The analysts at Callahan & Associates field all kinds of queries from clients and curious credit unions regarding data and trends across the industry, within the field of financial services, and among the U.S. population. This week, we’ll examine financial wellness. Got questions of your own? Drop us a line, and it could be answered in the future.

What is the state of retirement planning in the United States?

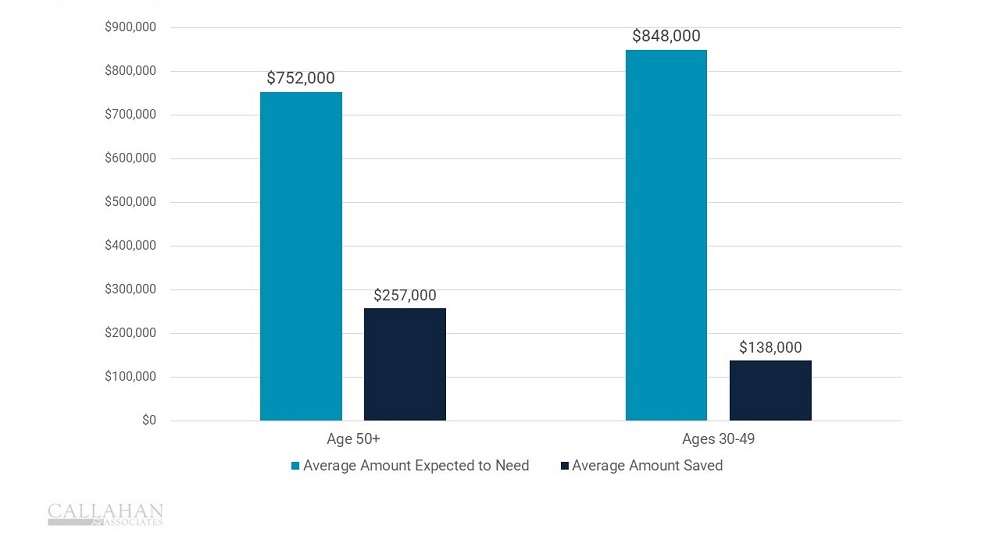

Americans are struggling to save for retirement. According to a 2024 study conducted by AARP, Americans older than 50 who are not yet retired reported needing $752,000 for retirement yet had saved only $257,000.

With so many Americans short of retirement savings, and little safety net beyond Social Security, there is concern among many. Credit unions can use savings products as well as financial education to help members think about the future and plan for retirement and beyond.

AVERAGE AMOUNT SAVED VS. EXPECTED NEED IN RETIREMENT

FOR PARTICIPANTS IN AARP FINANCIAL SECURITY TRENDS SURVEY

© Callahan & Associates | CreditUnions.com

What can credit unions do to help their members prepare for retirement?

Credit unions can offer retirement planning and advice to their members.

Many credit unions offer IRA/Keogh accounts to help members save for retirement. The IRA allows members to deposit tax-deductible contributions, deferring taxes on earnings until they’re withdrawn. Keogh accounts work similarly for self-employed members.

As of the second quarter of 2024, 3,286 credit unions had members that hold IRA/Keogh accounts. That’s 71.4% of the industry’s credit unions, according to FirstLook data from Callahan & Associates. At mid-year, the credit union industry held 4.5% of the share portfolio in IRA/Keogh accounts.

Looking for FirstLook access? Callahan’s FirstLook program provides data weeks in advance of NCUA’s official release — giving users a jump-start on performance analysis and strategic planning. Don’t wait for data, connect with Callahan today.

How are my members, and the rest of America, managing debt?

According to Experian, the average American carried $104,215 in debt as of the third quarter of 2023. This was up 2.3% from 2022 and 8.1% since 2021. With higher prices on everything from the grocery bill to housing, Americans have added to their debt as a way to handle rising costs.

Meanwhile, Americans’ assets are rising in value, allowing many to afford that increase. Americans held 8.8 times the amount of assets as they did liabilities in the first quarter of 2024. This is an increase from the 6.8 times in the first quarter of 2014. Still, 52% of Americans report their net worth is less than $30,000; 25% say their net worth is $0 or negative.

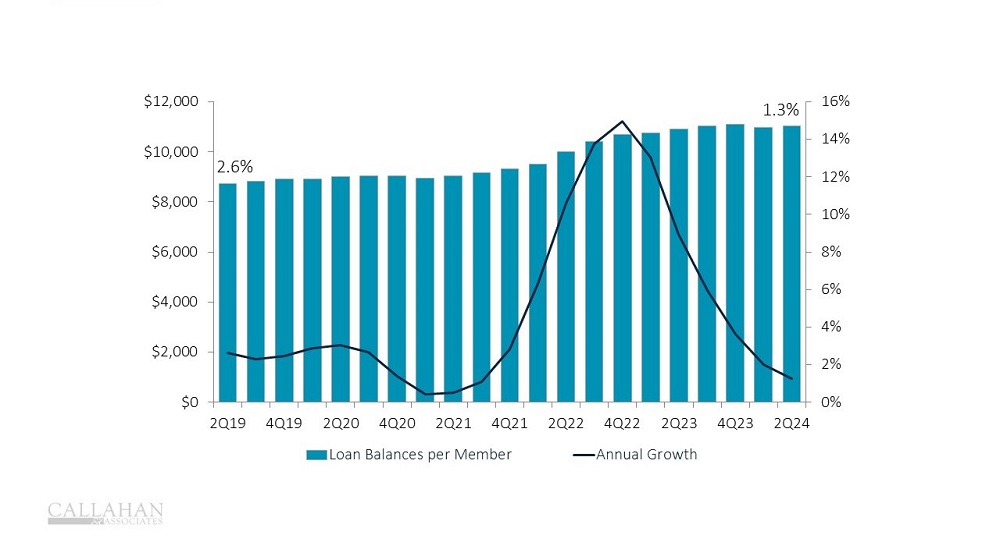

LOAN BALANCE PER MEMBER AND ANNUAL GROWTH

FOR U.S. CREDIT UNIONS

© Callahan & Associates | CreditUnions.com

In the second quarter of 2024, the average member at U.S. credit unions held $11,048 in loans with their credit union. This does not include loans sold on the secondary market and not every credit union member holds a credit union loan; however, this data does offer a sense of the direction. The measure has increased 26.3% since the second quarter of 2019.

Credit unions are not immune to the rise in debt, as it winds up on their balance sheets. Now the onus is on credit unions to make sure the level of borrowing is sustainable for members.

How can credit unions get in front of their members’ financial wellness needs?

Credit unions can get out ahead of their member’s financial wellness needs by setting up programs to do so.

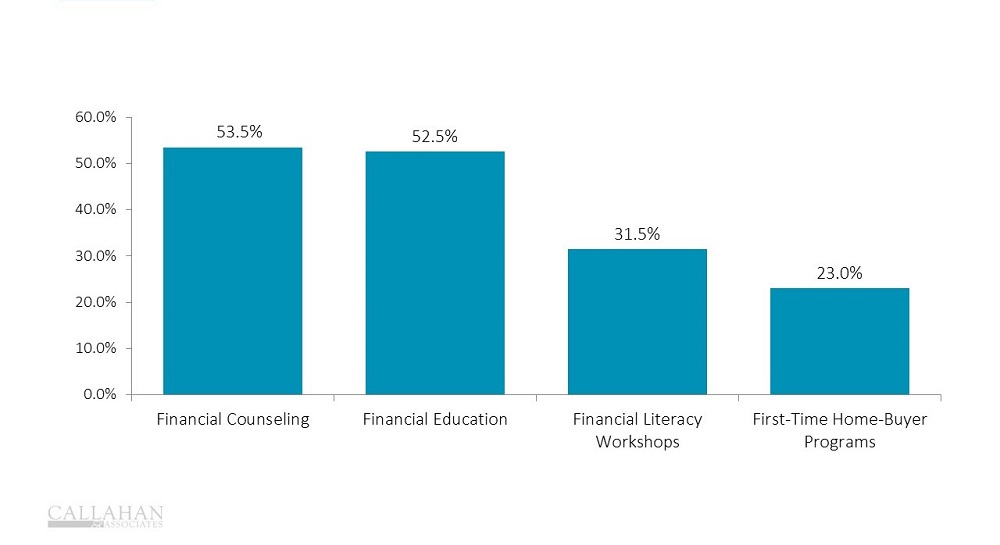

In the second quarter of 2024, 53.4% of credit unions offered members financial counseling, 52.5% offered financial education, and 31.5% offered financial literacy workshops, according to data from the 5300 Call Report.

FINANCIAL EDUCATION PROGRAMS OFFERED

FOR U.S. CREDIT UNIONS

© Callahan & Associates | CreditUnions.com

A recent survey conducted by TIAA Institute and the Global Financial Literacy Excellence Center, showed a relationship between financial literacy and financial wellbeing. Survey respondents with a very low level of financial literacy were shown to be twice as likely to be debt constrained and four times more likely to lack one month of emergency savings.