Top-Level Takeaways

- Successful mortgage marketing pages feature compelling visuals and clear, concise messaging that engages potential borrowers and simplifies complex information.

- These pages prioritize a user-friendly design with intuitive navigation, ensuring visitors can easily find the information they need about mortgage products and services.

- Prominent and persuasive calls to action encourage visitors to take the next step, whether it’s applying for a loan or contacting the credit union for more information.

Buying a house is the largest purchase most members will ever make, and the transaction’s unfamiliar processes are ripe for complication and anxiety.

Luckily, credit unions are well-positioned to look out for their members’ best interest; unfortunately, members often don’t know they can get a mortgage with a credit union. According to data from Callahan’s first quarter Trendwatch webinar, credit unions captured only 6% of total originations, meaning there’s plenty of growth opportunity.

Higher interest rates and low inventory are creating a sluggish housing market with the lowest levels of affordability in decades. In this kind of environment, it’s important for credit unions to be on their marketing game with websites designed to capture the business of members and potential members looking for the right mortgage partner.

From clear calls to action to personal touches, credit union marketers are deploying more than a few strategies to make homebuying easier for members.

All About The Home. All In One Place.

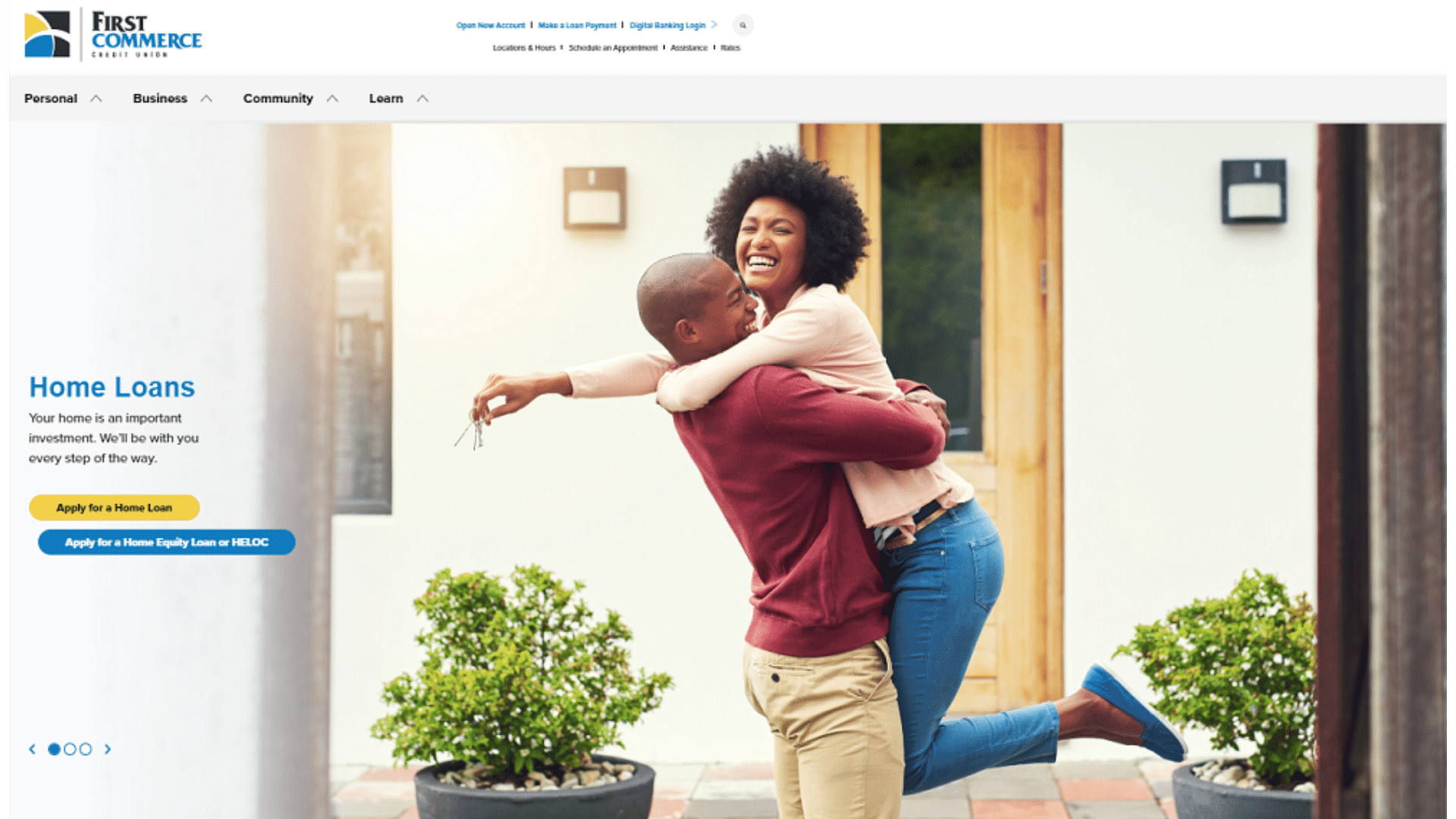

First Commerce doesn’t make members go digging for home loan versus HELOC; it offers all members need in one easy-to-find (and browse) webpage.

Don’t let information overload scare away potential borrowers. Instead, make it easy for members to find the answers they need when they need them.

Oftentimes, credit unions separate mortgages and HELOCs on their websites, which is understandable given how lenders handle the products internally. To members, however, both of these loan types involve homes, so it feels natural to look for information on both in one central location.

First Commerce Credit Union ($1.1B, Tallahassee, FL) showcases loan products next to each other in its home loans rotator. There is no confusion about the most important call to action. The rotator contains three images but each features the same language and call to action. Simplicity at its finest.

Not only does First Commerce make it easy to find information, it also makes it clear the credit union will be with borrowers every step of the way. That’s the reassurance many need to move forward.

And when members are ready to take the next step, the credit union makes that easy, too, with a required documentation section located on the same page that outlines exactly what members need.

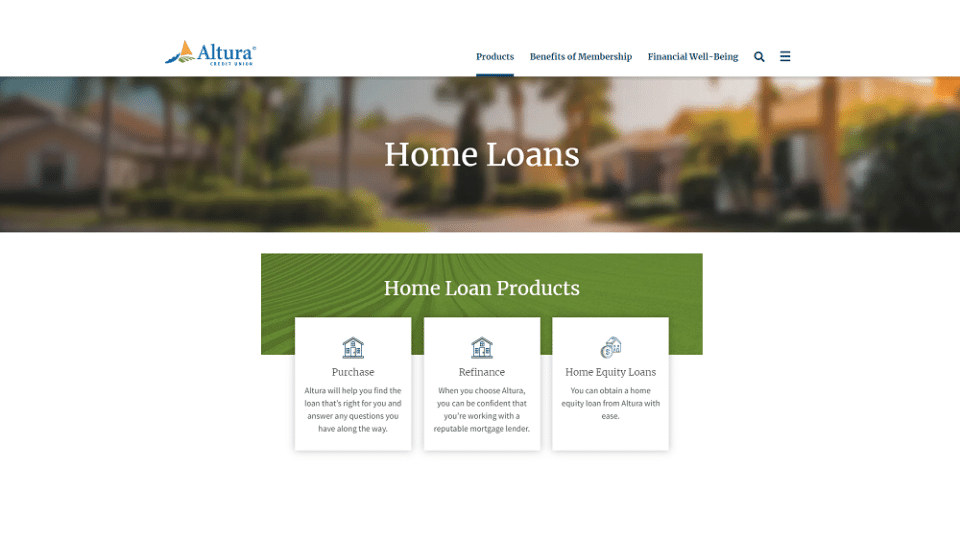

Altura embraces the KISS design principle — keep it simple, stupid — by outlining the three main reasons a member would visit the credit union’s home loan page.

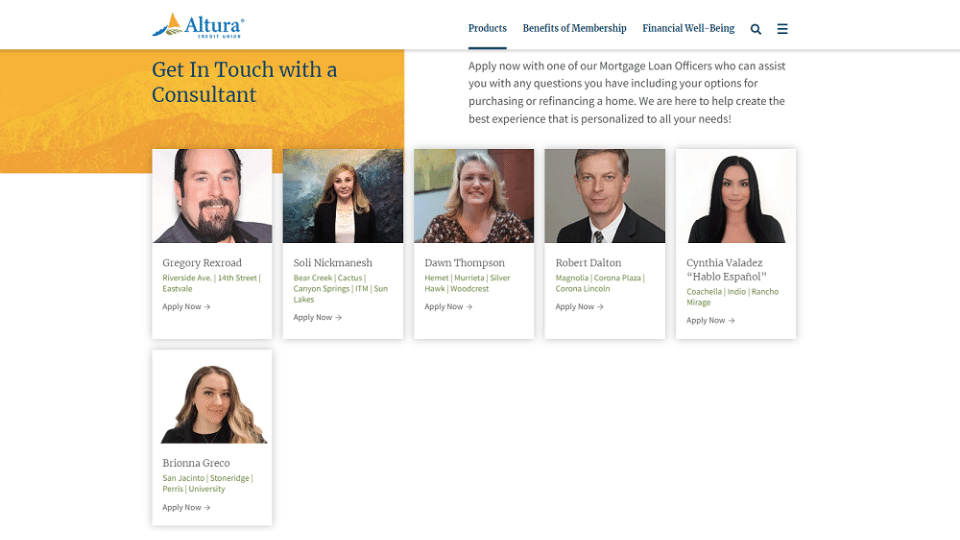

Altura shows smaller is better by making its mortgage team accessible and easy to reach. Note, one consultant even emphasizes the fact she speaks Spanish — an important aspect for a market where Hispanics comprise north of 90% of the population in some areas.

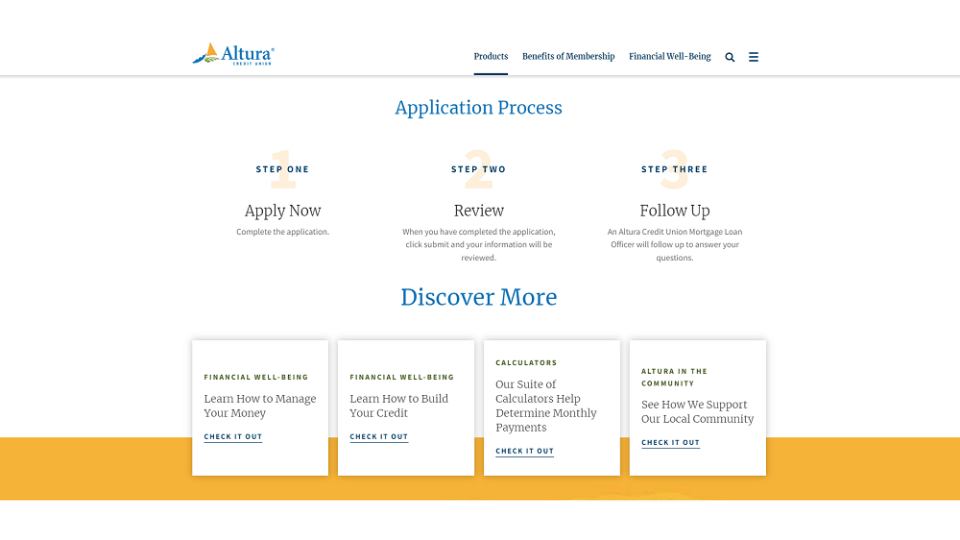

Altura makes taking out a loan as easy as 1,2,3 with a clearly outlined application process and financial wellbeing resources for would-be borrowers.

Check out First Commerce’s marketing page at firstcommercecu.org/personal/loans/home.

Mortgage Marketing With An Educational Twist

It’s all about member education at Altura Credit Union ($2.6B, Riverside, CA). The credit union gets right to the point, right at the top, of its mortgage page with an outline of three use cases for why a member would visit the page — purchase, refinance, or line of credit.

But dig a little deeper, and would-be borrowers find details that take the process of buying a home from transactional to personal.

Where large mortgage lenders go big, Altura seizes the opportunity to go personal with a delicate touch that differentiates its service standards. The credit union provides the names and photos of its mortgage loan officers as well as the market areas for which they are responsible. A quick click to “apply now” takes borrowers to a welcome page that prompts them to set up an account that allows them to verify personal details and submit documents — if they choose — in a secure environment. For members who want a little more face time, they can reach out directly to the loan officer via email.

Finally, Altura makes taking out a loan as easy as 1,2,3 with a clearly outlined application process — apply, review, follow up — bolstered by financial wellbeing resources including an affordability calculator, insurance coverage need-to-knows, and articles that dig into how to manage money and build credit.

Check out Altura’s marketing page at alturacu.com/products/home-loans.

Special Products For Exceptional Members

Making appointments to work with a mortgage representative is no longer a perk, it's a prerequisite. At Workers, consultants help borrowers craft a personalized homeownership plan.

House hunting can be hectic, finding a mortgage shouldn’t be. Workers’ clear comparison of mortgage products helps borrowers find the perfect product.

It’s no wonder Workers Federal Credit Union ($2.6B, Littleton, MA) has a clearly outlined product suite on its marketing page — the big Massachusetts cooperative recently combined marketing and product oversight under a single SVP level role. The product comparison on its find-a-mortgage page makes it easy for borrowers to determine which loan fits their needs.

Ever since COVID closed branches and changed the way consumers expect service, the ability to make an appointment has become a necessity versus a perk. Workers’ online tool makes scheduling a mortgage consultation a breeze and takes the pressure to know what to do next off the borrower. After meeting with a Workers’ financial coach, members have a clear path forward for what it will take to turn the key in their dream home.

Check out Workers’ marketing page at wcu.com/your-life/find-a-mortgage.

Remember, at the end of the day, making mortgages is not about originating loans, it’s about helping members invest in a home of their own. We hope this sparks ideas as you evolve your own mortgage marketing strategy. Get inspired — the credit union way

Make It Work … For You

You’ve seen how other credit unions are marketing their mortgages; now, how can you put these insights into practice? Start by asking yourself the following questions:

-

How do you organize your home loan products on your website to create clarity?

-

Are there personal touches you can add to your page to make the credit union feel more human, less intimidating?

-

What educational resources do you provide to help guide members along their mortgage journey?

-

Are your calls to action clear and concise? Do you have too many or not enough?

-

To publish rates or not to publish rates, that is the question.

Get Inspired: 3 Mortgage Marketing Pages That Sell

Top-Level Takeaways

Buying a house is the largest purchase most members will ever make, and the transaction’s unfamiliar processes are ripe for complication and anxiety.

Luckily, credit unions are well-positioned to look out for their members’ best interest; unfortunately, members often don’t know they can get a mortgage with a credit union. According to data from Callahan’s first quarter Trendwatch webinar, credit unions captured only 6% of total originations, meaning there’s plenty of growth opportunity.

Higher interest rates and low inventory are creating a sluggish housing market with the lowest levels of affordability in decades. In this kind of environment, it’s important for credit unions to be on their marketing game with websites designed to capture the business of members and potential members looking for the right mortgage partner.

From clear calls to action to personal touches, credit union marketers are deploying more than a few strategies to make homebuying easier for members.

All About The Home. All In One Place.

Oftentimes, credit unions separate mortgages and HELOCs on their websites, which is understandable given how lenders handle the products internally. To members, however, both of these loan types involve homes, so it feels natural to look for information on both in one central location.

First Commerce Credit Union ($1.1B, Tallahassee, FL) showcases loan products next to each other in its home loans rotator. There is no confusion about the most important call to action. The rotator contains three images but each features the same language and call to action. Simplicity at its finest.

Not only does First Commerce make it easy to find information, it also makes it clear the credit union will be with borrowers every step of the way. That’s the reassurance many need to move forward.

And when members are ready to take the next step, the credit union makes that easy, too, with a required documentation section located on the same page that outlines exactly what members need.

Check out First Commerce’s marketing page at firstcommercecu.org/personal/loans/home.

Mortgage Marketing With An Educational Twist

It’s all about member education at Altura Credit Union ($2.6B, Riverside, CA). The credit union gets right to the point, right at the top, of its mortgage page with an outline of three use cases for why a member would visit the page — purchase, refinance, or line of credit.

But dig a little deeper, and would-be borrowers find details that take the process of buying a home from transactional to personal.

Where large mortgage lenders go big, Altura seizes the opportunity to go personal with a delicate touch that differentiates its service standards. The credit union provides the names and photos of its mortgage loan officers as well as the market areas for which they are responsible. A quick click to “apply now” takes borrowers to a welcome page that prompts them to set up an account that allows them to verify personal details and submit documents — if they choose — in a secure environment. For members who want a little more face time, they can reach out directly to the loan officer via email.

Finally, Altura makes taking out a loan as easy as 1,2,3 with a clearly outlined application process — apply, review, follow up — bolstered by financial wellbeing resources including an affordability calculator, insurance coverage need-to-knows, and articles that dig into how to manage money and build credit.

Check out Altura’s marketing page at alturacu.com/products/home-loans.

Special Products For Exceptional Members

It’s no wonder Workers Federal Credit Union ($2.6B, Littleton, MA) has a clearly outlined product suite on its marketing page — the big Massachusetts cooperative recently combined marketing and product oversight under a single SVP level role. The product comparison on its find-a-mortgage page makes it easy for borrowers to determine which loan fits their needs.

Ever since COVID closed branches and changed the way consumers expect service, the ability to make an appointment has become a necessity versus a perk. Workers’ online tool makes scheduling a mortgage consultation a breeze and takes the pressure to know what to do next off the borrower. After meeting with a Workers’ financial coach, members have a clear path forward for what it will take to turn the key in their dream home.

Check out Workers’ marketing page at wcu.com/your-life/find-a-mortgage.

Remember, at the end of the day, making mortgages is not about originating loans, it’s about helping members invest in a home of their own. We hope this sparks ideas as you evolve your own mortgage marketing strategy. Get inspired — the credit union way

Make It Work … For You

You’ve seen how other credit unions are marketing their mortgages; now, how can you put these insights into practice? Start by asking yourself the following questions:

How do you organize your home loan products on your website to create clarity?

Are there personal touches you can add to your page to make the credit union feel more human, less intimidating?

What educational resources do you provide to help guide members along their mortgage journey?

Are your calls to action clear and concise? Do you have too many or not enough?

To publish rates or not to publish rates, that is the question.

Daily Dose Of Industry Insights

Stay informed, inspired, and connected with the latest trends and best practices in the credit union industry by subscribing to the free CreditUnions.com newsletter.

Share this Post

Latest Articles

Takeaways From Day 2 Of GAC

Takeaways From Day 1 Of GAC

Credit Union Storytelling With A Mission Focus

Keep Reading

Related Posts

Takeaways From Day 2 Of GAC

Takeaways From Day 1 Of GAC

What’s Job No. 2?

Credit Union Storytelling With A Mission Focus

Marc RapportHow Lake Trust Turns Member Experiences Into Brand Strategy

Savana MorieHow An Internal Storyteller Fuels Member Growth At Navy Federal

Marc RapportView all posts in:

More on: