What do roughly 80% of American adults have in common? They have credit cards.

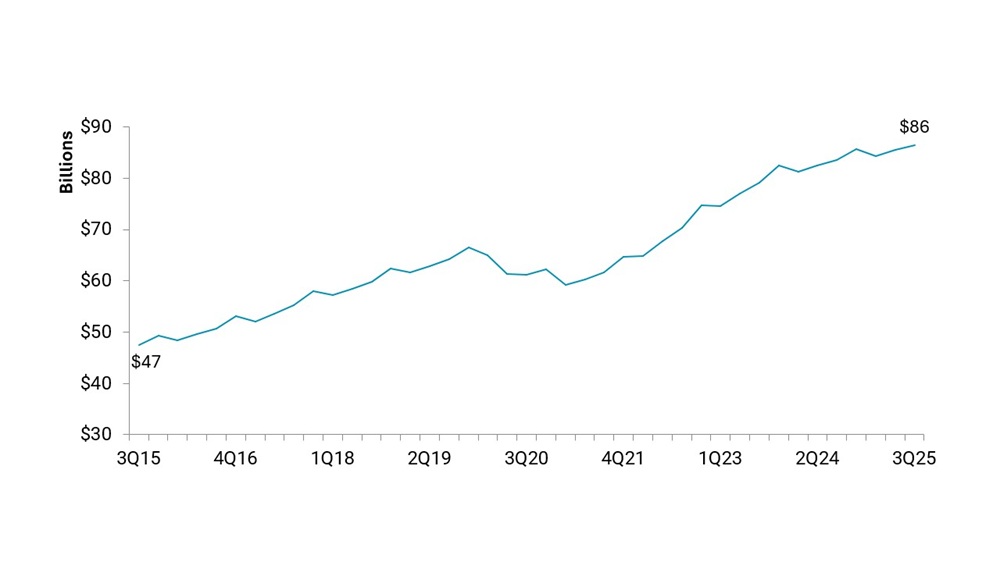

Drilling down, nearly 26 million credit union members, or 17.7%, have a credit union credit card, and credit unions hold $86.4 billion in credit card loans on their balance sheets. Credit card borrowing at U.S. credit unions has steadily increased since the COVID-19 pandemic as households struggle to keep up with inflation.

In early 2026, the Trump Administration, in conjunction with bipartisan allies in Congress, announced a plan for a 10% cap on credit card rates. The proposal is intended to lighten the load for households and approve affordability in the United States. Many financial services organizations have spoken out about the policy, meriting a closer look at the data for the credit union industry.

CREDIT CARD LOANS OUTSTANDING

FOR U.S. CREDIT UNIONS

SOURCE: CALLAHAN & ASSOCIATES

A Credit Card Cap And The Credit Union Balance Sheet

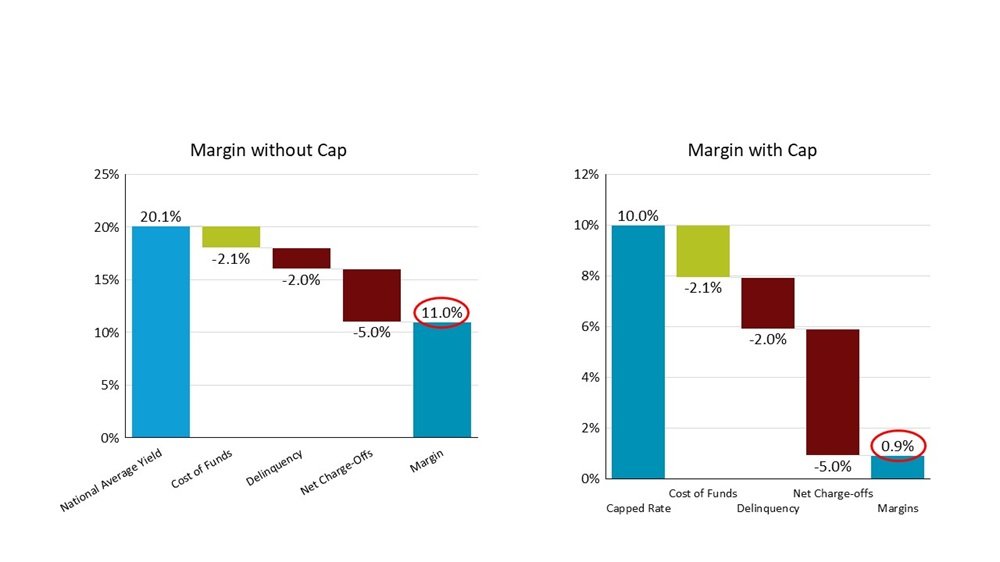

The credit union earnings model rests on a cooperative’s ability to earn more from its lending than it spends on interest expenses, delinquency, and net charge-offs. Adding a wedge like an interest rate cap forces institutions to make tough decisions about where and how to apply credit. A 10% cap on credit cards, for example, would tighten margins and could limit the ability of credit unions to issue a credit card to certain members.

Although credit unions don’t report the interest they receive on individual loan products, Bankrate reports the nationwide average credit card rate was 20.1% at the end of September. The cost of funds for credit union’s entire loan portfolio is 2.06%. A hypothetical rate cap at 10% would mean the asset quality ratio would need to be less than 7.94% for credit unions to not lose money.

The delinquency rate for credit cards at U.S. credit unions was 2.03% as of Sept. 30, 2025; the charge-off rate was 5.00%. Add this to the cost of funds, and a hypothetical credit card lending program would need to earn a yield of 9.09% to break even — and that’s before taking into account the costs to service the loan. If they can’t charge more than 10%, they’ll need to be more selective in issuing cards.

CREDIT UNION EARNINGS

FOR U.S. CREDIT UNIONS

SOURCE: CALLAHAN & ASSOCIATES

In cases like this, borrowers who have poor credit, no credit, or otherwise risky credit lose out. For credit unions, it’s likely many would simply drop their credit card programs altogether, especially if their asset quality ratio plus cost of funds exceeds 10.0%. If members are regulated out of credit access, they’ll be more likely to turn to Buy Now, Pay Later; payday lenders; loan sharks; and other, less reputable lenders that do not embrace the same fiduciary or financial wellbeing standards as a credit union.

On the surface, capping credit card rates at 10% looks like a win for members and affordability, but dig a little deeper, and it becomes clear that financial institutions will have to make tough decisions to remain operational. Issuers will have to choose between cutting program perks or even leaving some deserving borrowers out in the cold. If the White House wants to make a difference here, there might be other rate-cap levels that would disenfranchise fewer members, deliver savings to U.S. households, and preserve profitability for many card programs. However, credit unions need to keep the lights on. At 10%, the margin might be too thin to navigate at scale.