The Federal Reserve was late in admitting that high inflation data was not transitory; consequently, it now finds itself behind in the battle to manage inflation. Consumer price index reports show prices have risen with each passing month, straining cost-of-living expenses for consumers.

To fight inflationary pressures, the Fed has several tools, including raising rates or restricting the growth of the money supply. However, limiting the flow of easy money puts asset prices at risk particularly in the equity and real estate markets and could spark a full-blown recession.

The economic shocks of the COVID-19 pandemic and prior short-term monetary and fiscal responses have left policymakers stuck between a proverbial rock and a hard place. Markets and the public at large eagerly await further signals as to what the Fed will do regarding rates and its nearly $9 trillion balance sheet. The bond market will be watching intently for any indication of when and how the Fed plans to normalize, as tightening quicker than anticipated would be bad news for many investment portfolios.

Trend 1: Investments Increase $8.7 Billion

Total investments held by credit unions increased 1.2%, or $8.7 billion, in the fourth quarter of 2021 and finished the year at $718.6 billion. The increase mirrored the third quarters 1.3% advance. Slower three-month growth rates indicate the era of double-digit quarterly growth in investment portfolios might be over as share growth slows and loan balances stick to balance sheets.

Credit unions have responded to loan demand by funding loans first through low-yielding cash balances. As such, cash and cash equivalents held by credit unions fell 1.1% quarter-over-quarter, which is in line with the past few quarters. As of Dec. 31, cash and equivalents comprised just 36.4% of the credit union investment portfolio, the lowest portion since year-end 2019. Instead of cash, credit unions placed most new investment dollars into higher-yielding securities and certificates, balances of which increased 3.4% in the fourth quarter. Credit unions are positioning their balance sheets to deliver greater yields as investment and lending conditions adapt to a late-pandemic environment.

TOTAL INVESTMENT AND QUARTERLY GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.21

Callahan Associates |

The era of double-digit quarterly growth in investment portfolios might be over as share growth slows and loan balances stick to balance sheets.

Trend 2: Industry Yield Inches Up For The Third Straight Quarter

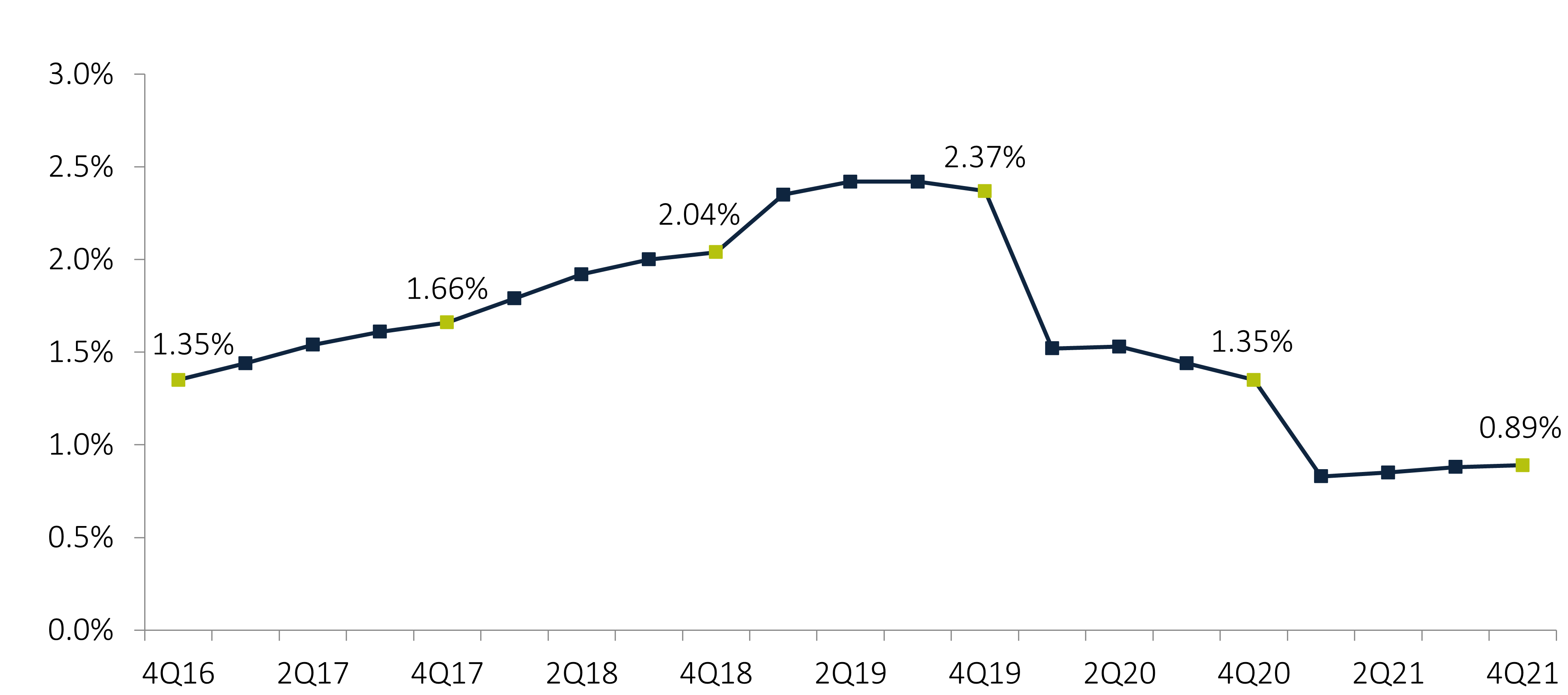

The average yield on investments increased 1 basis point to 0.89% in the fourth quarter. This was the third consecutive quarter of marginal increases.

Investment yield peaked at 2.42% in the third quarter of 2019. Then government relief during the pandemic underpinned a sudden, substantial expansion in low-yielding cash portfolios. Cash inflows combined with rate cuts by the Federal Reserve together dampened investment yields until the second quarter of 2021. Investment portfolio yields are now showing signs of recovery as baseline rates inch back up and the influence of government aid wanes.

YIELD ON INVESTMENTS

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.21

Callahan Associates |

Investment portfolio yields are showing signs of recovery as baseline rates inch back up and the influence of government aid wanes.

Trend 3: Portfolios Continue To Lengthen

The weighted average life of credit union investments was 2.39 years as of Dec. 31. Thats up from 2.32 years in the third quarter of 2021. After initially shortening at the start of the pandemic because of the initial effects of government cash infusions, the life of the portfolio has extended every quarter since mid-year 2020.

Credit unions that are reducing cash and turning to securities in the three-to-five-year maturity range are the largest contributor to the extension; this has been the case for several quarters. More recently, credit union investment managers have monitored changing yield dynamics and invested funds further out on the yield curve. Allocations to five-to-10-year maturities increased in the fourth quarter after declining in the third.

WEIGHTED AVERAGE LIFE

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.21

Callahan Associates |

After initially shortening at the start of the pandemic because of the initial effects of government cash infusions, the life of the portfolio has extended every quarter since mid-year 2020.

Do you want to compare your credit union against the industry or a specific peer group? TCU can help. Contact our analysts at 800-237-5678 or TCUgroup@callahan.com.

>

William Hunt contributed to this reporting.

About Trust for Credit Unions

Trust for Credit Unions (TCU) helps credit unions succeed in serving their members by providing a professionally managed family of mutual funds — exclusive to credit unions — as well as the information and analysis they need to support investment decisions. Created by some of the leading credit unions with oversight by a board of trustees, TCUs mutual fund options allow credit unions to meet their short duration needs, are professionally managed, and are based on the cooperative values of credit unions.

Visit www.trustcu.com or call us at 800-237-5678 to learn more.

The Trust for Credit Unions (TCU) is a family of institutional mutual funds offered exclusively to credit unions. Callahan Financial Services is a wholly-owned subsidiary of Callahan Associates and is the distributor of the TCU mutual funds. ALM First Financial Advisors LLC is the investment advisor of TCU mutual funds. To obtain a prospectus which contains detailed fund information including investment policies, risk considerations, charges and expenses, call Callahan Financial Services, Inc. at 800-CFS- 5678. Please read the prospectus carefully before investing or sending money. Units of the Trust portfolios are not endorsed by, insured by, obligations of, or otherwise supported by the U.S. Government, the NCUSIF, the NCUA or any other governmental agency. An investment in the portfolios involves risk including possible loss of principal.