The first quarter of 2022 marked another quarter of change in the credit union space. Reporting and regulatory changes affected the industry at large, but the reversal of some recent top-level industry trends can be attributed to macroeconomic changes. Some slowdowns in growth are the result of the normalization throughout the industry following two years of abnormal pandemic-related policies and market dynamics. Other changes stem from ongoing issues, such as inflation.

The mortgage market, which exploded at the start of the new decade, was surpassed by consumer loan growth as the driver of industry loan generation. Still, the mortgage market remains hot, and all these new loan dollars are sticking around on balance sheets at greater rates. This loan portfolio expansion has accelerated as credit unions reduce their secondary market mortgage sale activity, and portfolio more 1-4 family residential loans., Credit unions are also performing well relative to competitors; the industry’s real estate origination market share is up year-over-year.

Things are as good as ever in terms of asset quality. The seasonal first-quarter dip resulted in a record low delinquency rate, despite consumer delinquency ticking up from the previous year.

Callahan’s quarterly Trendwatch webinar dove into those topics and more. Read on for five takeaways from the data.

No.1: Loan growth outpaces share growth

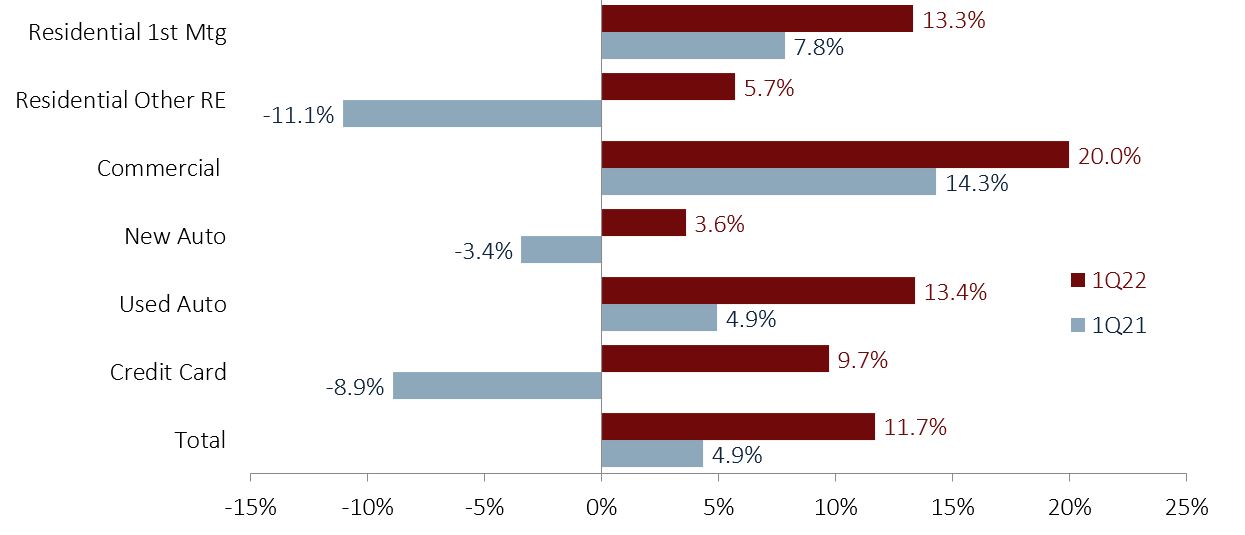

For the first time since the second quarter of 2019, the larger annual growth rate is not from shares, but loans, which rose by 11.7% year over year. This is also the first time since 2019 that the annual growth rate for all major loan types is positive. Commercial, used auto, and residential first mortgages were the biggest drivers of outstanding loan growth year over year. With government-issued pandemic-relief payments a thing of the past, fewer members are paying down their loans early, allowing loans to stick to the balance sheet.

Share growth returned to its pre-pandemic pace, though it remains elevated. Two contributing factors here are inflation specifically wage inflation and tax returns. Liquid core deposits continue to be member favorites despite share certificate rates climbing. Luckily, credit union performance means that they don’t need the liquidity and many institutions likely won’t market them for a while. Loan and share growth patterns moving in opposite directions is generally characterized as good for credit unions, as the reduction in early loan payments lessens operational and earnings pressures.

TOTAL LOANS AND ANNUAL GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.22

Callahan Associates |

No.2: Originations have slowed dramatically, but

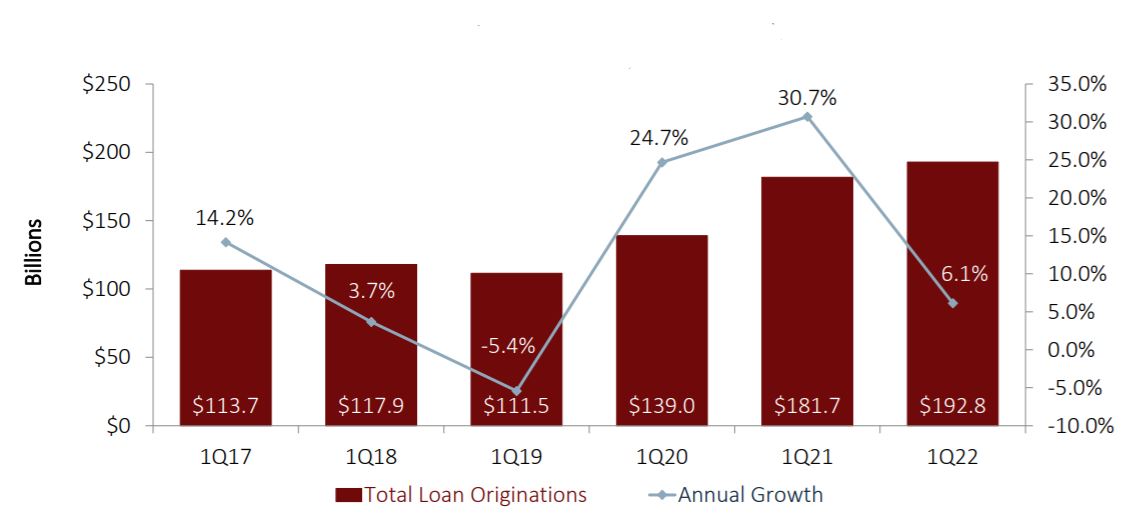

Credit unions have originated 11.3 million loans so far in 2022, a 22.2% decline from the same period one year ago. This is the sharpest first-quarter decline in loan originations in industry history the previous record was a dip of nearly 21% all the way back in 2001.

While the number of originations dropped, the dollar amount of loans granted year-to-date grew 6.1% annually to a first quarter record $192.8 billion. This can be attributed to rising asset prices, especially in the real estate market. Consumer lending was the driver of dollar origination growth, recording 11.1% growth compared to 0.2% real estate growth. Although these numbers are well below pandemic-era origination growth, industry lending remains healthy, especially when considering slowing origination numbers.

YTD LOAN ORIGINATIONS AND ANNUAL GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.22

Callahan Associates | CreditUnions.com

No.3: NII is down

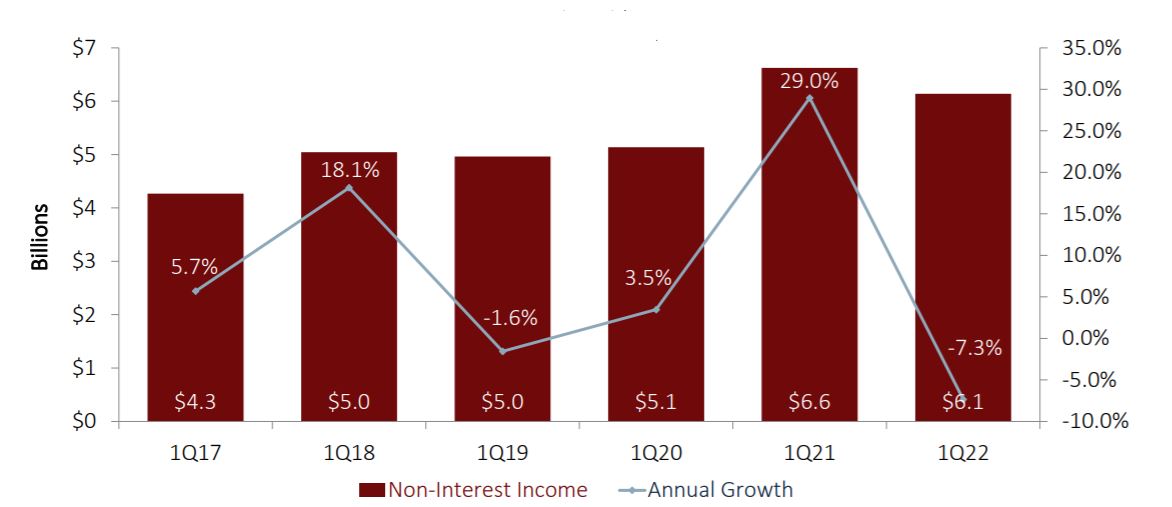

Non-interest income declined 7.3% from totals through March 2021. Although fee income rose by 8.8% year-over-year, other operating income declined 12.8%. Fee income is still below pandemic levels on a per-member basis, as more and more credit unions begin the process of punitive fee reduction, specifically NSF fees. Other operating income includes interchange income and gains on sales to the secondary market. The volume of loan sales, as well as the premiums, dropped from 2021 levels.

YTD NON-INTEREST INCOME

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.22

Callahan Associates |

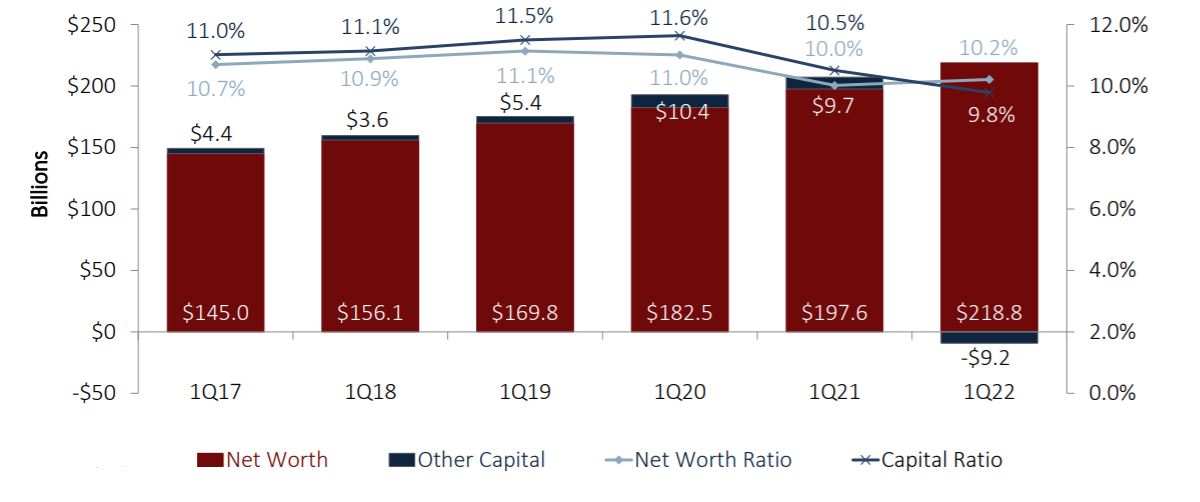

No.4: Capital takes a hit as regulatory changes take effect

The net worth ratio increased 19 basis points to 10.2%, but the total capital ratio fell to 9.8% from 10.5% one year ago. This is the worst market for fixed income in over 40 years, evident in the unrealized gains/losses on available-for-sale securities that are present in the capital ratio. Most credit unions hold securities until maturity, so these unrealized losses are unlikely to stick long-term; however, it continues to affect the current capital ratio.

Additionally, recent regulatory changes National Credit Union Administration have muddied the waters around capital. The main change is in regard to the risk-based capitalization (RBC) calculation. This affected what the NCUA categorizes as complex credit unions, or institutions with greater than $500 million in assets. Prior to this change, the net worth regulatory threshold was 7%, a line met by 99.6% of credit unions. This quarter, the threshold for reporting the Complex Credit Union Leverage Ratio (CCULR) was raised to 9%, and the percentage of complex credit unions meeting this new requirement dropped to an estimated 70.2%. This pushes about 210 complex credit unions to complete the more complex RBC calculation. While the RBC calculation requires more heavy lifting from an accounting perspective, a strong RBC ratio can be beneficial to a credit union’s relationship with its regulator.

NET WORTH AND OTHER CAPITAL

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.22

Callahan Associates | CreditUnions.com

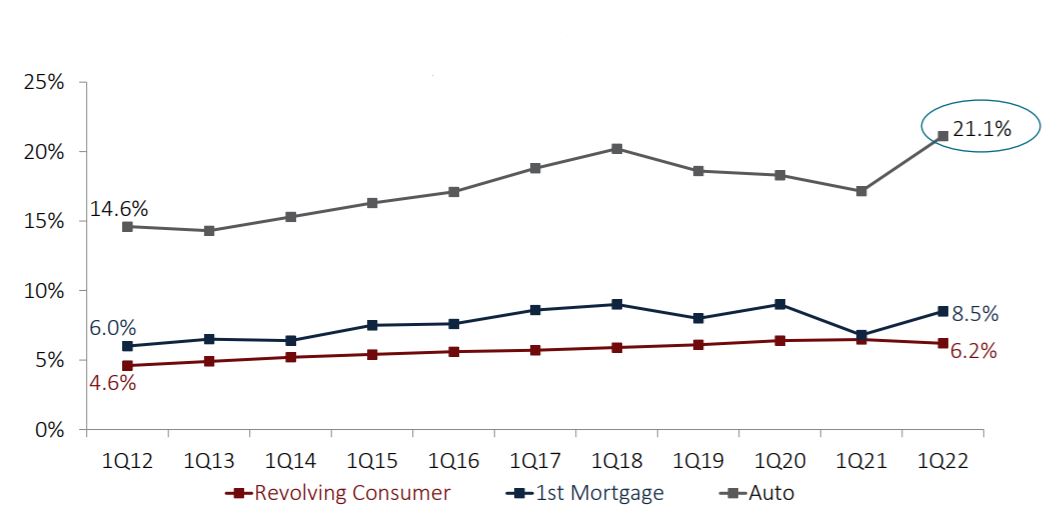

No.5: Indirect lending is hotter than ever

Despite a difficult market for auto sales, credit unions continue to make gains. The industry closed out the first quarter with a 21.1% share of the auto market, the highest figure ever recorded. This success has been bolstered by a return in indirect lending. Indirect loans make up over two-thirds of the national auto loan portfolio, and the 16.7% growth rate recorded at the end of Q1 is the fastest pace since 2017. That’s due in part to credit unions shifting how they generate those loans, including working not just with dealerships, but also with fintechs, CUSOs, and others.

A perk of indirect lending is being able to utilize the built-in marketing footprint and name recognition of other loan providers while allowing a credit union to get its loan offerings publicized. This benefit is two-fold: loan production is boosted and credit union membership increases. However, the tradeoff is in lower loan yields. Additionally, indirectly sourced membership is often temporary; members brought in via indirect lending are notoriously difficult to keep in the membership fold after their loan is paid off.

CREDIT UNION MARKET SHARE BY PRODUCT

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.22

Callahan Associates | CreditUnions.com