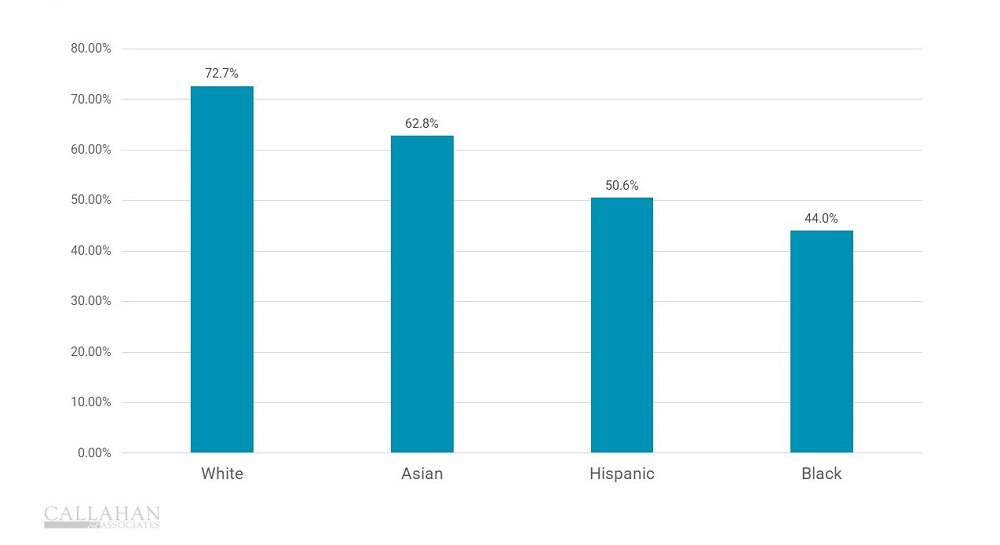

HOMEOWNERSHIP RATES BY RACE

FOR U.S. HOMEOWNERS | DATA AS OF 2021

© Callahan & Associates | CreditUnions.com

Finding affordable housing in America these days isn’t easy. It’s even more difficult if you’re a member of a racial minority.

According to the 2023 Snapshot of Race and Homebuying In America from the National Association of Realtors, housing affordability remains a concern for multiple demographics; however, Black, Hispanic, and Asian consumers face distinct struggles and have for years. The study’s findings showcase some of the challenges credit unions are up against as they move to address racial equity issues in homeownership.

Some highlights from the report include:

- Hispanic and Asian consumers made the biggest homeownership gains between 2011 and 2021, with each group rising 4% or better to surpass 50% homeownership overall at the end of 2021. In contrast, Black homeownership in that same period rose just 40 basis points, from 43.6% in 2011 to 44% in 2021. The homeownership rate for white Americans remains slightly higher than 70% and has hovered near that mark for roughly a decade.

- For homeowners, racial minorities struggle with affordability more than their white counterparts. Nearly one-third of Black homeowners — 30% or 2 million — spend 30% or more of their income on housing. By comparison, 28% of Hispanic homeowners and 26% of Asian homeowners spend that much. For white homeowners, that figure is 21%.

- According to HMDA data, lenders declined 20% of the mortgage applications for Black borrowers. By comparison, lenders denied 15% of Hispanic applicants, 11% of white applicants, and 10% of Asian applicants. The denial rate rose to 51% for Black borrowers who applied for home improvement loans. The report details denial rates by race at the state level: Black applicants are denied between 11% – 29% of time compared to White applicants whose peak denial rate topped out at 14%.

GreenState and other Iowa credit unions are looking to address racial issues in housing in their state. Read more here: A Call for Cooperatives to Close The Racial Homeownership Gap

Identify Your Application And Decline Rates By Ethnicity Without Slogging Through HMDA Records