This is part of the Callahan Financial Performance Series. Presented by the analysts at Callahan & Associates, the series helps leaders interpret data to drive smarter decisions and uncover new approaches to measure performance.

Callahan clients can access the full version of this article right now on the client portal. Read it today.

As the Federal Reserve continues to adjust its benchmark rates, credit unions across the country are watching closely. Lower interest rates are supposed to make borrowing more attractive and saving less so, but does this theory hold up in the real world?

The Federal Reserve typically lowers rates in response to economic weakness, and that uncertainty can make it hard to predict how households will react. Sometimes, lower rates are enough to jump-start lending and spending. Other times, they merely help steady the ship, preventing a slide into recession.

For credit unions, the key is balancing opportunity and risk. So, what might the future hold if interest rates continue to fall?

Loan Originations Will Continue To Rebound

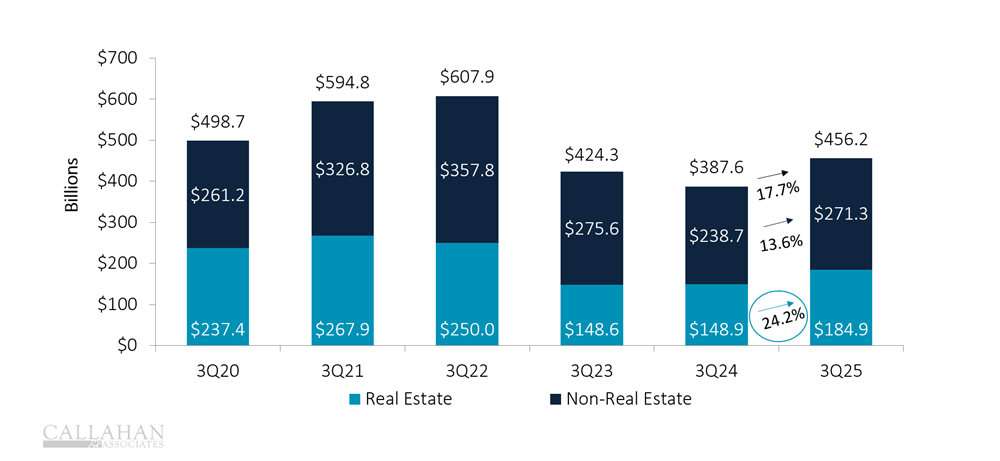

In the third quarter of 2025, loan originations increased 17.7% year-over-year, a striking rebound and the highest level of originations through the third quarter since 2022. If more interest rate cuts are on the horizon, it stands to reason that demand for both new mortgages and refinances will increase.

YEAR-TO-DATE LOAN ORIGINATIONS

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

Member Appetite For Share Certificates Will Decrease

With a lower dividend rate, fewer members will want to park their savings in share certificates. Instead, they’ll gravitate toward more liquid options like regular shares or money market accounts. Members might also withdraw large portions of savings to chase the potentially inflation-beating yields of stocks or crypto.

The Net Interest Margin Will Move Closer To The Operating Expense Ratio

If low rates push members to refinance existing loans and take out new ones (in essence, repricing the loan portfolio) and liquidity pressure keeps the cost of funds from falling, then the spread between interest income and interest expense will shrink, compressing margins and creating headwinds on earnings.

Ready To Read The Full Story? Callahan clients may access this exclusive content within the client portal. Read it today. Not yet a client but looking for expert insights to help you adapt to change, develop your organization’s leaders, and stay at the forefront of industry trends? Connect with our team to learn more.