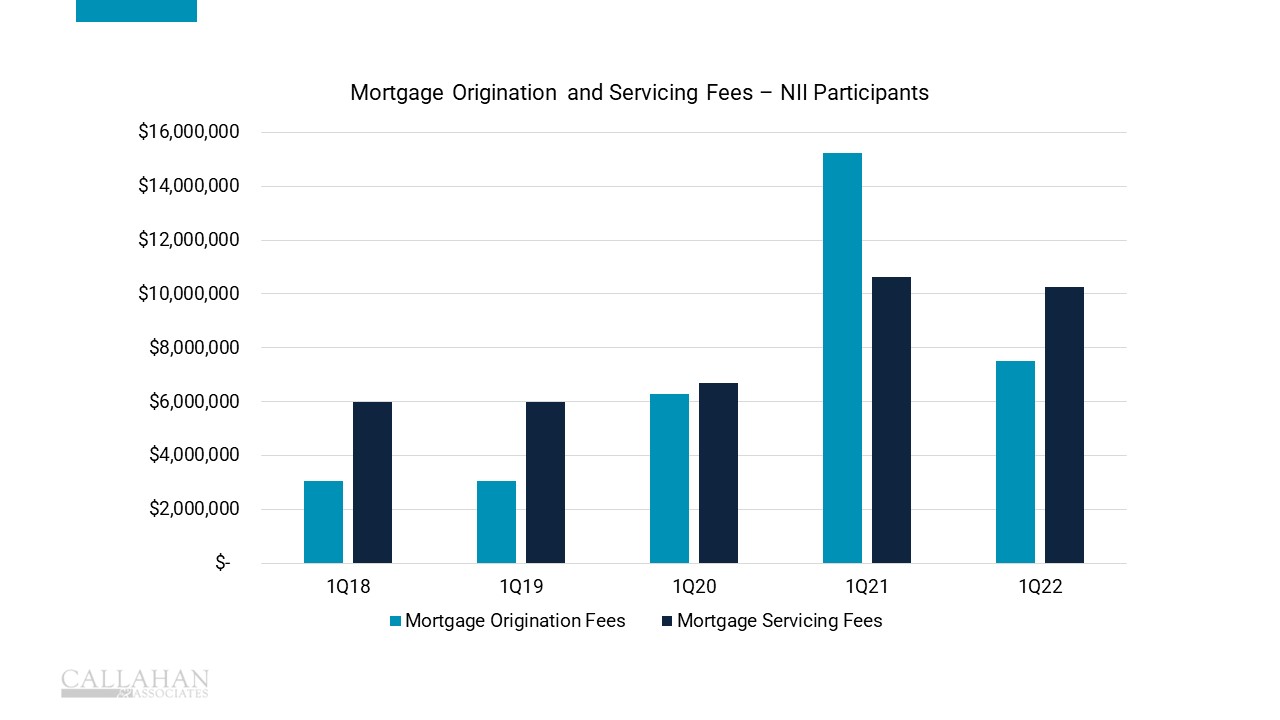

- Mortgage servicing fees declined 3.5% year-over-year among participants in Callahan Associates Non-Interest Income Study. Slowing mortgage sales to the secondary market in the first quarter meant less servicing fee income earned through NII channels

- After robust real estate activity caused mortgage origination fees to rise 142.9% in the 12 months ending March 31, 2021, a slowdown in the number of mortgages originated during the following 12 months caused origination fees to halve through 1Q22.

- Even though fewer homes were sold in the first quarter of 2022 compared to a year ago, higher home prices kept the dollar amount of real estate originations high. The median listing price of a home in the U.S. increased 26.5% to $404,950 from March 2020 to March 2022.

- The number of mortgages slowing was a result of few available homes on the market after a frenzy of buying the past two years.

Above data are for credit unions who participate in Callahan’s Non-Interest Income (NII) study. If you would like more information on how to participate, email analystsupport@callahan.com