Top-Level Takeaways

-

Shoreline Credit Union sold its indirect lending CUSO.

-

The credit union is minimizing that line of business in favor of core products and is building the bottom line through traditional investments.

After some soul-searching prompted by regulators and the market, Shoreline Credit Union ($94.6M, Two Rivers, WI) has decided to become, well, a credit union again, says president and CEO Nathan Grossenbach. And for the Badger State credit union, that means exiting indirect lending.

CU QUICK FACTS

Shoreline Credit Union

Data as of 09.30.17

HQ: Two Rivers, WI

ASSETS: $94.6M

MEMBERS: 10,066

BRANCHES: 3

12-MO SHARE GROWTH: 0.1%

12-MO LOAN GROWTH: -8.0%

ROA: 0.33%

We had 40% of our loans with people we never talk to, in counties where we had a charter but no branches, and our conversion rate of indirect borrowers was about 3%, says Grossenbach, who took the helm approximately six months ago.

The Wisconsin cooperative had been originating $1 million a month or more in indirect lending, and its marketplace had grown from one county to nine, driven by the success of a CUSO ― Financial Institution Lending Options ― it co-founded in 2007. ContentMiddleAd

But capital concerns, concentration risk, and the fact it could make as much money in simple investments as it could in the profit-splitting world of indirect lending led Shoreline to sell the CUSO in 2013 and retreat from indirect lending beginning in 2015.

When Grossenbach joined the credit union as an accounting manager five years ago, deposits weren’t keeping up with demand and the credit union was buying jumbo CDs that paid 3% over five years. That high cost of funds exacerbated the thin margin that comes with the reserves paid to dealers and other costs associated with indirect lending.

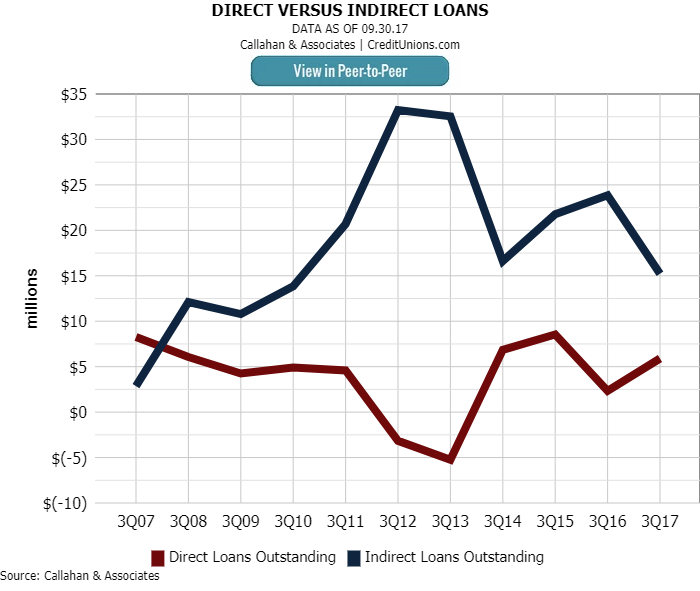

Since selling its stake in its indirect lending CUSO in 2013, the proportion of indirect and direct loans at Shoreline have moved toward each other.

Indirect Object Of Affection

Indirect auto lending has surpassed direct loans in the aggregate among the nation’s credit unions, with diverse approaches and opinions emerging. Check out these perspectives:

- Blank Checks Are Better Than Middle Men

- A Personal Approach To Dealer-Referred Loans

- Indirect Lending At Year-End 2016

The quick rate of payoffs of indirect auto loans, often in a year or two, added more pressure to Shoreline’s bottom line. And to boot, regulators were concerned about concentration and market risk.

We were operating more like a hedge fund or a bank than a credit union, Grossenbach says. We weren’t really meeting our mission statement.

The credit union also wasn’t really making that much money. Coming out of the recession, indirect loans were yielding 1% to 1.5% whereas simple investments were paying 1.8% to 1.9% with less risk and no charge-offs.

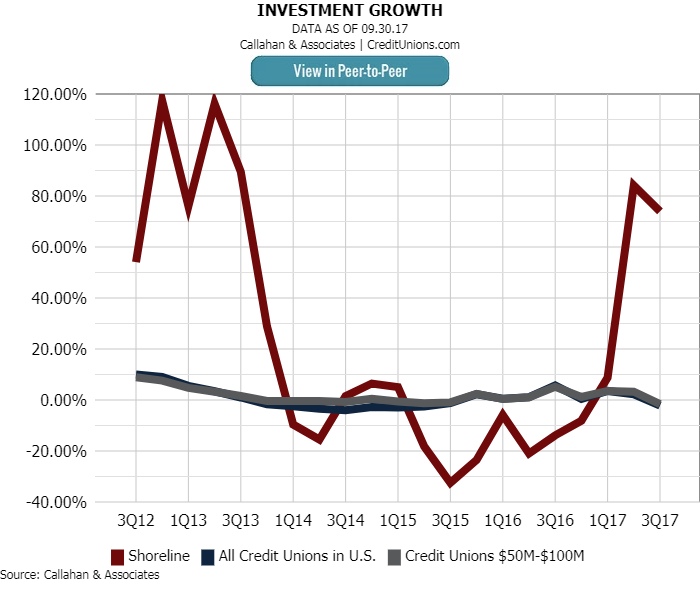

Shoreline has sharply grown its investment portfolio since it started moving away from indirect lending.

But it’s hard to give up the habit.

You can see why indirect lending is addicting, Grossenbach says. The credit union’s income growth exploded, and assets grew 50% in four years.

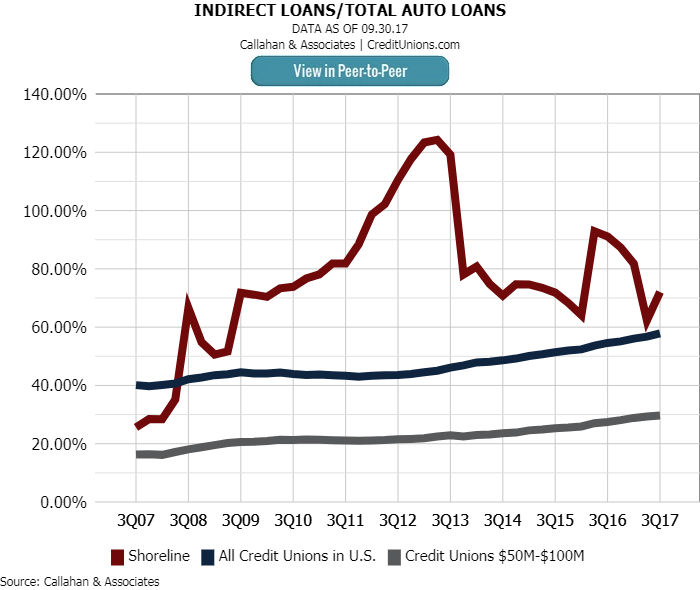

That activity peaked in late 2012 when the credit union had $33.2 million in indirect loans on its books. The 2013 sale of FILO cut that by half within 12 months and direct auto loans have grown dramatically, from $5 million in 2013 to the current $12.7 million.

We’re now fostering our community brand, Grossenbach says.

How Does Your Auto Portfolio Stack Up?

Callahan’s Peer-to-Peer lets you quickly identify your auto lending strengths and weaknesses by making it easy to benchmark against relevant peers.

The new strategy of becoming an old-school credit union again has included raising deposit rates and increasing consumer loans outstanding by 25% and real estate by 5% each of the past three years.

That change in emphasis, however, has resulted in total new auto loans, including FILO loans, falling 30.35% year-over-year through Sept. 30, 2017, to $3.6 million, and used auto loans dropping 16.60% to $17.5 million. On the other hand, credit card loans have increased 13.01% to $2.7 million as of third quarter 2017 and first mortgages were up 6.67% to $28.9 million.

But even with that growth, Grossenbach says, it’s going to take five or six years to work off the heavy load of indirect loans on the books, and the credit union still does make some indirect loans, but not with FILO.

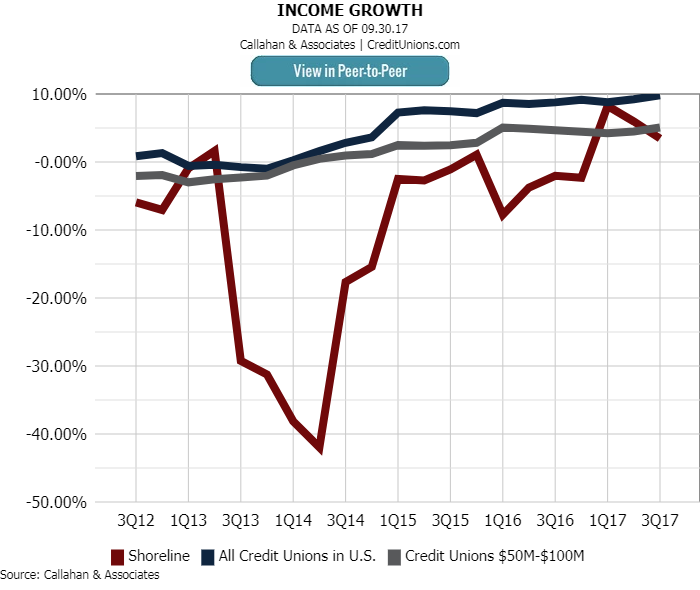

Indeed, annualized interest income was $5.2 million in third quarter 2012. Five years later, it’s $3.2 million. But income growth at Shoreline, after cratering in 2014, has returned to something near normal among U.S. credit unions.

Income growth at Shoreline Credit Union has returned to industry norms after it rebalanced its portfolio and reaffirmed its commitment to core products.

Grossenbach says the credit union, and its examiners, knew loan volume and income would drop as it got out of indirect lending. He has this advice for those thinking of weathering that same storm: Make sure you have a well-oiled machine to make up for that loss.

Oiling that machine at Shoreline began with cutting expenses by 30% since 2013 and now includes looking to sell a $1 million building located along Lake Michigan. It also converted three back-office support people into lenders which gave the credit union five instead of two and added a business development officer. The credit union also added its first-ever marketing manager.

He’s an on-point delivery channel guy who was in blue-collar manufacturing before moving to banking, Grossenbach says. Our original SEG was a wood-type manufacturer. That’s the kind of credit union we were, and that’s who we are again.

The proportion of indirect loans to total auto loans at Shoreline Credit Union has fallen sharply since its 2013 peak, when it was more than 120% through its CUSO work.

Grossenbach emphasizes that he’s not sour on FILO.

It’s a well-run, well-established program, he says of the CUSO his credit union and co-founder Guardian Credit Union ($225.4M, West Milwaukee, WI) sold in 2013 to Connexus Credit Union ($1.8B, Wausau, WI).

He also emphasizes that indirect lending, especially in participation loans, can be a valuable source of income and liquidity, but advises they remain a source and not the source.

Don’t make it a core part of your strategy, especially as we’re now seeing auto loan originations beginning to drop across the industry, the Shoreline CEO says. Concentrate on a strong message that you’re there to help your members however you can with whatever products they need. That’s more sustainable and more successful in the long run.