CONSUMER LOAN DELINQUENCIES

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.22

© Callahan & Associates | CreditUnions.com

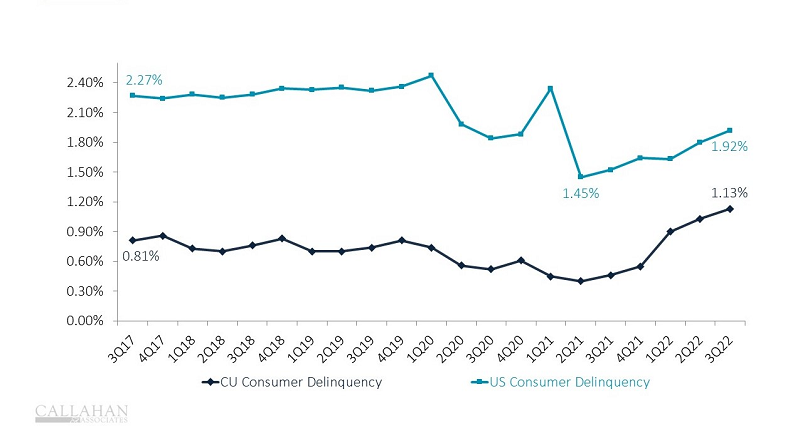

- Late payments are on the rise for consumer loans. The national average hit 1.92% at the end of the third quarter. At U.S. credit unions, however, the delinquency rate for consumer loans — non-commercial and non-real estate loans — was just 1.13%. Of note, banks report delinquencies beginning at 30 days as well as 90 days; reportable delinquency at credit unions begins at 60 days.

- Consumer loan delinquency crossed 1% in mid-2022; still, it remains lower than during the Great Recession, when rates averaged 1.43%.

- Credit card delinquency has risen steadily the past 12 months as consumers prioritize paying off higher-balance loans. As of Sept. 30, credit card delinquency was 2.08% nationally and 1.29% at credit unions. Used auto loans have the second-highest delinquency rate — 0.65% — at credit unions..

- Federal relief for COVID cushioned loan payments and contributed to a drop in delinquency in 2020 and 2021. The delinquency rate now appears to be normalizing. Still, with a possible recession around the corner, credit unions should closely monitor their delinquency.

Do It Yourself In Peer

Do you like the graphs you see in our Graph Of The Week? Try re-creating them yourself using Callahan’s Peer Suite to see how your credit union is performing against other institutions.

To create a line multiformula display like the one above, log into Peer and use the following formulas:

- US_delinquencies_all_consumer/100

- cu_consumer_delinquency_rate

Want to make the most of your Peer subscription? Register today for a Peer bootcamp