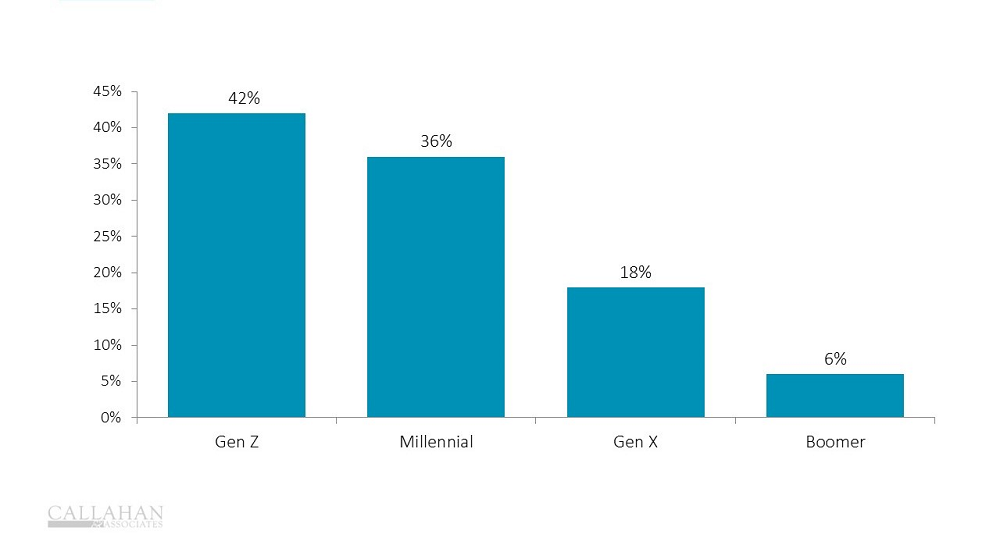

INVESTORS THAT HAVE ACTED UPON FALSE FINANCIAL INFORMATION ONLINE

FOR POLL RESPONDENTS | DATA AS OF August 2023

© Callahan & Associates | CreditUnions.com

- Roughly one-third (34%) of working consumers ages 18 to 54 have acted upon financial information from social media or other online platforms that turned out to be false, according to an August 2023 survey from Nationwide.

- Gen Z was seven times as likely as baby boomers to encounter and act on financial misinformation.

- Newer platforms are particularly ripe for misinformation. According to a web analysis by WallStreetZen, two-thirds of financial videos on TikTok are misleading, and 95% do not include disclaimers.

- Credit unions provide a relationship-based financial experience and can help combat this trend by offering members, particularly younger ones, more financial education and guidance.