The annual Governmental Affairs Conference from America’s Credit Unions rolled on Tuesday, with remarks from industry insiders, lawmakers, sports luminaries, and more. Here’s a look back at some of the highlights from the GAC.

Takeaway No. 1: A Slowdown At NCUA?

An executive order from the White House aimed at increasing presidential control and oversight of federal agencies could result in a slowdown in rulemaking at the National Credit Union Administration.

Among other things, the Feb. 18 order on “Ensuring Accountability For All Agencies” requires that all rules from federal agencies are reviewed by the Office of Management and Budget and stipulates that the president and attorney general are the final arbiters of interpretations that govern independent agencies.

“This represents what could be a dramatic shift in separation of powers,” said Luke Martone, senior director of advocacy and counsel at America’s Credit Unions, adding that the trade group supports maintaining NCUA’s status as an independent regulator and insurer and backs the agency’s structure as a bipartisan three-member panel.

One of the key questions at play, continued Martone, is what actually makes an independent agency independent. Traditionally that has meant they operate outside the executive branch, but President Trump has said this and other executive orders are necessary to ensure independent agencies are carrying out the will of the administration.

Increased back and forth between the regulator and the White House could slow the pace of rulemaking, and some rules might not be finalized if the White House feels they aren’t in line with the administration’s priorities, said Martone, although he was quick to add that this and other orders are likely to be challenged in court.

The order also requires a White House liaison at each agency, although it’s unclear whether that should be a new hire or an existing employee, added Elizabeth Eurgubian, a principal at Atlas Advocacy and a former staffer at the Credit Union National Association.

“I wouldn’t expect to see any new, super innovative regulations from the NCUA coming anytime soon,” she said.

During Monday’s general session, Kyle Hauptman, the new chair of the NCUA, indicated the regulator will likely reduce staffing by approximately 10% in the next year. Eurgubian noted the NCUA already has a fairly lean staff compared to other banking regulators, and a smaller headcount could result in more time between on-site examinations — something Hauptman alluded to during his remarks.

Possible consolidation of federal banking regulators has been a hot topic throughout the conference, and Martone noted that America’s Credit Unions has sent letters to Congress, the White House, and Elon Musk’s Department of Government Efficiency outlining why that would be a bad idea. Eurgubian indicated she doesn’t believe that’s likely to happen — but, she added, she also didn’t think Congress would create an agency for consumer protection, either.

Takeaway No. 2: A Cloudy Legislative Forecast

Republicans in Washington might have been excited about winning the White House and both chambers of Congress, but “reality has started to set in a bit” as the president takes action and Congress attempts to get the ball rolling legislatively, said Cliff Roberti, co-founder and principal of Federal Hall Policy Advisors, LLC.

“I’ve been in Washington 20 years,” Roberti said during a panel discussion on the legislative outlook. “This is by far the most wild time I’ve seen here.”

One of the biggest uncertainties includes the future of the Consumer Financial Protection Bureau, which has been in DOGE’s crosshairs. Roberti noted that if Republicans “are really taking a chainsaw to the CFPB,” some Democrats in Congress might be forced to work with Republicans to reshape the bill, but Democrats aren’t ready to have those conversations yet. There’s some possibility that could change down the line, but for now Roberti said he is not optimistic — in part because policy changes can’t be accomplished through budget reconciliation, so changes to the funding structure or shifting the leadership from a single director to a commission would require separate legislation.

Data privacy and security has been an industry priority for years, and although Roberti said there might be enough bipartisan support to get something done, jurisdictional issues between different House committees could create hurdles.

Takeaway No. 3: The Newest NCUA Board Member Speaks (Briefly)

Tuesday’s proceedings also included brief remarks from Tanya Otsuka, the newest member of the NCUA board. Although on Monday Hauptman indicated the agency would be scaling back its consumer protection work, Otsuka said the regulator must embrace that role along with lowering the cost of financial services and prioritizing service over profit.

“The credit union difference is the ultimate competitive advantage,” she said during remarks from the main stage.

Outlining some of her priorities for the board, Otsuka emphasized the importance of supporting small credit unions and minority depository institutions as well as expanding access to underserved communities.

The board is also considering a rule that would allow credit unions to reimburse board members for childcare and eldercare expenses incurred during board meetings.

Takeaway No. 4: Americans ‘Feel They’re Being Taken Advantage Of’

U.S. Rep. Pete Aguilar (D-CA) was one of the few lawmakers to address the GAC crowd, a marked difference from previous years that were chock-full of remarks from legislators and other policymakers.

The 2024 election sent a clear message, according to Aguilar: Americans “are distrustful of the institutions in their lives because they rightly feel they’re being taken advantage of.”

Credit unions have the opportunity to push back against that by continuing to prioritize members and service. But, he added, Congress also has a role to play in ensuring the industry thrives.

“You should have the same flexibility that other FIs do,” he said. “We need a level playing field for credit unions so you can offer members services and continue to provide the level of service they’re accustomed to in their communities.”

Although Washington feels “topsy turvy” right now, he said, it’s important to cut through the noise and pursue legislation that makes credit unions stronger.

“When you succeed, our communities succeed,” he said.

Takeaway 5: Coach K Says, “Understand Your ‘Why’”

The day’s most popular speaker might also have been the most unlikely. Mike Krzyzewski, better known as Coach K, led men’s basketball at Duke University for more than four decades. The coach won multiple national championships with Duke and led the U.S. men’s basketball team to multiple Olympic gold medals.

Coach K offered insights into teamwork and leadership, including rebutting a popular saying.

Although many leaders encourage teammates to “leave your ego at the door,” Coach K rejects that.

“I want who you are — all your talent, all your ego,” he said.

He put that ethos toward stars like LeBron James and Kobe Bryant, who Krzyzewski coached on the Olympic team, but the same applies to credit unions.

“These guys are the best on their own team,” he explained. “I asked them to put all their egos under one ego umbrella, let’s call it the USA umbrella. If we do that, we’ll win the world. American credit unions form another team, very similar to an Olympic team.”

As credit unions recenter their work around purpose and mission, Krzyzewski said determining why they are doing something is just as important as understanding what it is and how to do it. Moreover, embracing why makes how and what easier.

“You represent 100 million people!” he said. “All the ‘why’ is in the people you represent … Understand your ‘why,’ and then you’ll keep figuring out the ‘how’ and the ‘what’ better.”

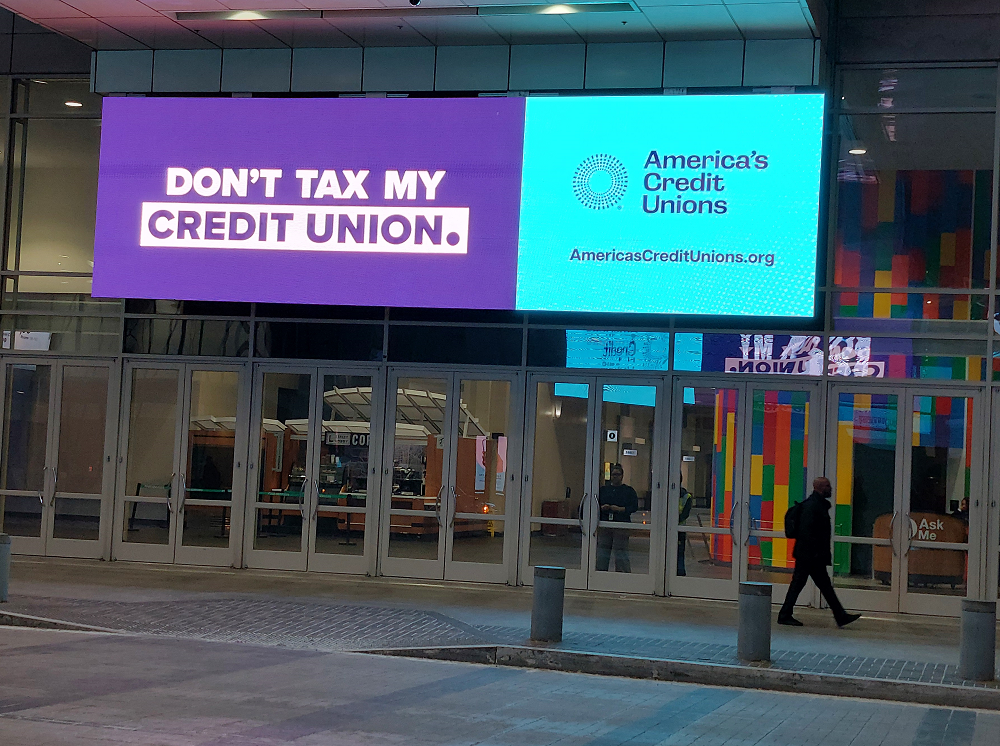

Read More On-Site Coverage. The first full day of the Governmental Affairs Conference included a frank assessment of threats to the credit union tax status, news about the future of the NCUA, and more. Read “Chaos, Taxation, And More: Takeaways From Day 1 Of GAC 2025.”