Americans are bringing their financial stresses to work with them, and it’s impacting their productivity and efficiency.

Not surprisingly, those concerns are also affecting sleep, mental and physical health, relationships, and more. The good news is this is an area where credit unions have an opportunity to make a real difference — and some already are.

FINANCIAL STRESS IS TAKING A TOLL AT WORK

FOR U.S. WORKERS SURVEYED BY PWC

SOURCE: PWC Employee Financial Wellness Survey

Strategic Insights

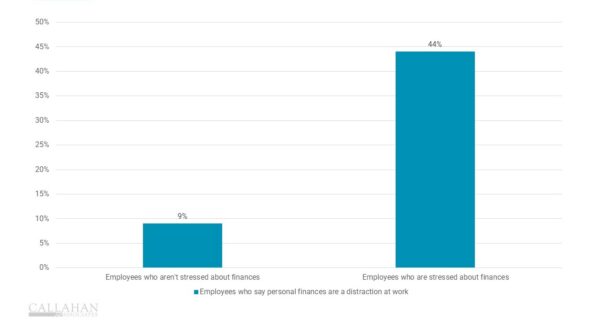

- More than half — 57% — of American workers say finances are the No. 1 cause of stress in their lives, according to a recent study from PWC, and it’s impacting productivity on the job. Among employees who report feeling stressed about their finances, 44% say those worries are a distraction at work, making them feel less engaged during office hours.

- A rising percentage of American workers also say compensation isn’t keeping up with cost of living — a figure that has jumped from 41% in 2021 to 59% in 2023.

- The overwhelming majority — 74% — want help with their personal finances. Furthermore, the stigma around asking for help has declined by 9 percentage points, dropping from 42% in 2019 who said they were embarrassed to ask for guidance to just 33% in 2023.

- Coinciding with that decline, the number of workers who say their employer provides financial wellness services has risen dramatically, growing from just 51% in 2012 to 68% in 2023. Some credit unions are also providing specialized assistance for their staff.

— This column originally appeared on CreditUnions.com on Aug. 26, 2024.

Now It’s Your Turn

What is your credit union doing to support its employees? Do you support staff in the same way you support your members? Let us know, and your credit union could be featured on CreditUnions.com.

LET CALLAHAN KNOW

LET CALLAHAN KNOW