The existence of social media is not breaking news, but its widespread adoption in today’s increasingly digital world makes it a topic that continues to gain in importance. By some estimates, there are 3.2 billion social media users worldwide today. This isn’t an engagement channel that credit unions of any size can afford to miss out on.

However, launching a social media program brings with it the responsibility to post regularly and engage followers. There’s a natural struggle to constantly pump out new, appealing content. Content is king, but producing excellent content requires time a precious resource for credit union marketers across the nation.

According to the National Association of Stress, 80% of workers report feeling stressed on the job. Social media shouldn’t be stressful. It should be a simple, straightforward way to connect with current and potential members.

So, how can credit unions steadily create content that showcases their brand and humanity? That drowns out the noise of competitors? Under a tight time and money budget? Without anxiety?

The answer isn’t as complicated as you might expect: Planning and variety.

Your Guide To Online Reviews

Need to respond to online reviews, but aren’t sure where to begin? CUBrandMonitor is here to help. Respond to reviews, monitor social media accounts, and more through this easy-to-use tool. Let us show you how with a custom review and brand audit.

Request Your Audit

Not all posts have to direct followers to a 600-word blog. In fact, it’s important to spice up social channels with different types of posts and topics. How? Start by taking a step back and listing all the categories and mediums from which the credit union can pull. Think of this as your social media inventory. Then, sketch out a social calendar that pulls from across said inventory.

For inspiration, consider these ways other institutions engage followers, customers, supporters, and more on social media.

1. Offer Expert Insight

Don’t forget, the credit union is an expert in financial topics. You know the ins and outs of taking out a mortgage or buying a car. Share that knowledge with your audience.

Not sure which topics your members need help with? A prize wheel at Michigan State University Federal Credit Union ($4.5B, East Lansing, MI) combines reconnaissance and recreation. Members and attendees at community events spin the wheel and answer financial questions to win prizes. The topics on which members struggle are the ones the MSUFCU team prioritizes for content creation.

Staffers at Uniwyo Federal Credit Union ($364.0M, Laramie, WY) make the most of time in front of members by asking them questions about financial topics while they wait in line at a branch. Everyone gets a prize, and the credit union gets the benefit of knowing which topics cause stress. What better way to identify new content ideas than to get them straight from the members?

Also, don’t underestimate the value of content shared from respected sources like local news channels. Sharing content like this shows members the credit union is looking out for them and thinking about how to make their lives better.

See It In Action

Australia-based, customer-owned Beyond Bank shares its expert knowledge about finances to help customers make smarter decisions about money.

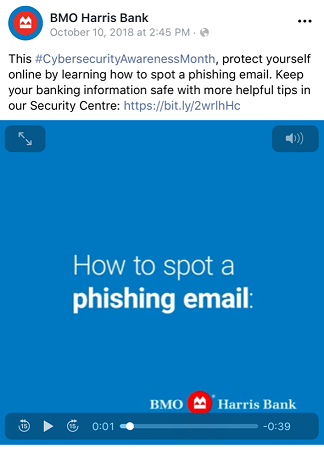

BMO Harris Bank doesn’t just educate followers about financial scams. This Midwestern FI ties its post with a call to action to ensure customers know where to go to get more information.

PenFed piggybacks on the value of great content by sharing posts from respected sources, such as local news outlets.

2. Put A Twist On Contests

Are you tired of the same old photo contest? Your audience is, too. Worse yet, there are Facebook groups dedicated to scamming contests like yours.

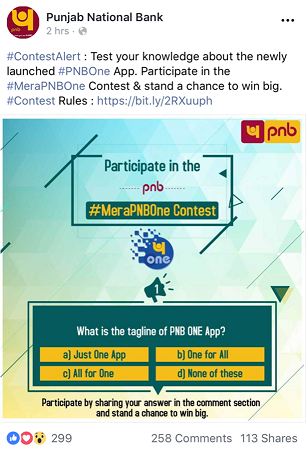

Put a twist on your next contest by tying it to an engagement metric. Indian-based Punjab National Bank fostered engagement by posting a question about its newly launched mobile app. To share their answers, for a chance to win big, people had to log into the app.

Indian-based Punjab National Bank used the launch of its mobile app to educate customers about the bank and encourage engagement from followers. It’s a modern twist on the tried-and-true contest.

Video contests are another way to nurture engagement. Looking for new ways to draw in applicants for the credit union’s grant or scholarship program? A video contest is a great way to get to know would-be recipients on a deeper level while highlighting the credit union’s connection to and support of its community.

Remember, though, some states have specific legal requirements surrounding contestants and sweepstakes, and Facebook has contest rules of its own. Be sure you understand these before running a contest for the credit union.

3. Put The Power In The People

Every organization today must allow others to see the human behind the handle.

People crave authenticity, and marketers must ensure that authenticity comes across in social posts. One of the best ways to humanize your voice on social is to highlight your employees the people that make your brand what it is. Look beyond dress up days and holiday cube decorations. Dig deeper to uncover different ways to showcase what’s happening behind the scenes. Don’t exclude management in this planning. Most people rarely get to see the CEO, and removing the mystery there can be an effective way to show people what cooperative financial services means across the credit union, not just within the branches.

Spire Credit Union ($1.1B, Falcon Heights, MN) captured video of its CEO when he was out with business owners getting his hands dirty at a local pottery studio. The video made the credit union relatable all the way to the top.

Spire Credit Union shows off the people behind its brand. When it took its CEO out of the corner office and placed him in the pottery studio, it helped break down barriers between the members and the management responsible for running the cooperative. Watch the video here.

If your CEO is camera shy, consider other avenues that give a face to executives. Advice to members questions, favorite inspirational quotes, quality photos from employee events, and handwritten notes are all examples of posts that will go a long way in making your feed interesting and your organization trustworthy.

Click the tabs below to see examples of posts that will help your social media engagement.

INSPIRATIONAL QUOTES

There are many ways to foster executive face time on social. Chase Bank shares inspirational quotes from managers.

EMPLOYEE EVENTS

There are many ways to foster face time on social. Langley FCU shows staff celebrating reaching annual goals.

HANDWRITTEN NOTES

There are many ways to foster face time on social. Suncoast Credit Union writes handwritten notes to members.

4. Shine The Local Spotlight

Credit unions are rooted in their mission to serve their communities, which makes mission and community great topics to showcase on social.

Do that, but think beyond a picture of the credit union’s tent at a local community event. Although those events and photo ops are important, credit unions need to stand out from the crowd on social media just as much as in real life.

Infinity Federal Credit Union ($333.9M, Portland, ME) sent team members to a local coffee shop with a mission to pay it forward. The credit union got to show off its community roots and support. Patrons of the coffee shop got a free lunch.

Infinity FCU sent team members to a local coffee shop to provide lunch to patrons. Events (and posts) like this underscore the deep community roots of the cooperative.

Across the country, Golden 1 Credit Union ($12.6B, Sacramento, CA) has shared the post from a local nonprofit that touts the relationship it has with the credit union. But Golden 1 doesn’t simply toot its own horn, it reminds other area organizations of the support they could receive from the credit union.

It feels good to share a post in which others say something nice about you. Golden 1 takes the opportunity to remind area organizations of the support they could receive from the credit union.

And, Umpqua Bank includes a display table at its Potrero Hill, San Francisco, branch that gives different local businesses the opportunity to share their craft with the community. The artist, not the bank, shared this post on social media. What a special way to connect with the community.

Umpqua Bank maximizes its branch footprint by giving a local artisan space to promote their trade. Community members that want to #shoplocal look for local FIs, too.

These are just four examples meant to spark inspiration. There are many more waiting for you.

The most important factor in establishing a fresh social media strategy is to establish a network of influential brands. The Financial Gym and Financial Diet are two popular options. Ask your members for their favorites as well. Then, go to these brands when you need inspiration.

After you have your inventory, create a monthly calendar that includes all your social efforts by channel, medium, and most importantly category. Color code your categories so you can easily identify holes and ensure you are posting a variety of information on your social channels. Want to see an example? Download this sample calendar now.

Happy posting!

4 Ways To Foster Social Media Engagement

The existence of social media is not breaking news, but its widespread adoption in today’s increasingly digital world makes it a topic that continues to gain in importance. By some estimates, there are 3.2 billion social media users worldwide today. This isn’t an engagement channel that credit unions of any size can afford to miss out on.

However, launching a social media program brings with it the responsibility to post regularly and engage followers. There’s a natural struggle to constantly pump out new, appealing content. Content is king, but producing excellent content requires time a precious resource for credit union marketers across the nation.

According to the National Association of Stress, 80% of workers report feeling stressed on the job. Social media shouldn’t be stressful. It should be a simple, straightforward way to connect with current and potential members.

So, how can credit unions steadily create content that showcases their brand and humanity? That drowns out the noise of competitors? Under a tight time and money budget? Without anxiety?

The answer isn’t as complicated as you might expect: Planning and variety.

Your Guide To Online Reviews

Need to respond to online reviews, but aren’t sure where to begin? CUBrandMonitor is here to help. Respond to reviews, monitor social media accounts, and more through this easy-to-use tool. Let us show you how with a custom review and brand audit.

Request Your Audit

Not all posts have to direct followers to a 600-word blog. In fact, it’s important to spice up social channels with different types of posts and topics. How? Start by taking a step back and listing all the categories and mediums from which the credit union can pull. Think of this as your social media inventory. Then, sketch out a social calendar that pulls from across said inventory.

For inspiration, consider these ways other institutions engage followers, customers, supporters, and more on social media.

1. Offer Expert Insight

Don’t forget, the credit union is an expert in financial topics. You know the ins and outs of taking out a mortgage or buying a car. Share that knowledge with your audience.

Not sure which topics your members need help with? A prize wheel at Michigan State University Federal Credit Union ($4.5B, East Lansing, MI) combines reconnaissance and recreation. Members and attendees at community events spin the wheel and answer financial questions to win prizes. The topics on which members struggle are the ones the MSUFCU team prioritizes for content creation.

Staffers at Uniwyo Federal Credit Union ($364.0M, Laramie, WY) make the most of time in front of members by asking them questions about financial topics while they wait in line at a branch. Everyone gets a prize, and the credit union gets the benefit of knowing which topics cause stress. What better way to identify new content ideas than to get them straight from the members?

Also, don’t underestimate the value of content shared from respected sources like local news channels. Sharing content like this shows members the credit union is looking out for them and thinking about how to make their lives better.

See It In Action

Australia-based, customer-owned Beyond Bank shares its expert knowledge about finances to help customers make smarter decisions about money.

BMO Harris Bank doesn’t just educate followers about financial scams. This Midwestern FI ties its post with a call to action to ensure customers know where to go to get more information.

PenFed piggybacks on the value of great content by sharing posts from respected sources, such as local news outlets.

2. Put A Twist On Contests

Are you tired of the same old photo contest? Your audience is, too. Worse yet, there are Facebook groups dedicated to scamming contests like yours.

Put a twist on your next contest by tying it to an engagement metric. Indian-based Punjab National Bank fostered engagement by posting a question about its newly launched mobile app. To share their answers, for a chance to win big, people had to log into the app.

Indian-based Punjab National Bank used the launch of its mobile app to educate customers about the bank and encourage engagement from followers. It’s a modern twist on the tried-and-true contest.

Video contests are another way to nurture engagement. Looking for new ways to draw in applicants for the credit union’s grant or scholarship program? A video contest is a great way to get to know would-be recipients on a deeper level while highlighting the credit union’s connection to and support of its community.

Remember, though, some states have specific legal requirements surrounding contestants and sweepstakes, and Facebook has contest rules of its own. Be sure you understand these before running a contest for the credit union.

3. Put The Power In The People

Every organization today must allow others to see the human behind the handle.

People crave authenticity, and marketers must ensure that authenticity comes across in social posts. One of the best ways to humanize your voice on social is to highlight your employees the people that make your brand what it is. Look beyond dress up days and holiday cube decorations. Dig deeper to uncover different ways to showcase what’s happening behind the scenes. Don’t exclude management in this planning. Most people rarely get to see the CEO, and removing the mystery there can be an effective way to show people what cooperative financial services means across the credit union, not just within the branches.

Spire Credit Union ($1.1B, Falcon Heights, MN) captured video of its CEO when he was out with business owners getting his hands dirty at a local pottery studio. The video made the credit union relatable all the way to the top.

Spire Credit Union shows off the people behind its brand. When it took its CEO out of the corner office and placed him in the pottery studio, it helped break down barriers between the members and the management responsible for running the cooperative. Watch the video here.

If your CEO is camera shy, consider other avenues that give a face to executives. Advice to members questions, favorite inspirational quotes, quality photos from employee events, and handwritten notes are all examples of posts that will go a long way in making your feed interesting and your organization trustworthy.

Click the tabs below to see examples of posts that will help your social media engagement.

INSPIRATIONAL QUOTES

There are many ways to foster executive face time on social. Chase Bank shares inspirational quotes from managers.

EMPLOYEE EVENTS

There are many ways to foster face time on social. Langley FCU shows staff celebrating reaching annual goals.

HANDWRITTEN NOTES

There are many ways to foster face time on social. Suncoast Credit Union writes handwritten notes to members.

4. Shine The Local Spotlight

Credit unions are rooted in their mission to serve their communities, which makes mission and community great topics to showcase on social.

Do that, but think beyond a picture of the credit union’s tent at a local community event. Although those events and photo ops are important, credit unions need to stand out from the crowd on social media just as much as in real life.

Infinity Federal Credit Union ($333.9M, Portland, ME) sent team members to a local coffee shop with a mission to pay it forward. The credit union got to show off its community roots and support. Patrons of the coffee shop got a free lunch.

Infinity FCU sent team members to a local coffee shop to provide lunch to patrons. Events (and posts) like this underscore the deep community roots of the cooperative.

Across the country, Golden 1 Credit Union ($12.6B, Sacramento, CA) has shared the post from a local nonprofit that touts the relationship it has with the credit union. But Golden 1 doesn’t simply toot its own horn, it reminds other area organizations of the support they could receive from the credit union.

It feels good to share a post in which others say something nice about you. Golden 1 takes the opportunity to remind area organizations of the support they could receive from the credit union.

And, Umpqua Bank includes a display table at its Potrero Hill, San Francisco, branch that gives different local businesses the opportunity to share their craft with the community. The artist, not the bank, shared this post on social media. What a special way to connect with the community.

Umpqua Bank maximizes its branch footprint by giving a local artisan space to promote their trade. Community members that want to #shoplocal look for local FIs, too.

These are just four examples meant to spark inspiration. There are many more waiting for you.

The most important factor in establishing a fresh social media strategy is to establish a network of influential brands. The Financial Gym and Financial Diet are two popular options. Ask your members for their favorites as well. Then, go to these brands when you need inspiration.

After you have your inventory, create a monthly calendar that includes all your social efforts by channel, medium, and most importantly category. Color code your categories so you can easily identify holes and ensure you are posting a variety of information on your social channels. Want to see an example? Download this sample calendar now.

Happy posting!

Share this Post

Latest Articles

Americans Report Favorable Views On Small Business

Fed Leaders Hope To Avoid Repeating The Mistakes Of The 1970s

Financial Fraud Hits Close To Home

Keep Reading

Related Posts

Americans Report Favorable Views On Small Business

Fed Leaders Hope To Avoid Repeating The Mistakes Of The 1970s

Financial Fraud Hits Close To Home

The Power Of Business Lending And Services

Marc RapportEnhancing The Member Experience With AI

Life Goes On: Capitalizing On Member Life Events Amid Market Volatility

Total Expert IncView all posts in:

More on: