FINTECH USAGE RISING ACROSS ALL DEMOGRAPHICS

Callahan Associates | CreditUnions.com

Source: Plaid

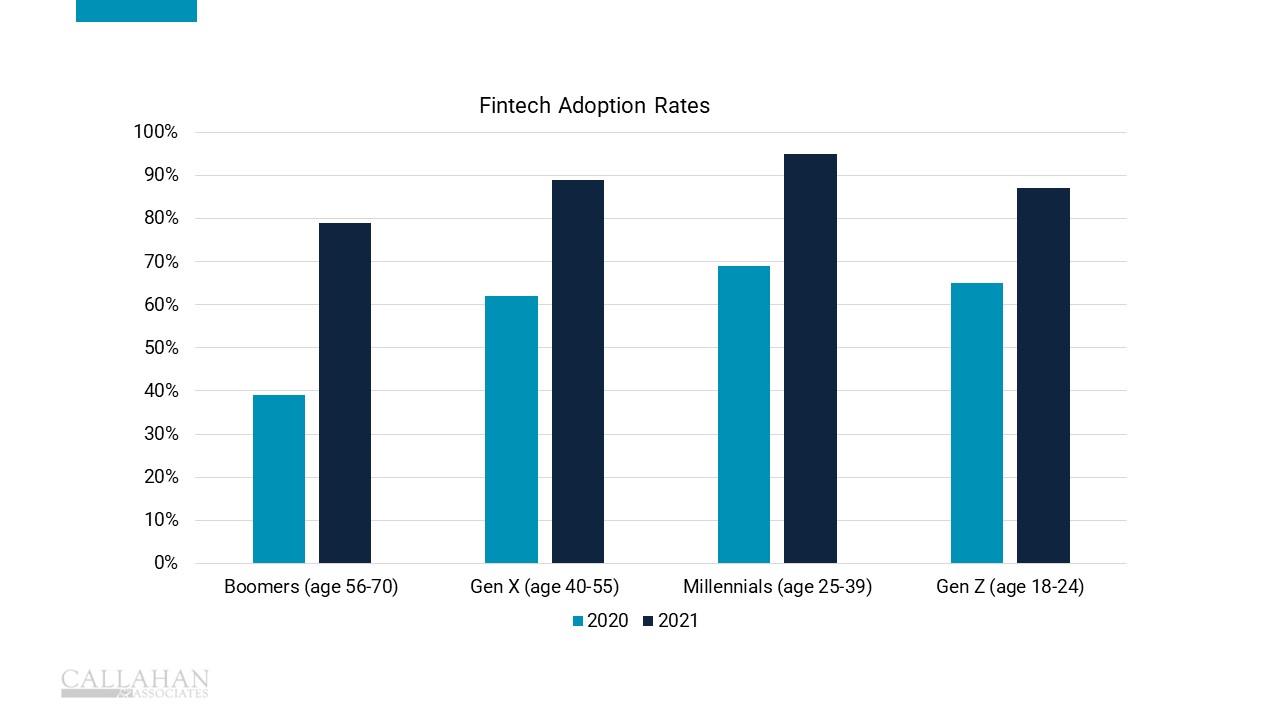

- Driven in large part by the pandemic, overall fintech usage rose by 30% between 2020 and 2021, according to a recent study from Plaid, with 88% of consumers saying they use some type of financial technology service.

- Fintech adoption is rising across all demographics. Older consumers saw the biggest gains in usage rates, but that group also had the most ground to gain. Just under 40% of baby boomers were using these services in 2020, compared to more than 60% of all other age groups.

- Usage among men and women is now essentially level compared to 2020, when nearly two-thirds of men reported using fintech tools compared to barely half of female respondents.

- Breaking down the survey’s findings along racial and ethnic lines, fewer Black consumers (81%) use fintech tools than any other group surveyed. Hispanic users saw the biggest gains, topping the list at 96%, a 34% increase from 2020.

- Payment services are overwhelmingly the post popular tools for American fintech users, at 70%, while only 14% use fintech for lending.

- A word of caution: It’s worth noting the source here. Plaid surveyed 4,000 consumers for this data, evenly split between the United States and the United Kingdom, so the sample size is plenty large. But Plaid designs fintech solutions for organizations all over the world, so while the data in this report has value for credit unions, the company is hardly an unbiased observer.