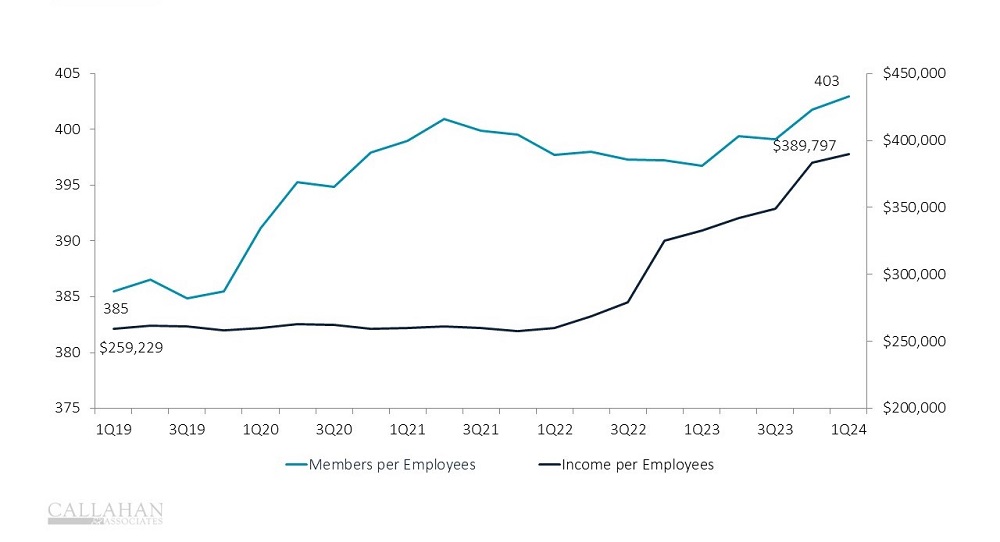

MEMBERS PER EMPLOYEE AND INCOME PER EMPLOYEE

FOR U.S. Credit Unions | © CALLAHAN & ASSOCIATES | © CREDITUNIONS.COM

- According to the U.S. Chamber of Commerce, employers added 3.1 million jobs in 2023. Although a robust job market helped fill many of these job vacancies, a shortage of workers means many positions remain unfilled. Despite having more Americans in the workforce today than before the pandemic, the overall labor force participation rate has declined.

- Industry membership has grown at a compounded annual rate of 3.5% during the past five years, outpacing employee growth of 2.6%. As a result, credit union leadership and employees have had to leverage the power of purpose and technological efficiencies to provide the same level of service .

- In the past five years, assets per employee have increased by a compounded rate of 5.8% and reached $6.6 million as of March 31, 2024. In the wake of higher loan and investment yields, income per employee reached $389,785. These numbers suggest credit union employees have been able to handle the influx of members, allowing credit unions to bring in more income.

Don’t Wait For Data! Member service representatives serve more members today than they did five years ago — they also earn more for the credit union. Callahan’s online performance benchmarking tool provides an early look at quarterly performance results, giving leaders crucial insight weeks before the official data release from the NCUA. Don’t wait for data; contact Callahan today. Start your analysis now.