Susan Gruber joined Patelco Credit Union($4.2B, Pleasanton, CA) as chief financial officer last fall, after serving as Jeanne D’Arc Credit Union’s CFO for nineyears and spending time with Bank of America. In this Q&A, she discusses how the credit union is transitioning its investment portfolio to more closely align with its overall balance sheet needs.

CU QUICK FACTS

Patelco Credit Union

data as of 12.31.14

- HQ: Pleasanton, CA

- ASSETS: $4.2B

- MEMBERS: 285,954

- BRANCHES: 40

- 12-MO SHARE GROWTH:3.79%

- 12-MO LOAN GROWTH:22.32%

- ROA:1.04%

What changes have you made to the investment portfolio since you joined Patelco?

Susan Gruber: The most significant change we’ve made is looking at the investment portfolio within the context of the full balance sheet. Instead of making decisions to benefit the portfolio itself, such as simply increasing our investment yield,the credit union now reviews those decisions more holistically to ensure all of our investments are positioned to benefit the overall balance sheet.

Can you give an example?

SG: The credit union holds a lot of fixed-rate, jumbo mortgages as a result of the higher home prices in our market. Therefore, we need to use the investment portfolio to provide interest rate protection. We recently sold a lot of our fixed-rate, agencybullets and began buying floating-rate securities. These securities are tied to an index such as one-month LIBOR or the prime rate, so when rates do begin to rise, we should experience some of that upside potential.

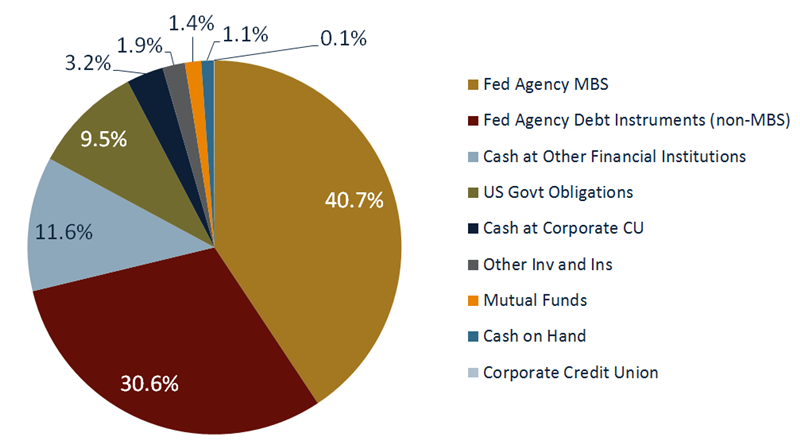

Patelco Credit Union Investment Composition

Data as of 12.31.14

Callahan & Associates | www.creditunions.com

Source: Callahan & AssociatesPeer-to-Peer Analytics

What else have you changed, on an organizational level and portfolio level?

SG: Internally, we are investing in more asset liability management training and have integrated the assistant vice president who is in charge of managing the portfolio on a daily basis into more balance sheet discussions. He is now anactive member of our asset liability committee (ALCO) and is attending outside conferences to gain a deeper appreciation of the overall balance sheet.

Another change we’ve made on the portfolio level is shifting from investing in non-amortizing paper to amortizing paper. We need that monthly cash flow to meet our lending demand, which has outpaced share growth significantly.

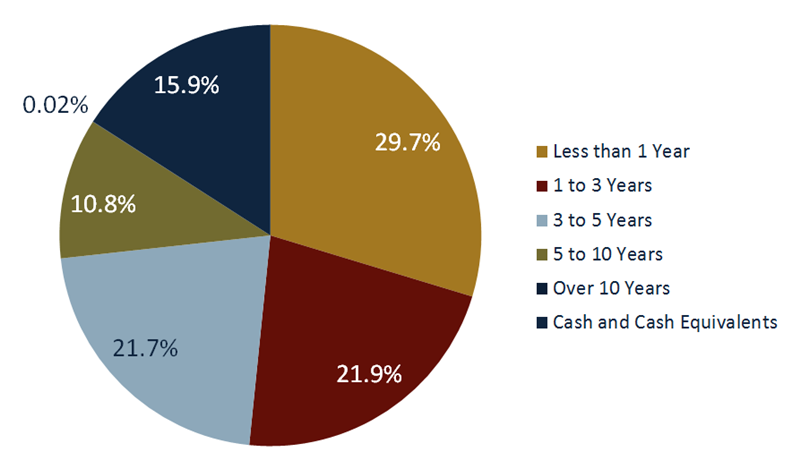

We were also holding quite a bit in cash, approximately $350 million last fall. We like to keep cash at the $100 million level on a daily basis, so we moved about $250 million of that into securities that mature in three to four years. This has helpedus pick up yield and extend our overall maturity by about a quarter of a year.

Patelco Credit Union Investment Maturity

Data as of12.31.14

Callahan & Associates | www.creditunions.com

Source: Callahan & AssociatesPeer-to-Peer Analytics

Tell me more about Patelco’s loan growth versus share growth.

SG: Lending activity has outstripped our deposit gathering at a significant pace. As of year-end 2014, our loan growth was 22.32%, whereas our share growth was only 3.79%. That is a disparity we can’t maintain over the long term, so our focus in2015 is on deposit gathering. We believe loan growth will moderate, and we plan to use the investment portfolio to bridge gaps in liquidity.

No matter what, never ever buy a bond you don’t understand. If you don’t understand it, the credit union has no business buying it.

Our loan-to-share ratio was at 78.89% at year-end, and 80% is where we are comfortable. We have recently entered into a borrowing agreement with the Federal Home Loan Bank so we have liquidity sources, should we need them, to fund loans for our members.

Patelco Credit Union Total Investments

Data as of12.31.14

Callahan & Associates |www.creditunions.com

Source: Callahan & AssociatesPeer-to-Peer Analytics

Total investments declined as loan growth increased.

What advice would you give another credit union who is making changes to their own investment portfolio?

SG: Don’t chase yield for yield sake. You need to review each investment decision based on the credit union’s overall balance sheet.

At Patelco, we’re getting rid of individual investments that are not performing. Instead of a simple buy-and-hold strategy, we’re evaluating each security at a CUSIP level to determine what we should hold and what we should sell.

Most importantly, no matter what, never ever buy a bond you don’t understand. There are a lot of brokers out there looking to sell product, but if you don’t understand it, the credit union has no business buying it.