A rapid increase in interest occurred at credit unions in 2023. Interest on loans, that is. And with new rules such as the pitch clock, interest in baseball was also on the rise. With that in mind, Callahan presents its 2023 World Series preview, examining how the state of Texas (and the Rangers) matches up with Arizona (and the Diamondbacks) in the credit union industry — and whether that can translate to success in the Fall Classic.

Game One: Revenue Per FTE

Baseball is all about sharing the workload. Unlike in other sports, one player cannot take over a game. Having a deep lineup can be the difference, as one player getting hot can make up for another going cold. Credit unions are similar, where having a deep roster of talented employees can give a cooperative the edge it needs to beat its competition.

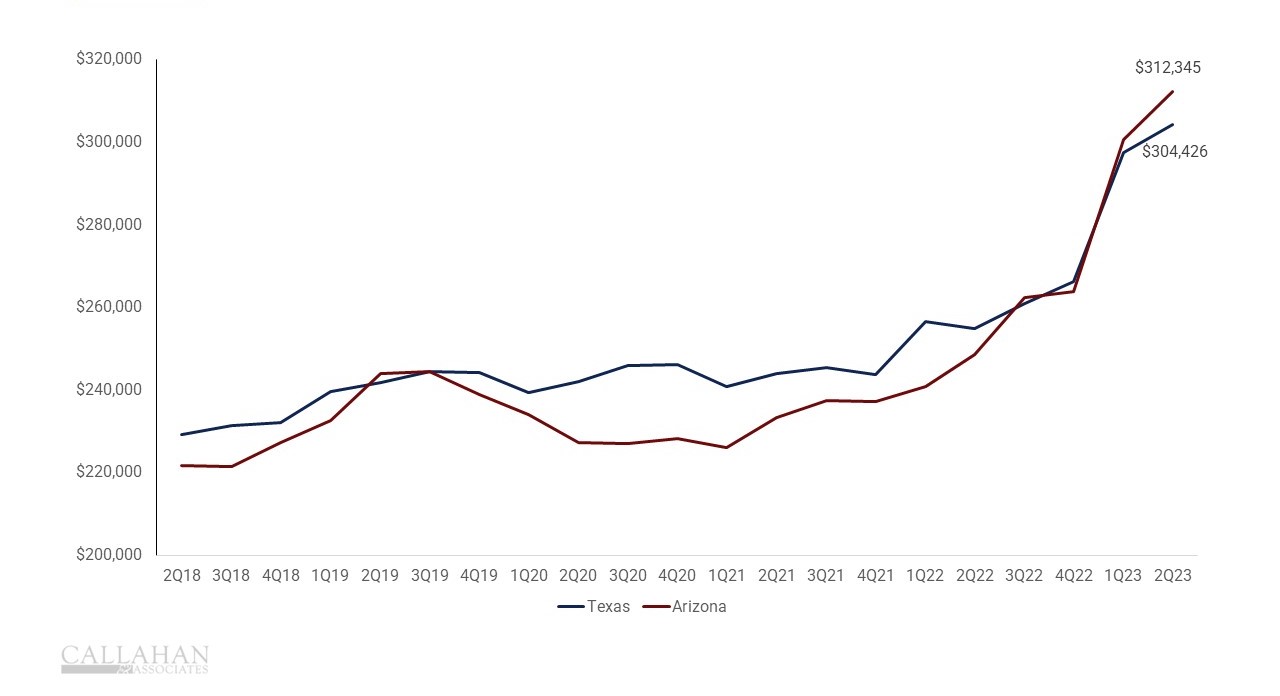

When you evaluate who has the deepest lineup, it’s tempting to compare the top guys like the Rangers’ Adolis Garcia or the Diamondbacks’ Christian Walker. But when examining the numbers, it’s clear a team must be excellent not just at the top, but also on average. And with an average of $312,345, Arizona credit unions bring in more revenue per employee.

SCORE: Arizona 1, Texas 0

REVENUE PER EMPLOYEE

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.23

© Callahan & Associates | CreditUnions.com

Game Two: Dividends Per Member

There are multiple ways to build a roster, one not necessarily better than the other. The Texas Rangers built its roster through savvy free-agent acquisitions, such as shortstop Corey Seager, mixed in with up-and-coming talent such as Adolis Garcia. In the other dugout, the Diamondbacks has gotten where it is with a unique, small-ball approach mixing stars in the making such as rookie outfielder Corbin Carroll with veteran leaders like second baseman Ketel Marte.

What ultimately matters though, is the return the teams get on their rosters. A team, much like a credit union, wants to reward its fans, or members, with a return on their investment. Although fans in Arizona and Texas might have to wait a few days to see what their payback is for years of support, credit union members in each state can see right now who gets the most bang for their buck. And in that column, Texas credit unions win with $134 annual dividends per member versus Arizona’s $125.

SCORE: Texas 1, Arizona 1

AVERAGE DIVIDEND PER MEMBER

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.23

© Callahan & Associates | CreditUnions.com

Game Three: Auto Loan Growth

Baseball players spend a lot of time on the road. From the minors to the majors, travel is a key component of making it through the season. Being able to make the most of the travel can help a team bond and stay together when times get tough.

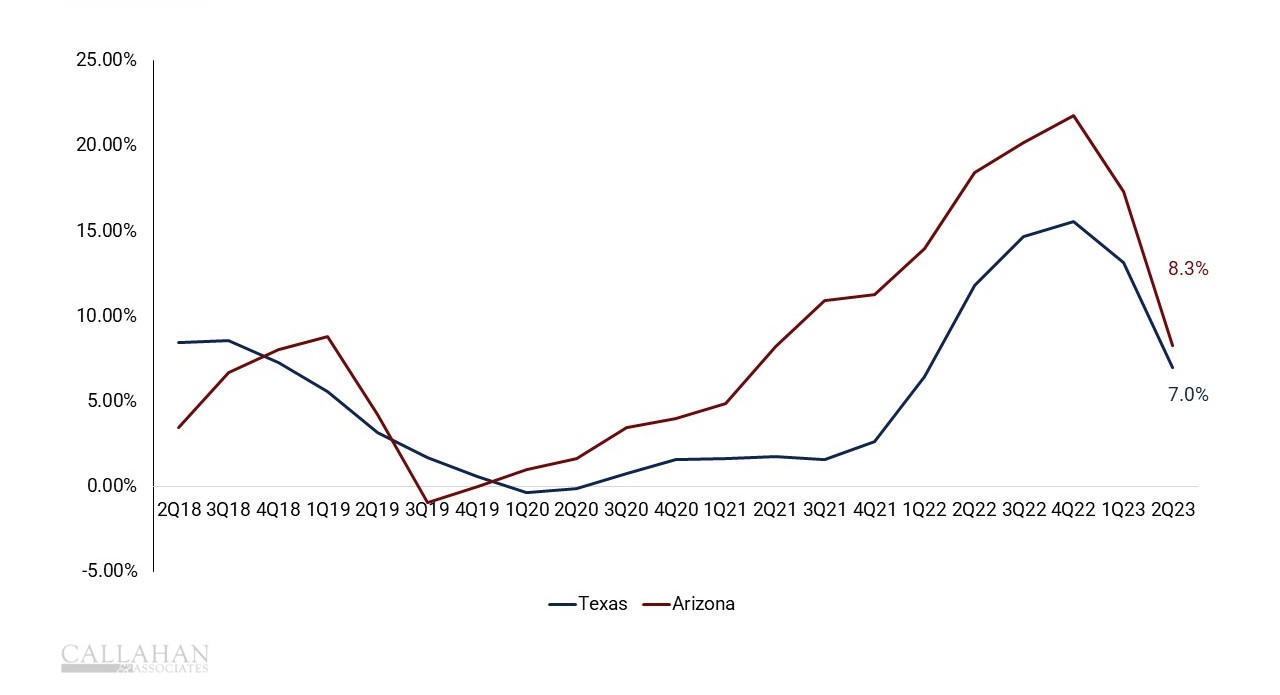

Credit union members are no different. Travel is an important part of life, as is getting to and from destinations with ease. It turns out, Arizona credit unions have the advantage here, with their auto loan portfolio growing 8.26% versus Texas’ 7.0%.

SCORE: Arizona 2, Texas 1

TOTAL AUTO LOAN GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.23

© Callahan & Associates | CreditUnions.com

FINAL: ARIZONA DIAMONDBACKS 2, TEXAS RANGERS 1

With that, Callahan predicts the Arizona Diamondbacks to win the World Series by a razor-thin margin. Make sure to tune in to see how our prognostication holds up. The series begins Oct. 27, with Game 7 (if needed) taking place Nov. 4.

Power Up Your Team With World-Class Performance Insights

Looking for an edge to inspire your team and best your competition? A complimentary scorecard from Callahan & Associates will help you develop a clear picture of your credit union’s position in the marketplace and how to improve it. Armed with your desired KPIs plus a few we might suggest, you’ll be in a better position to benchmark against desired peer groups, share findings with your board, and help members reach new levels of financial stability.