questions out of a belief that a solid financial footing contributes to wellness in other areas as well.

In 2021, Blue members scored higher on the Vitality Index than non-members, but scores for both cohorts fell in 2023. In particular, scores in the “My Money” category fell by 4.5%, which served as a signal that Blue needed to refocus on its core business as its community grappled with inflation, high housing prices, and economic uncertainty.

Looking for more? Blue FCU’s long-term plans balance both the balance sheet and community impact. Read more in “Anatomy Of Blue Federal Credit Union,” available today in the Callahan client portal.

Blue Skies And Promising Growth

At $2.1 billion in assets, Blue is by far the largest credit union in the Cowboy State — more than double the size of the state’s second-largest credit union — but it has taken more than 70 years to get there.

When Propps joined Warren FCU as vice president of administration in 2000, assets stood near $100 million. She became CEO five years later, when assets were approximately $200 million. When she took the helm, Warren FCU had been through several years of turnover, including the retirement of a long-time CEO, a short-term successor, and other executive turnover. Propps’ first charge from the board was for the credit union to regain its footing from the community and leadership perspectives. Once that was settled, she set her sights on growth and expansion, and in the 20 years since she took over, the credit union’s assets have grown tenfold.

Originally chartered in 1951 as Warren FCU, the credit union historically served F.E Warren Air Force Base, the oldest continually active installation within the U.S. Air Force. After 65 years, Warren FCU merged with Colorado-based Community Financial Credit Union, creating Blue — a moniker intended to reflect its Air Force roots and the open skies of the Rocky Mountains — and marking the start of the cooperative’s southward reach.

Blueprint 2030 outlines specific targets around asset growth, expansion, and more. Part of that includes moving beyond the credit union’s home base and into new markets. It has expanded into Colorado, starting in the northern part of the state with Fort Collins before moving south along I-25 to the Denver metro area and on to Colorado Springs and Pueblo.

“I’m blessed to work with great people and a great board that has supported my vision to expand and grow the credit union,” Propps says, adding that she’s raised a family in Cheyenne and fallen in love with the community. “It’s the best of all worlds for me here; I’ve never had any reason to leave.”

Back To The Basics

Growth is still a priority today, but Blue’s board and leadership place a premium on culture and focus more on existential discussions, including about purpose and why the credit union exists. They recognize the need to be more strategic and understand desired growth patterns and trajectories. That’s where Blueprint 2030 comes into play.

“Taking on the 10-year Blueprint 2030 initiative has elevated the organization from a culture perspective,” Propps says.

When it comes to digging into purpose, the CEO says the process is a “pretty big challenge” and an ongoing journey.

“It’s a lift,” she says. “We are continuing that work.”

Propps led the charge on Blueprint 2030, but she emphasizes that its launch — and ongoing success — wouldn’t have been possible without buy-in from the board, leadership, and the entire organization. The initiative started with board-level focus groups and then moved through the ranks of employees all the way to members.

“Engaging your staff and your board in the process is pivotal to getting buy-in to anything you do,” Propps says. “If they’re a part of it, it creates ownership that goes beyond giving feedback.”

Ultimately, Blueprint 2030, the research behind the Vitality Index, traditional KPIs, and more all are key to determining if the credit union is meeting its mission and understanding when it might need to pivot.

“We might think growth is the perfect strategy, but our members are telling us that the No. 1 thing they want is somebody who can explain our products and services to them better,” says Kim Alexander, chief strategy officer at Blue. “So we need to make sure we’re training staff to understand where members are coming from.”

Propps, Alexander, and other Blue leaders use the same phrase repeatedly: Back to basics. For Blue, that means listening to member sentiment and ensuring staffers have the tools and knowledge they need.

“You’ve always got to be good at the basics,” Alexander says. “Sometimes big strategies can take you away from that focus.”