Mountain America Credit Union ($5.1B, West Jordan, UT) has been losing cash since it began using analytics and forecasting software across its far-flung branch network. And that’s a good thing.

The big Utah credit union has reduced its cash inventories by 20% and customized its cash needs all the way down to specific denominations in the eight years since it began using the technology.

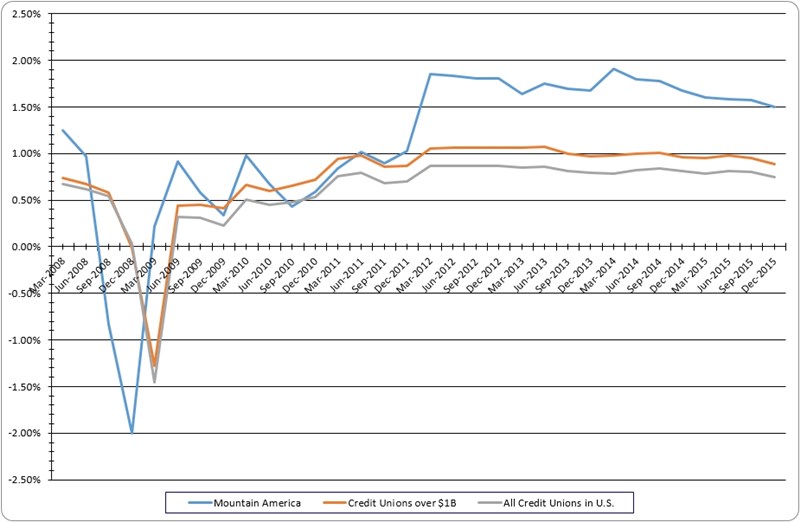

It’s been part of a strategy that has helped the credit union post better-than-peer results in metrics such as efficiency ratios and return on assets.

Excess cash is essentially a non-earning asset, says Daniel Phillips, senior vice president of finance and controller at Mountain America. There are more effective ways to put it to use throughout the credit union.

ROA

For all U.S. credit unions | Data as of 12.31.15

Callahan & Associates | www.creditunions.com

Source:Peer-to-Peer Analytics by Callahan & Associates

CU QUICK FACTS

MOUNTAIN AMERICA CREDIT UNION

Data as of 12.31.15

- HQ: West Jordan, UT

- ASSETS: $5.1B

- MEMBERS: 565,805

- BRANCHES: 86

- 12-MO SHARE GROWTH: 14.58%

- 12-MO LOAN GROWTH: 20.77%

- ROA: 1.50%

One of Mountain America’s core values is continuous improvement, Phillips says. We wanted to be more efficient and to better manage vault cash.

By using historical data to track cash inventory and forecast needs at each site including adequate denomination counts the credit union has reduced its number of courier deliveries and its individual cash needs by an average of $85,000 per branch.

That’s a lot of cash. Mountain America has just hit the $4 billion mark in deposits at its network of 86 branches in Utah, Nevada, Arizona, Idaho, and New Mexico, according to its Branch Analyzer profile by Callahan & Associates.

Make sense of deposit data for individual branches, institutions, and entire markets. With BranchAnalyzer, the ability to make smart tweaks to your branching strategy is just a click away.Learn more.

Phillips says the credit union’s understanding of cash management has improved at each branch location. Standard order amounts are significantly reduced, and branches are more prepared to meet expected demand.

Centralized ordering also reduced the number of emergency orders, Phillips says. It reduced employee stress and guesswork that accompanied ordering cash prior to implementation.

Watch It On CreditUnions.com

In the Anatomy Of A Dual Market video series, Texas-based Security Service Federal Credit Union talks about cash management, employee security, and member service.

Click Here

Mountain America has a solid system in place now, but there have been hiccups in the past eight years.

Upon initial implementation, we encountered some reluctance by branch employees to completely follow the program recommendations, Phillips says. They were concerned that they would not have adequate cash needed for member requests.

Excess cash is essentially a non-earning asset, and there are more effective ways to put it to use.

As those branches began to follow the weekly recommendations, they realized the program not only helped them place their weekly orders, but also provided the guidance needed on specific denominations their members were using and requesting, the SVP continues.

The credit union’s accounting team worked directly with each branch to evaluate needs and address concerns, and trained branch managers on how to use the system via conference calls and manager meetings, Phillips says.

Member service and branch security have both improved, and the credit union and the software have grown more sophisticated since 2008, when Mountain America became the first Symitar core processing client to use the cash management software from Atlanta-based CetoLogic.

Mountain America uses cash management tools from CetoLogic. Find your next partner in Callahan’s online Buyer’s Guide. Browse hundreds of supplier profiles by name, keyword, or service area.

The software now automatically uploads daily denomination cash endings to better track branch, ATM, and vault cash. It uses an internal Access database and interfaces with the Symitar Episys core to communicate to CetoLogic’s own servers the credit unions’ end-of-day cash positions by denomination, providing that historical data used to forecast more accurate orders and deposits of cash.

And according to Phillips, the credit union’s cash management will keep improving as its people and its software continue to work together.

Excellent communication and training remain essential to increase understanding, confidence, and effective usage of the cash management software, he says.

You Might Also Enjoy

- 4 Ways To Deliver A Superior Experience In The Virtual World

- Brick-And-Mortar Trends By The Numbers

- How PenFed Improved Its Branch Experience

- How 4 Credit Unions Beat The Branch Doldrums