CRYPTOCURRENCY LOSSES FROM ELDER FINANCIAL ABUSE

FOR IC3 VICTIMS OLDER THAN 60| DATA AS OF 2022

© Callahan & Associates | CreditUnions.com

Elder financial abuse rose dramatically in 2022, according to a new report from the FBI. More than 88,000 people older than 60 reported fraud claims to the FBI last year, with losses totaling more than $3.1 billion — an 84% increase over the previous year.

The National Credit Union Administration has identified the topic as a key focus area, but the crisis can’t improve without a clear understanding of what the industry is up against. Read on for key findings from the FBI’s report.

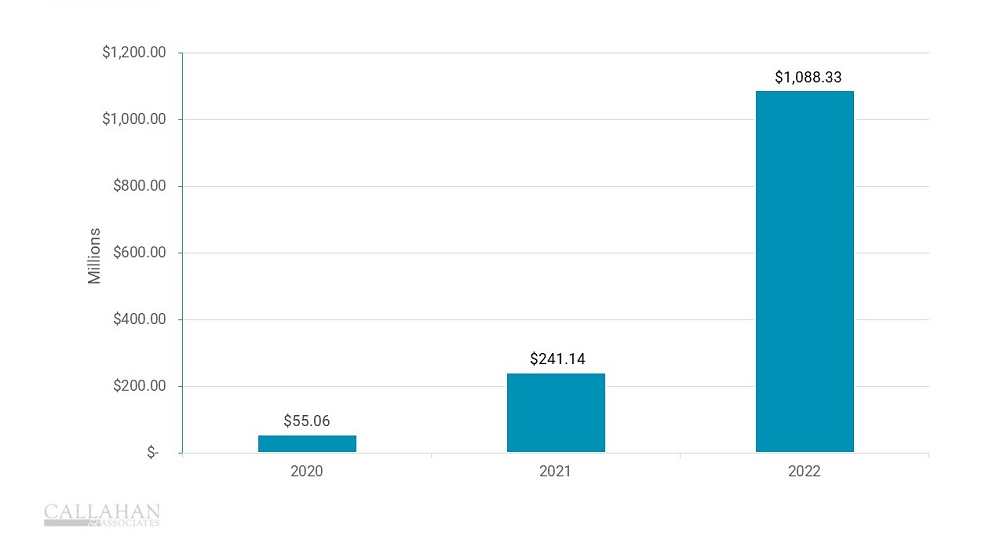

- Average losses per victim older than 60 exceeded $35,000 last year. Much of that was fueled by an explosion in losses from consumers investing in cryptocurrencies. Nearly 10,000 people reported complaints, with losses surpassing $1 billion, an increase of more than 350%.

- Social media continues to be problematic for many older consumers, with many falling victim to scammers posting false advertisements. Victims reported ordering from links advertising on social media and receiving either nothing at all or items different from what was advertised. These scams fall under the bureau’s “non-payment/non-delivery” category, the second-most reported category of fraud last year, with losses of more than $51 million in 2022.

- Total losses from romance scams — also known as confidence scams — totaled nearly $419 million last year, which is a slight decline from 2021.

- Grandparent scams, where criminals impersonate a loved one in desperate need of money, represented losses of roughly $3.8 million last year, with nearly 400 incidents reported.

How Can Data Power Your Performance?

Callahan’s Peer Benchmarking Suite offers a deep dive into the performance analytics of your institution against comparison groups. Whether you’re looking for information on the institutions in your market or those of your asset size around the nation, Peer gives you the insight you need to make smart, strategic business decisions.