The Sand States Arizona, California, Florida, and Nevada were some of the hardest hit areas of the country by the recession. Although the entire nation experienced the fallout from loosened underwriting standards, deteriorating asset quality and shrinking loan portfolios exaggerated the downturn in the Sand States.

Since then, however, credit unions in those states have made great strides to clean up their balance sheets. And in first quarter 2015, they posted impressive returns to profitability.

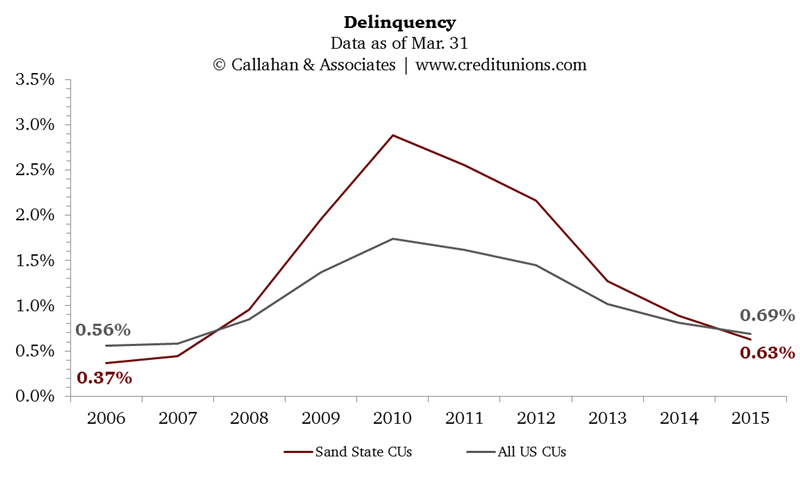

Delinquency rates in the Sand States, historically well below the national average, spiked in the years following the recession. On average, the states credit unions have made substantial progress. As of first quarter 2015, their average delinquency rate dipped below the national average.

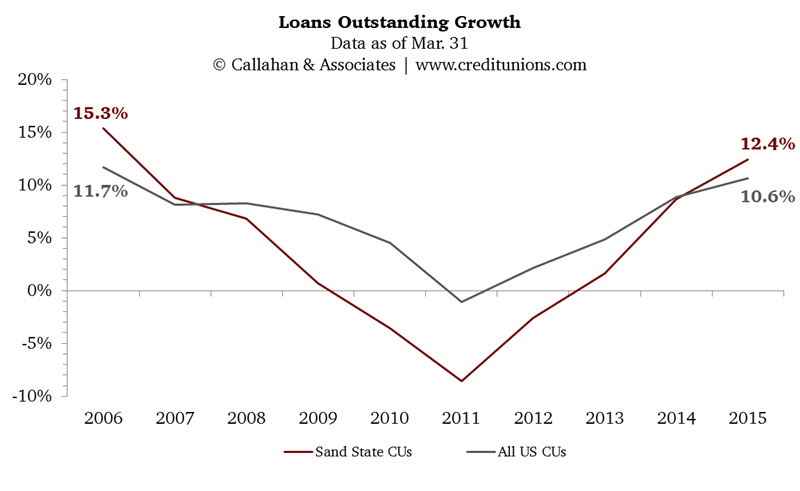

Similar to the trend in asset quality, loan portfolios in the Sand States contracted sharply in the years following the recession. Tightened lending standards and a systemic decline in borrower credit quality contributed to depressed loan growth. After hitting a low point in 2011, credit unions in the Sand States on average have posted positive year-over-year loan growth and surpassed the national average in the first quarter of 2014.

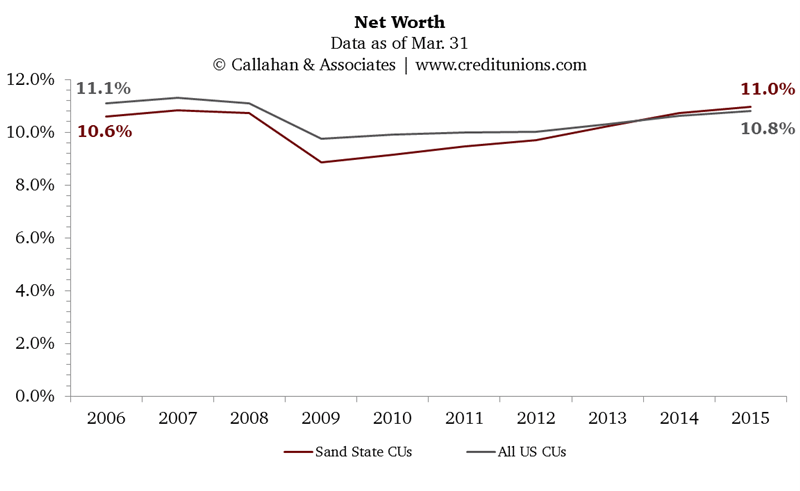

Sand States have historically posted lower-than-average returns in net worth as a percentage of assets, but that gap widened from 2008 to 2010. After bottoming out with a net worth ratio of 8.9% in March 2009, credit unions in the Sand States have consistently increased their net worth year-over-year and surpassed the national average in the first quarter of 2014.

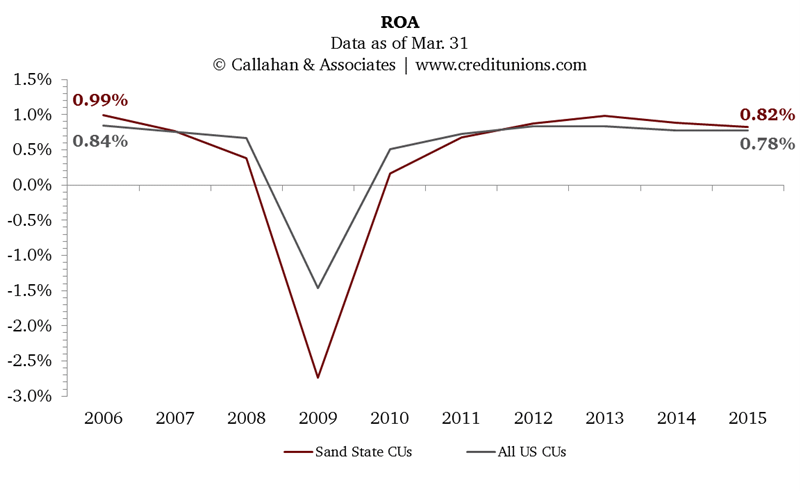

Finally, the recession significantly depressed earnings measured by return on assets at credit unions everywhere. Despite the fact the recession hit the Sand States particularly hard, credit unions there have significantly increased profitability. After a deep decline in 2009, they even started surpassing the national average in the first quarter of 2012.

Source for all graphs:Peer-to-Peer Analytics by Callahan & Associates