According to FirstLook estimates from Callahan & Associates, 2015 was a record-setting year for credit unions on a number of fronts.

Both consumer and first mortgage originations hit record highs in the fourth quarter of 2015, growing 8.6% and 33.2% year-over-year, respectively.

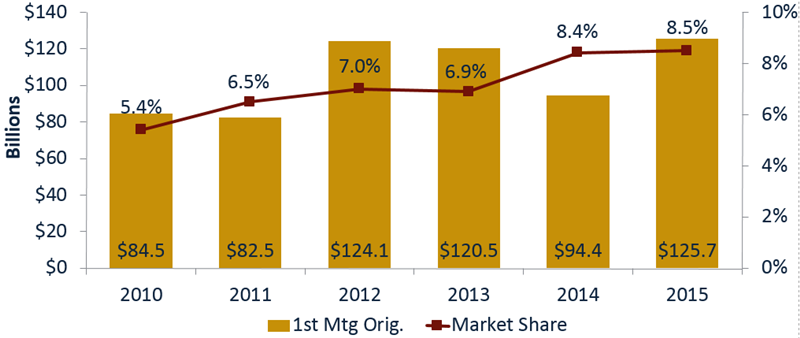

Credit union first mortgage originations, bolstered by strong demand from members for purchase mortgages, set records in not only the dollar amount originated but also in market share attained, which hit 8.5%. This represents the highest fourth quarter level on record and is significantly higher than the 5.4% market share captured in 2010.

YEAR-TO-DATE FIRST MORTGAGE

ORIGINATIONS AND MARKET SHARE

For FirstLook credit unions | Data as of 12.31.15

© Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates, Mortgage Bankers Association

On the consumer side, new and used auto lending continued to expand. In aggregate, the credit union automotive portfolio increased 14.0% over fourth quarter 2014, with new auto lending growth outpacing the used market by 3.2%.

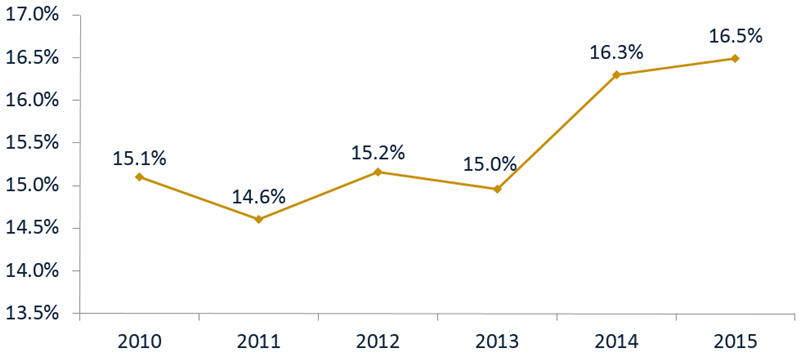

From a dollar-amount perspective, used auto lending expanded $18.6 billion while new auto lending grew $13.9 billion. These gains collectively resulted in credit unions increasing their share of the auto loan market by 20 basis points, rising from 16.3% in December 2014 to 16.5% in December 2015.

YEAR-TO-DATE AUTO MARKET SHARE

For FirstLook credit unions | Data as of 12.31.15

© Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates, Experian Automotive