Credit union lending has not been a strong driver of asset growth during the pandemic. Government relief has helped members pay down loan balances nearly as fast as they’ve taken out new loans. However, record lending performance is now starting to convert to substantial balance sheet growth in the absence of additional relief.

Loan balances at credit unions increased $29.9 billion from June 30, 2021, to Sept. 30, 2021, reaching nearly $1.24 trillion at quarter’s end. This 2.5% quarter-over-quarter increase is the largest quarterly loan growth rate for the industry in both dollar and percentage since 2018.

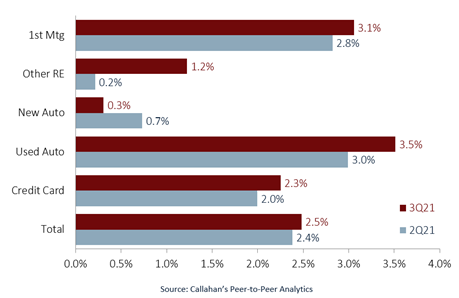

First mortgage and used auto turned out the largest quarterly increases of any major loan product. They were up 3.1% and 3.5%, respectively. Other real estate loan balances were up 1.2%, new auto lending expanded 0.3% despite microchip shortages and supply chain issues and credit card balances expanded for the second consecutive quarter, increasing 2.3% from June 30 to Sept. 30.

QUARTERLY LOAN GROWTH BY PRODUCT TYPE

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.21

CALLAHAN ASSOCIATES |

Strong loan growth in first mortgages and used auto continued in the third quarter.

Digging deeper into credit union performance, a few notable trends emerge.

Consumer Lending Rebounds To Fuel Loan Generation Growth

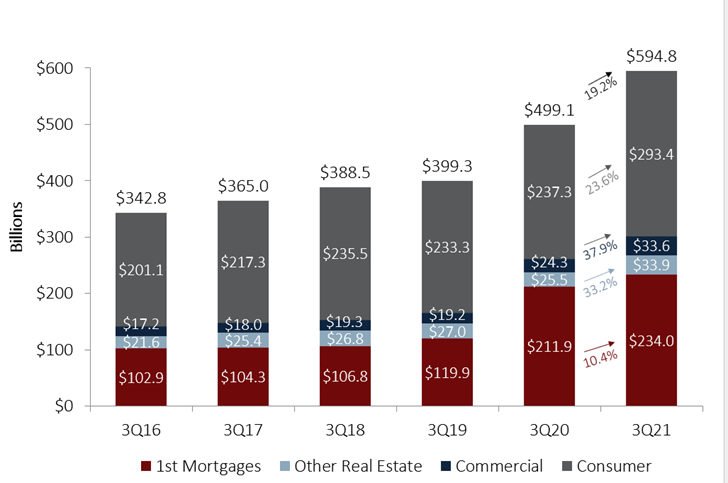

Total loan originations at U.S. credit unions hit $594.8 billion through the nine months ending Sept. 30, 2021, surpassing 2020’s record-breaking pace.

At $293.4 billion, consumer lending comprised the largest share of the origination pie year-to-date, growing 23.6% year-over-year and making up nearly half of all loan originations through the third quarter. Credit unions historically thrive in the personal and auto lending space, so an increase in demand here is welcome after two years of mostly flat performance.

YEAR-TO-DATE LOAN ORIGINATIONS

U.S. CREDIT UNIONS | DATA AS OF 09.30.21

CALLAHAN ASSOCIATES |

Commercial loan originations hit an all-time high for the credit union industry.

First mortgage originations totaled $234.0 billion as of Sept. 30 another nine-month record in this hot market. However, growth in this segment has slowed in the past few years, just 10.4% above 2020’s pace through September.

The largest relative jump in year-over-year originations, however, occurred in commercial lending. At $33.6 billion through Sept. 30, 2021, originations were 37.9% higher than the year prior. The third quarter of 2021 was the most successful quarter of commercial loan generation for credit unions on record, perhaps indicating some new success in this historically bank-dominated arena

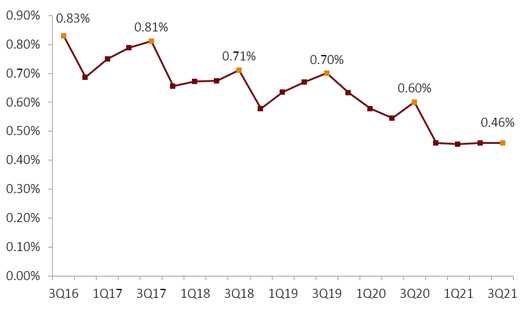

Asset Quality Continues To Improve

From a risk standpoint, asset quality has improved both year-over-year and quarter-over-quarter. Delinquency and net charge-offs rates are both at some of their lowest levels on record.

As of the third quarter, delinquency was down 8 basis points annually and has been holding steady at roughly 0.46% since the first quarter of 2021. Total net charge-off also decreased at U.S. credit unions, dropping to 0.26%. That’s an improvement of 22 basis points annually and 2 basis points quarterly.

DELINQUENCY RATES

U.S. CREDIT UNIONS | DATA AS OF 09.30.21

CALLAHAN ASSOCIATES |

Asset quality remains strong as delinquency rates maintain record lows.

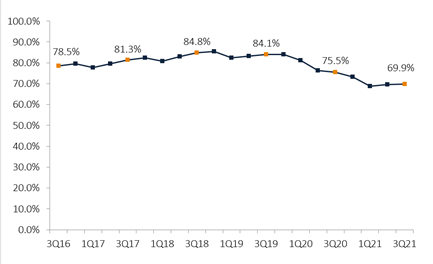

The Loan-To-Share Ratio Improves

Increased consumer lending coupled with a slowdown in early loan paydown rates helped loan growth outpace share growth quarter-over-quarter for the second consecutive period. As a result, the loan-to-share ratio is up 1.1 percentage points over the past six months, reaching 69.9% as of Sept. 30, 2021. After two years of plummeting liquidity ratios, credit unions are finally starting to find more success utilizing their assets on the lending side of the balance sheet.

LOAN-TO-SHARE RATIO

U.S. CREDIT UNIONS | DATA AS OF 09.30.21

CALLAHAN ASSOCIATES font-variant-east-asian: normal; font-size: 11pt; font-family: Calibri, sans-serif; vertical-align: baseline; white-space: pre-wrap;”> |

The industry’s loan-to-share ratio has begun to increase over the past six months.

On a per-member basis, average loan balances were up nearly $100 from June 30, 2021, and closed the third quarter at $8,673 per credit union member.

At a broader economic level, sustained low interest rates are encouraging members to take out loans. Local economies are reopening and the absence of federal relief means borrowers are not paying down debt quite so early.

All in all, the outlook is rosy for credit union lending in the coming months. The industry has plenty of liquidity on hand after nearly two years of deposit build-up and a large runway to take on strategic portfolio risk. Ultimately, credit unions should be well-prepared to support communities through continued lending production as the nation pushes through the tail-end of the Omicron wave.

Michael Zelna contributed to this reporting.