This is part of the Callahan Financial Performance Series. Presented by the analysts at Callahan & Associates, the series helps leaders interpret data to drive smarter decisions and uncover new approaches to measure performance.

In a landscape of economic uncertainty and lawmaker pressure, credit unions stand at a pivotal crossroads: They are challenged to reaffirm their relevance even as they double down on efforts to differentiate themselves, steer into their specialties, and reinforce member trust and loyalty.

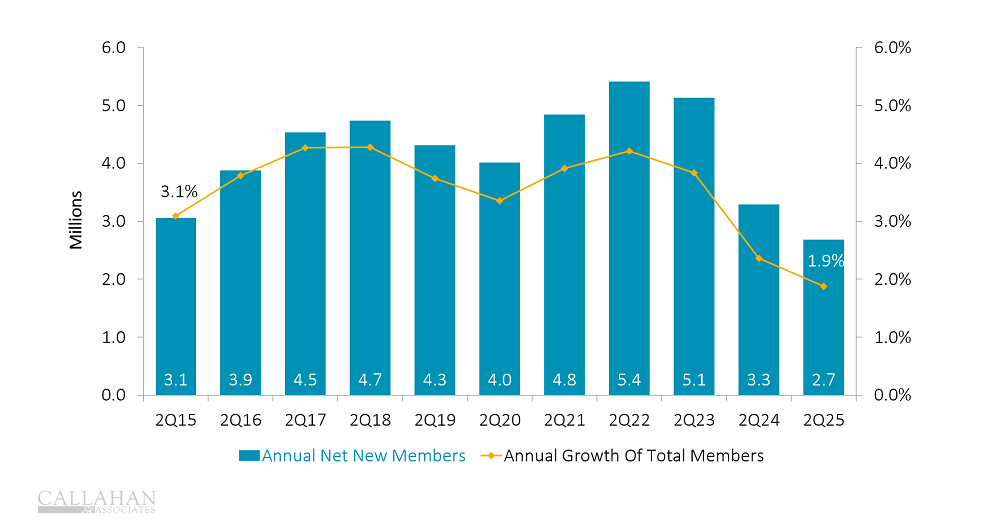

Although the credit union movement continues to grow, the rate at which it has added new members has drastically slowed in the past three years. At mid-year 2025, the industry’s annual membership growth dropped to just 1.88%, the slowest rate since the fourth quarter of 2011.

Factors contributing to these growth dynamics include higher interest rates, liquidity pressures, and the larger slowdown of the U.S. economy; however, changes to membership growth strategies and difficulties in marketing to a new generation also play a role.

NET NEW MEMBERS AND MEMBERSHIP GROWTH

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

The Credit Union Member At Midyear

Credit union membership has notably fluctuated in both members gained and member growth in the past decade. The industry reported particularly strong growth in the post-COVID years, when excess liquidity from the CARES Act drove credit unions to source loan demand from indirect partnerships. Growth peaked in 2022 and 2023 with more than 5 million new members per 12-month period and growth exceeding 4%.

However, membership growth started to decelerate in 2024 and dropped to just 1.88% in the second quarter of 2025. Net new members fell to approximately 2.7 million at midyear amid changes in credit union strategy, rising competition from fintech and traditional banks, and shifting consumer preferences.

INDIRECT LOAN GROWTH

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

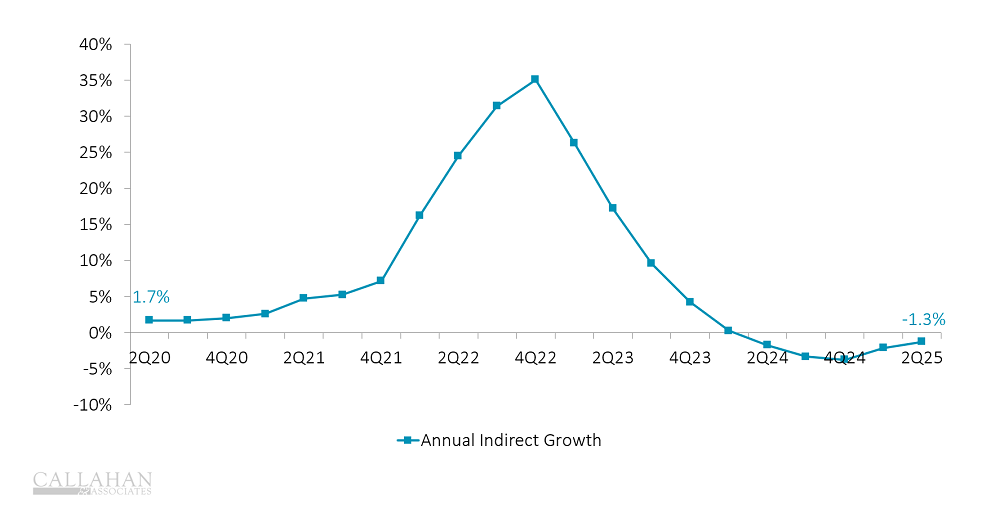

Changes In Credit Union Strategy

In mid-2023, indirect loans comprised nearly 25% of all credit union lending, suggesting an imbalance in membership focus.

At that time, many credit unions already recognized their balance sheets were skewing in favor of indirect members and were taking steps to re-engage with and nurture their core membership roots. Consequently, growth in indirect lending started to decline sharply in late 2022 and turned negative by the end of 2024, where it has remained in 2025.

Competition And Consumer Preferences

Even as credit unions consciously change their membership growth strategies to focus on direct member relationships, they must navigate a field of increased competition and battle for market awareness. Shifting consumer preferences toward digital-first experiences and personalized service further intensify the challenge. Large banks and fintechs possess the scale and financial resources to invest in state-of-the-art digital presences and attract consumers through targeted marketing and smooth rate-shopping interfaces.

CREDIT CARD LINES AND UTILIZATION

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

Impacts On Penetration

Despite their renewed focus on core members, many credit unions have struggled to develop lending relationships with them. As of June 30, 2025, less than half of credit union members held a direct loan with their credit union.

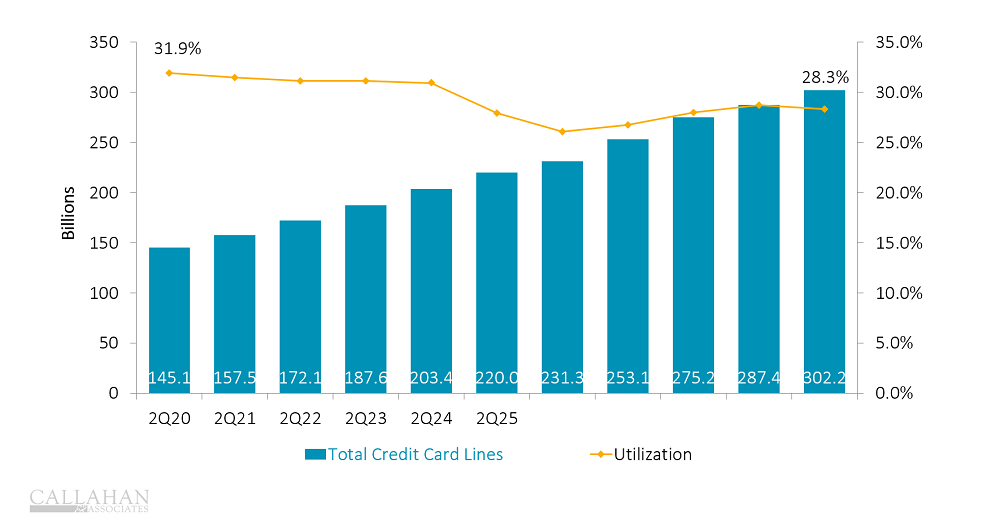

This disconnect is reflected in product engagement trends. Product penetration rates have been volatile, with credit cards and first mortgages both dipping during the pandemic, then recovering. Rates climbed to their highest levels ever in late 2022 and early 2023; unfortunately, they declined to pre-pandemic levels in 2025.

Credit unions reported a decline in overall credit card usage during the pandemic as cautious consumers reduced spending and avoided taking on new debt in the face of widespread economic disruptions and financial uncertainty. Members didn’t need to tap credit cards or HELOCs when they were at home and had access to relief packages.

Since then, utilization rates have climbed but have yet to surpass pre-pandemic rates. This might indicate members are struggling less than they were before the pandemic. It could also be a sign that members are not relying on their credit unions and are instead tapping credit elsewhere.

The Price Of A New Member

Despite slowing membership and penetration, credit unions are working to re-establish close relationships with members. Broadly speaking, member acquisition depends on how a credit union performs in three key areas:

- Does the credit union understand its membership’s needs?

- Can the credit union effectively tell its story and present itself as the solution?

- Is the credit union able to push this story in front of current or potential members?

Those who can answer “yes” to these questions tend to do well in acquiring and engaging members. However, member acquisition also tends to involve rising costs and new investments in surveying, branding, product design, and marketing — often through digital channels.

The cooperative, member-focused model provides a leg up in the competitive marketplace. How effectively credit unions tap into that advantage depends on how they balance operational sustainability with their missions to serve. Ultimately, credit unions that can clearly articulate their value — and deliver it with consistency — will be best positioned to turn their cooperative advantage into lasting member loyalty and market relevance.