Growth in the U.S. economy slowed during first quarter 2015, but credit unions closed the quarter with multiple financial performance records. According to first quarter data on more than 6,100 credit unions representing more than 98% of industry assets, credit unions originated $89.5 billion in loans during the first three months of 2015. That’s up 20.8% from one year ago.

Credit unions posted double-digit year-over-year growth in year-to-date originations in first mortgage, other real estate, and consumer loans. In total, the industry made $15.4 billion more loans than it did during the same time last year.

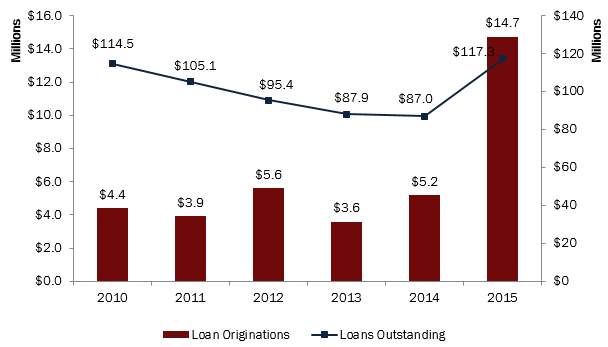

One exemplary credit union, Central Macomb Community ($177.0M, Mt. Clemens, MI) originated $14.7 million in total loans during the first three months of 2015. That’s nearly triple the amount of loans the credit union originated during the same time last year. The credit union’s first mortgage originations quintupled over the past year to reach $5.8 million. The Michigan credit union also posted a 34.8% year-over-year growth in total loans outstanding as of March 2015. Among all loan categories, auto loans grew at the fastest pace 93.8% YOY and exceeded $36.5 million.

Additionally, the Michigan credit union not only posted a strong membership growth rate of 6.1% but also strengthened its average member relationship. The sum of loans, excluding member business loans, and share balances divided by the number of members at Central Macomb Community increased to $16,079. That’s a 9.7% lift over March 2014.

TOTAL LOAN ORIGINATIONS PLUS LOANS OUTSTANDING

Central Macomb Community Credit Union | Data as of March 31, 2015

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates