Analysts from Callahan & Associates project credit union membership grew 4.2% year-over-year to reach 4.7 million as of March 31, 2019. That’s on the national scale, but what about in markets throughout the country?

The two major metropolitan markets that Amazon claimed for its headquarters Seattle, WA, and Washington, DC are similar in wealth. The median household incomes for the two markets are more than 1.4 times the U.S. average, at $82,133 for Seattle and $99,669 for Washington. Additionally, the median value of owner-occupied housing units in each market are almost double the U.S. average, at $439,800 in Seattle and $424,600 in Washington.

Seattle, WA, and Washington, DC, are outperforming national averages in income and housing. But how do these markets fare in credit union membership growth and engagement metrics?

Round 1: Membership Growth

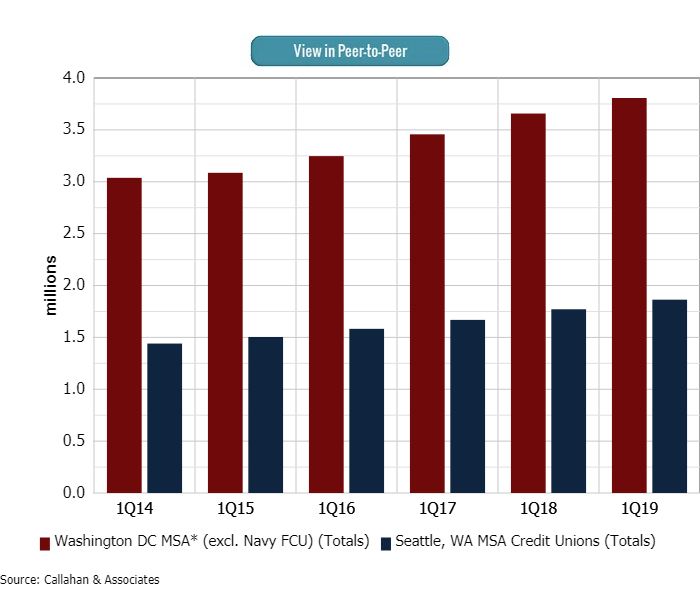

According to first quarter data available for the credit union industry, membership growth in Seattle and Washington followed the national trend. Callahan analysts project credit union membership rose 5.2% year-over-year to 1.9 million in Seattle and 4.1% to 3.8 million in Washington.

Credit unions in Seattle outpaced the year-over-year national average growth rate by 100 basis points, whereas Washington credit unions trailed by 10 basis points.

CREDIT UNION MEMBERSHIP

FOR SEATTLE, WA, MSA CREDIT UNIONS | DATA AS OF 03.31.19

Callahan & Associates | CreditUnions.com

Whereas credit unions in Washington collectively have more members than credit unions in Seattle, Seattle membership growth rates year-over-year outpaced Washington.

A few credit unions led the membership growth in the Seattle area over the past year. Community 1st Credit Union ($144.4M, Dupont, WA) reported growth of 54.1%, Puget Sound Cooperative Credit Union ($156.4M, Bellevue, WA) reported growth of 10.7%, and Salal Credit Union ($653.8M, Seattle, WA) reported growth of 10.6%.

A merger with $38.2 million Generations Credit Union contributed significantly to the jump in membership at Community 1st, which picked up close to 5,000 members from the smaller cooperative.

LEADERS IN 12-MONTH MEMBERSHIP GROWTH

FOR SEATTLE, WA, MSA CREDIT UNIONS | DATA AS OF 03.31.19

Callahan & Associates | CreditUnions.com

| Rank | Credit Union | State | 12-Month Growth | Members (03.31.19) | Members (03.31.18) | Total Assets | % Of CU Market Assets |

|---|---|---|---|---|---|---|---|

| 1 | COMMUNITY 1ST* | WA | 54.1% | 13,085 | 8,490 | $144,406,961 | 0.48% |

| 2 | PSSCU | WA | 10.7% | 16,019 | 14,474 | $156,439,181 | 0.52% |

| 3 | SALAL | WA | 10.6% | 41,301 | 37,337 | $653,753,695 | 2.15% |

| 4 | BECU | WA | 7.3% | 1,183,429 | 1,102,521 | $20,487,696,438 | 67.46% |

| 5 | SOUND | WA | 7.2% | 130,306 | 121,115 | $1,789,624,020 | 5.89% |

| SEATTLE, WA, MSA TOTALS | 5.2% | 1,1863,353 | 1,770,829 | $30,371,232,128 | 100.00% | ||

* Merged in the past year

Community 1st, PSSCU, and Salal rank in the top three for membership growth in Seattle. These credit unions collectively account for only 3.14% of credit union assets in the market.

In the Washington, DC, metropolitan market, three credit unions led that market’s membership growth. O.A.S. Staff Federal Credit Union ($247.0M, Washington, DC) reported growth of 27.6%, Department of the Interior Federal Credit Union ($211.5, Washington, DC) reported growth of 17.6%, and United States Senate Federal Credit Union ($964.3M, Alexandria, VA) reported growth of 12.8%.

On Aug. 1, 2018, a merger with $12.9 million National Geographic Federal Credit Union added more than 1,500 members to OAS’s base.

LEADERS IN 12-MONTH MEMBERSHIP GROWTH

FOR WASHINGTON, DC, MSA CREDIT UNIONS | DATA AS OF 03.31.19

Callahan & Associates | CreditUnions.com

| Rank | Credit Union | State | 12-Month Growth | Members (03.31.19) | Members (03.31.18) | Total Assets | % Of CU Mkt. Assets |

|---|---|---|---|---|---|---|---|

| 1 | OAS* | DC | 27.6% | 8,366 | 6,557 | $247,013,839 | 0.42% |

| 2 | INTERIOR | DC | 17.6% | 16,633 | 14,141 | $211,451,766 | 0.36% |

| 3 | US SENATE | VA | 12.8% | 40,283 | 35,709 | $964,259,631 | 1.62% |

| 4 | ANDREWS | MD | 8.1% | 130,950 | 121,197 | $1,891,757,098 | 3.18% |

| 5 | PAHO/WHO | DC | 6.8% | 5,688 | 5,325 | $230,306,022 | 0.39% |

| WASHINGTON, DC, MSA TOTALS (EXCL. NAVY) | 4.1% | 3,804,213 | 3,654,307 | $59,488,847,070 | 100.00% | ||

* Merged in the past year

OAS, Interior, and US Senate rank in the top three for membership growth in Washington, Dc, but these credit unions collectively account for only 2.39% of credit union assets in the market.

Round 2: Member Engagement

Beyond membership growth, credit union members also are displaying stronger engagement with their financial cooperatives.

Projections in real estate and credit card penetration rates indicate that credit unions in both Seattle and Washington bested their national peers. Credit unions in Seattle reported real estate penetration of 5.4%, and credit unions in Washington reported real estate penetration of 4.8%. By comparison, the national average was 4.4% as of March 31, 2019. For credit cards, credit unions in Seattle reported a penetration rate of 33.4%. Credit unions in Washington reported a penetration rate of 27.4%. The national average was 17.5%.

Hey Callahan! How Does My Membership Growth Compare?

Credit union membership grew 4.2% year-over-year as of March 31, 2019. How does your membership growth compare to local credit unions and your region as a whole? Find out today!

Performance for Washington credit union diverges from this trend when it comes to share draft penetration. According to Callahan data, credit unions in Washington reported share draft penetration of 36.0% as of March 31, 2019. This was notably lower than the 74.7% reported by Seattle credit unions as well as the national average, 58.2%.

Share balances for credit unions in Washington grew 5.4% to $48.6 billion in the first quarter. Aggregate loan balances grew 4.3% to $43.6 billion. By comparison, share balances for credit unions in Seattle grew 6.2% to $25.8 billion, and loan balances grew 8.7% to $20.2 billion.

Share and loan balances are increasing in lockstep and have in turn pushed the average member relationship the average consumer savings and loan balances a member holds with a credit union higher. Credit unions in Washington are on pace to report an average member relationship of $23,912 for the first quarter, compared with $23,568 for Seattle credit unions and $19,158 for credit unions nationally.

AVERAGE MEMBER RELATIONSHIP (EXCLUDING BUSINESS LOANS)

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.19

Callahan & Associates | CreditUnions.com

The average member relationship in both Seattle and Washington are well above national levels, indicating higher member engagement in both markets.

Whereas credit unions in Washington reported a larger average member relationship than credit unions in Seattle, the differences in loan and share growth between each market show Seattle credit unions are expanding their member relationships at a faster clip.

The Verdict

Credit unions in both Seattle and Washington have reported stronger-than-average performance in key areas. The growing membership base in each market coupled with increased engagement of its members indicates continued growth in future years.

Of the two markets, Seattle bested Washington in terms of membership growth, product penetration, and growth in the size of average member relationships. However, credit unions in Washington still serve more members and reported larger average member relationships.