Teamwork might make the dream work, but it’s data that drives collaborative effectiveness across credit unions. The rapid advancement of analytical tools for benchmarking, market tracing, next best product predictions, and more has deepened the need for forging real connections across the cooperative to make the most of artificial intelligence.

As member-owned collaboratives, credit unions are an ideal setting to bring together individual people and data points to accomplish more for the majority. Here, managers in key business intelligence roles at six cooperatives share how they build and sustain those connections.

Read Part 2 with insights from Grow Financial, Coastal FCU, and BCU today.

Virginia Credit Union

Lee Brooks has been senior vice president of enterprise data analytics at Virginia Credit Union ($5.0B, Richmond, VA) since he joined VACU four years ago.

How do you forge productive working relationships with the end-users of your business intelligence?

Lee Brooks: We are a centralized team covering end-to-end data functions, including ETL [extract, transform, and load], business intelligence, data analysis, data science, and governance. Strong partnerships with other business areas are critical to our work. Keys to our success have been:

- Establishing data and analytics as a corporate imperative.

- Creating annual team goals explicitly focused on specific business initiatives and targets.

- Hosting forums for business partners to influence our strategies and priorities.

- Having data resources understand the business need and influence better outcomes rather than just gathering requirements.

- Communicating project updates frequently to mitigate any misperceptions of lack of progress.

- Providing quick value wins for business areas and leveraging those wins to foster the case for large strategic data undertakings.

- Presenting successes loudly and broadly at all levels of the organization, and recognizing the business partner in that success; for example, by including a business representative as a presenter.

I would be remiss if I did not mention that showing gratitude with a simple thank you also goes a long way with a business partner.

What is the most effective internal partnership you have with other departments, and why?

LB: I would like to think that all partnerships have been effective; however, branch services and collections/recovery stand out. Both areas recognize the criticality of data and both have employed a full spectrum of our data services data mart builds, business intelligence reporting, and predictive models.

Ways to enhance the effectiveness of these partnerships include showing an eagerness to test different data strategies to improve their businesses, acting as equal partners and sharing ideas, being highly accessible and willing to engage frequently throughout projects, and expressing great appreciation for the partnership.

The ultimate litmus test for the effectiveness of these partnerships is that our shared endeavors have provided positive measurable outcomes benefitting our members and membership.

What project is the biggest accomplishment for BI work at your credit union? What impact did it have on the credit union’s ability to improve member service?

LB: I will highlight two. The first project involves our branch services associate performance reporting. When I joined VACU, the associate performance reporting was produced monthly on spreadsheets with underlying macros that routinely broke. Our data team initiated a project to replace these clunky spreadsheets with automated data warehouse marts underlying Tableau dashboards that update daily and provide high-level trend charts as well as drill-down into more detailed data. The end-to-end process is now fully automated and stable, and managers can provide daily coaching rather than wait until month’s end, which helps our front-line staff to better serve our members.

The second project was a next best product predictive model. The model leverages historical member data and machine learning algorithms to identify the financial products that a member is most likely to open next. The product recommendations are refreshed monthly and loaded into our CRM system to provide our front-line staff visibility to the recommendations. The model has proven extremely valuable, giving our front-line staff insights into what products might better serve our members’ needs.

Workers Credit Union

Ryan Testagrossa has been a data analyst on the enterprise analytics team at Workers Credit Union ($2.4B, Littleton, MA) for the past three years.

How do you forge productive working relationships with the end-users of your business intelligence?

Ryan Testagrossa:Constant communication is pivotal to understanding the needs and functions of other areas. It’s necessary to make sure end-users are comfortable with our business intelligence (BI) output, and we need to be able to give them an overview of any specific details. It’s worthwhile to follow up and to get feedback to provide the best outcome.

Maintaining a log for tracking projects and workspaces is essential for developing further rapport. We adhere to 30 culture fundamentals at our organization, which pave the way for our daily practices. A couple that come to mind that impact meaningful BI relationships are walking in others’ shoes, and making quality personal.

It’s also essential to know the end-users’ perspective and any challenges they might face. This will allow for superior results that exceed expectations.

What is the most effective internal partnership you have with other departments, and why?

RT: Our team works on many different levels that relate to all areas of the credit union we engage with all business leaders and colleagues. Depending on the project, we can work with different groups or individuals daily. We maintain highly effective internal partnerships with everyone we work with, setting up calls or meetings to gather as much information as possible. Without these partnerships, we wouldn’t be as effective in leading solutions and would be limited in the successes achieved.

What project is the biggest accomplishment for BI work at your credit union? What impact did it have on the credit union’s ability to improve member service?

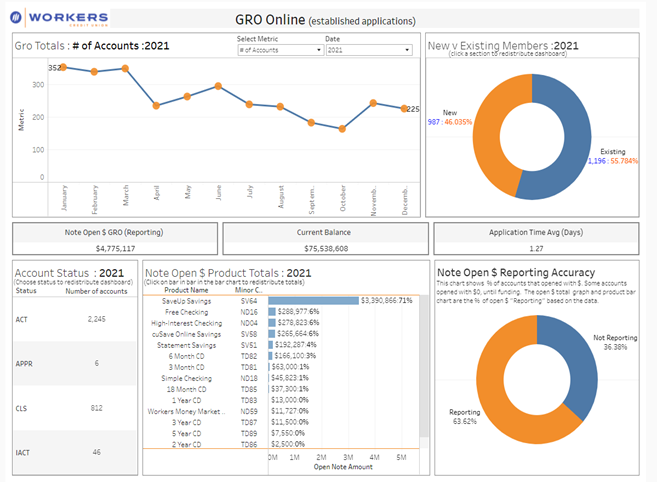

RT: The biggest accomplishment for BI work at Workers was creating core data integration into our project dashboarding. This has led to strategic visualizations that bring data awareness, create efficiencies, and assist in critical thinking. Through furthering the expansive analysis we can learn, grow, and provide detailed intelligence to make key data-driven decisions. By understanding our organizational data better, we can see things such as how products are improving or how members are reacting. This enables us to do better for members, which ties into our core purpose as an organization: to improve the daily lives of our members.

Greater Texas Federal Credit Union

Sidney Henderson joined Greater Texas Federal Credit Union ($952.5M, Austin, TX) as vice president of marketing four months ago and has 12 years of credit union experience.

How do you forge productive working relationships with the end-users of your business intelligence?

Sidney Henderson: The best way to build collaborative working relationships with other decision-makers is to find a common goal and then share data points and analyses that support the existing strategy or the proposed change of direction. Opening the conversation so the end-user has a chance to share their ideas and questions creates an opportunity for teamwork, too.

When sharing data with others, one should be prepared to answer questions about their sources and the validity of their information. Validating internal data against a single source of truth and being transparent about what factors are included in an analysis should help to increase confidence in data accuracy among business units.

Don’t stop here. Read Part 2 of “6 Credit Unions Dish On Data Dashboards And Enterprise Collaboration” for even more insights, tips, and best practices.

What is the most effective internal partnership you have with other departments, and why?

SH: Sharing data with lending, finance, and operations is highly effective. Within Greater Texas, marketing owns powerful data tools that help us better segment, visualize, and understand our membership through demographics, account penetration, and market demand.

The insights derived from these tools help other stakeholders form opinions and make decisions, so sharing information across the organization is key to building effective internal partnerships. We all use separate tools and have different perspectives, so offering data insights around our mutual goals brings us together to collaborate and develop ideas that shape the strategy of our credit union.

What project is the biggest accomplishment for BI work at your credit union? What impact did it have on the credit union’s ability to improve member service?

SH: Being so new to Greater Texas, I’m just now starting to really dig in and see where we can better leverage data. I’ve previously used data sources like market intelligence and consumer psychographics to complement internal data. This is a highly impactful way to integrate sources and widen your line of sight.

These interviews have been edited and condensed.