For the first time since January 2021, American real wage growth is finally outpacing inflation. Accordingly, consumer budgets are finally feeling some relief, which is good news for savings balances. The personal savings rate was 4.3% as of June 30. That’s up from the historic low of 2.7% one year ago.

After a year of limited deposit growth and concerns about liquidity, financial institutions might be primed for renewed depository funding. However, the resumption of student loan payments could squeeze any extra room in many Americans’ budgets

Don’t Miss Out! Callahan’s quarterly Credit Union Strategy & Performance is available for download in the Callahan Client portal today. Not a client? Learn how you can gain access to our award-winning publications, intuitive benchmarking tools, collaborative networks, and more.

Key Points

- Total share balances increased 1.2% annually in the second quarter, the lowest annual growth rate on record for the industry. Share certificates, however, surged, growing 68.4% annually and 11.7% in the quarter as credit unions turned to rate promotions to attract liquidity.

- Members joined the movement faster than deposits increased, and the average share balance fell $419 year-over-year to $13,466.

- The loan-to-share ratio — a key measure of credit union liquidity — jumped 8.4 percentage points year-over-year to 83.1%, leaving fewer funds available for lending.

- When dealing with tight liquidity, credit unions must either attract deposits or borrow money. Many opted for the latter. Borrowing balances were up 79.8% annually and funded 5.4% of industry assets as of June 30, the highest of this century.

Performance At-A-Glance

ANNUAL SHARE GROWTH BY TYPE

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.23

© Callahan & Associates | CreditUnions.com

For the third consecutive quarter, higher savings rates incentivized members to move money out of liquid savings accounts and into termed certificate promotions.

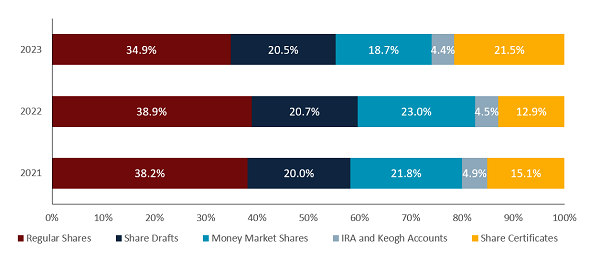

SHARE PORTFOLIO

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.23

© Callahan & Associates | CreditUnions.com

With a greater concentration of certificates and fewer regular shares, the share portfolio got more expensive for credit unions.

TOTAL COST OF FUNDS

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.23

© Callahan & Associates | CreditUnions.com

With a rising rate environment, both the cost of deposits and the cost of borrowing has risen at credit unions.

The Bottom Line

Credit union industry deposit growth lagged expansion in both membership counts and loan balances, tightening industry liquidity and leaving many credit unions with limited flexibility to fund future lending. To source new funds, cooperatives have turned mainly to certificate promotions and borrowing channels, with varying success.

Although the outlook for member savings is one of hazy optimism, operational relief might come from the loan side of the balance sheet. Higher interest rates are already suppressing demand for loan products, reducing the pressure for new funds. Regardless of lending needs, however, deposits remain the foundation of the member-credit union relationship. Cooperatives would do well to educate and support their members through budgeting and savings plans, fostering financial stability throughout the community.

How Do You Compare?

Learn More Today