Americans are wary about their financial lots.

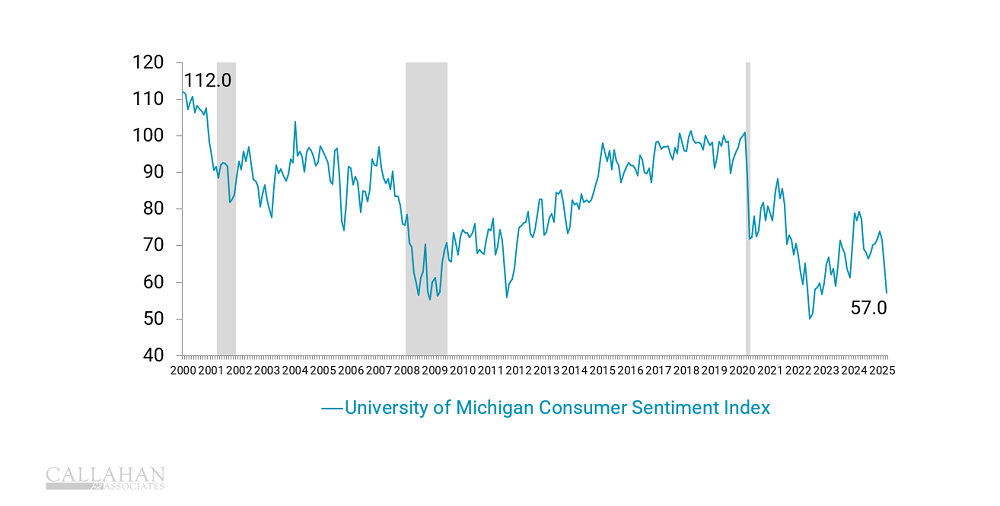

The University of Michigan’s Consumer Sentiment Index (MCSI) — which is based on a simple random sample selected from a list of all postal addresses in the 48 coterminous States and the District of Columbia — fell for the third straight month in March 2025, tumbling to 57.0 from 64.7 in February. The index has now lost nearly 30% in the past 12 months. (Editor’s Note: Since posting this article, the University of Michigan released April data, which shows the MCSI falling to 50.8).

Economists attribute this latest drop to worries Americans have regarding the future of the U.S. economy, with tariffs, DOGE, funding cuts, and immigration restrictions potentially pinching economic activity. Notably, the drop “reflects a clear consensus across all demographic and political affiliations,” according to Joanne Hsu, the director of Surveys of Consumers for the University of Michigan.

CONSUMER SENTIMENT INDEX

FOR U.S. CONSUMERS | DATA AS OF MARCH 2025

SOURCE: UNIVERSITY OF MICHIGAN

The Conference Board’s March release wasn’t much brighter. Its Consumer Confidence Index (CCI) — which is based on an online survey using a sample of more than 36 million consumers — declined in March by 7.2 points to 92.9. Its Expectations Index, which is based on consumers’ short-term “outlook for income, business, and labor market conditions,” fell 9.6 points to 65.2, the lowest score in 12 years.

A close analysis of survey results revels where divides exist. Consumers older than 55 were primarily responsible for the CCI tumble in March. Among consumers younger than 35, confidence actually rose slightly. Notably, the only income bracket that did report feeling less confident were households earning more than $125,000.

What Does This Mean For Credit Unions?

Consumer sentiment can act as a bellwether for future economic activity. When U.S. consumers or businesses fear for their future financial health, they might pull back on spending, creating a self-fulfilling prophecy with negative consequences for economic growth as well as knock-on effects for policy makers and financial institutions.

For credit unions, understanding this dynamic fits squarely into the mission of putting members’ best interests at heart.

Members’ relative pessimism can serve as a signal of potential economic headwinds brewing under the surface and provide instruction for how to react. For example, if consumers are anxious, they might need financial education, guidance, or temporary monetary relief.

The Pros And Cons Of Consumer Sentiment Indices

Measuring consumer sentiment helps everyone — from economists to lay people — better understand current trends as well as future expectations. This data captures not only how consumers feel about current conditions but also their expectations and concerns about the future.

Consumer sentiment surveys have tended to follow along economic downturns. And because consumer spending comprises approximately 70% of GDP, assessing sentiment provides a peek of what might be under the hood.

But like any metric, consumer sentiment indices have their drawbacks. There are often mismatches between hard economic data, such as consumer spending, and surveyed data, such as sentiment.

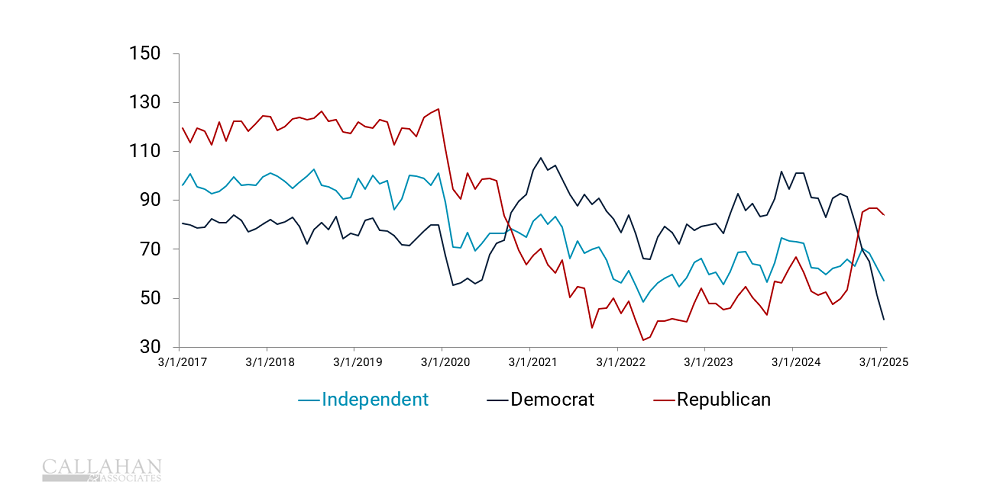

UNIVERSITY OF MICHIGAN CONSUMER SENTIMENT INDEX BY POLITICAL AFFILIATION

FOR U.S. CONSUMERS | DATA AS OF MARCH 2025

SOURCE: UNIVERSITY OF MICHIGAN

There are multiple reasons for such mismatches, but politics plays an outsized role. When a respondent’s preferred political party is not in office, dissatisfaction with other aspects of life can creep into their view of the economy. For example, a survey taker might say they are pessimistic but then spend their disposable income as if there is no risk to their financial wellbeing.

By The Numbers

Michigan Consumer Sentiment Index

- Benchmarked to a value of 100 in 1966.

- >100 indicate positive consumer confidence

- <100 indicate negative consumer confidence

Conference Board’s Consumer Confidence Index

- Benchmarked to a value of 100 in 1985.

- >125 indicates a moderately optimistic outlook.

- <75 indicates a moderately pessimistic outlook.

- A value of 80 has historically signaled the potential for a coming recession.

- Month-over-month changes of more than five points are significant.