Credit unions are inherently complex institutions whose operations require skilled managers and consistent management. Financial and operational challenges can arise from a variety of factors and impact nearly every aspect of the credit union. From a financial perspective, executives must manage everything from branch profitability to interest rate risk.

In today’s changing and often-uncertain economic environment, balance sheet management specifically, liquidity management is top-of-mind with credit union executives. Managers can push and pull a number of levers as the situationwarrants, and in recent quarters managers have started deploying new strategies at a broader scale across the industry.

Here are three popular ways for credit unions to manage liquidity.

1. Pricing Strategies

To maximize member value, credit unions must provide competitively priced savings and loan products. A credit union’s ability to provide the latter is largely dependent upon its ability to attract members through the former.

Traditionally, credit unions have strengthened their balance sheet by increasing share balances and distributing those funds in the form of loans. All things being equal, a credit union can use its members’ share balances to make as many loans asits members demand. Even becomingloaned out, the term applied when loan balances equal share balances, has not stopped some prolific lending shops.

When the economy expands or contracts, loan growth and share growth have historically had an inverse relationship. In times of economic prosperity, consumers demand more or larger loans. During periods of economic contraction, consumers seek safe havensfor their savings.

LOAN GROWTH VS SHARE GROWTH

For all U.S. credit unions | Data as of 09.30.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

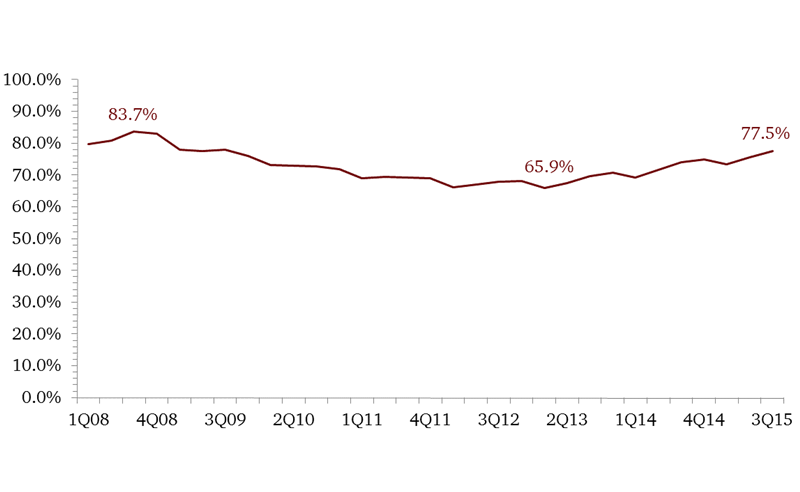

During the Great Recession, the average credit union loan-to-share ratio peaked in September 2008 at 83.7%. In the difficult quarters and years to follow, it steadily declined until hitting a low of 65.9% in March 2013.

Over this period, tightened underwriting standards and a general pull-back in financial institutions’ appetite for risk across nearly every lending category greatly reduced consumer access to credit.

LOAN-TO-SHARE RATIO

For all U.S. credit unions | Data as of 09.30.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

Although higher loan-to-share ratios are generally indicative of a stronger economy, rising loan-to-share ratios present a dilemma for credit union executives.

On the one hand, a growing loan portfolio is proof-positive of the credit union’s success in satisfying loan demand; however, at times it can be at the expense of deposit growth.

There are several options available to a credit union faced with a steadily growing loan-to-share-ratio. One of the easiest strategies is to spur deposit growth. Credit unions do this typically in the form of limited-duration savings specials, e.g., a2% special on a three-month share certificate.

If a targeted deposit growth strategy alone does not ease the upward pressure, a credit union can also slow loan growth by limiting marketing and promotion activities or becoming more selective in its underwriting.

2. Sales To The Secondary Market

For credit unions that do not want to limit lending, there are other options available to manage liquidity.

For example, fixed rate first mortgage loans have both the largest capital requirement and longest average duration on a per loan basis of any product in most credit unions’ loan portfolios. Because of these requirements, 35.2% of credit unionsthat originated a first mortgage loan as of the third quarter of 2015 managed their liquidity and interest rate risk by selling these loans after they originate them.

The most popular avenue to sell first mortgage loans is commonly referred to as the secondary market. The primary parties that purchase loans on the secondary market are government-sponsored enterprises including Fannie Mae, Freddie Mac, GinnieMae, and Federal Home Loan Banks other government affiliates such as the Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA), and to a lesser extent other financial institutions and insurance companies.

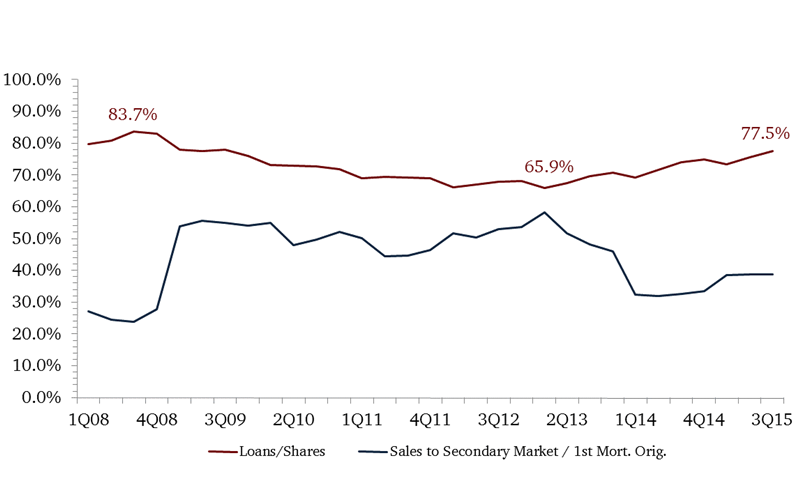

For lenders that want to serve their members but are wary of adding loans to their balance sheets, the secondary market can be an attractive option. From a directional perspective, sales to the secondary market as a percentage of first mortgage originationswill generally lag behind a rising or falling loan-to-share ratio.

LOAN-TO-SHARE RATIO VS SALES TO THE SECONDARY MARKET

FOR FIRST MORTGAGE ORIGINATIONS

For all U.S. credit unions | Data as of 09.30.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

For example, in the quarters leading up to September 2008, sales as a percentage of originations hovered around 25%, a historically low proportion.

However, shortly after that third quarter peak, sales to the secondary market as a percentage of originations incrementally ticked up as credit unions sought to make loans while selling almost a majority, 55.7% in March 2009, of their first mortgage originations.

Mortgage sales continued to climb, contributing to the March 2013 loan-to-share ratio low.

As the chart above shows, when consumer confidence rebounded in 2013, credit unions had ample capital available for lending. Consequently, the loan-to-share ratio for the credit union industry began to increase while sales of mortgages as a percentageof originations declined.

3. Loan Participation Sales

Selling loans to the secondary market can be an effective way to manage the liquidity and interest rate risk of a credit union’s first mortgage portfolio. So, too, is selling loan participations to other financial institutions.

In principal, the end result of selling loan participations is similar to selling first mortgage loans to the secondary market. However, loan participations are not limited by loan type. In fact, credit unions can sell real estate, member business loans,and consumer loans alike.

The broader industry dynamics associated with secondary market sales holds true for sales of participation loans. When loan growth consistently outpaces share growth, there is an incremental increase in sales of participation loans. As credit unions seek to free up capital, they convert assets into liabilities they can redeploy to areas that better fit their operational goals for the given economic environment. For example, in times of economic growth, credit unions might find it advantageous to sell less-profitable portions of their portfolio and increase their activities in higher-yielding areas.

Looking ahead, liquidity management will continue to be an important and necessary practice for executives to guide their credit union. Although portions of the broader economy have rebounded and are experiencing phenomenal growth, other areas continueto lag and threaten to hamper overall growth. As discussed above, regardless of the financial climate, different liquidity management strategies exist to help credit unions better position themselves for the future during economic expansion and contraction alike.

You Might Also Enjoy

-

How To Buy A Participation Loan

-

Earnings Performance By The Numbers(3Q 2015)

-

How To Make Investments Pay Dividends

-

How Firefighters First Credit Union Plans To Hit $1 Million In Net Income